Tax Form 210

What is the Tax Form 210

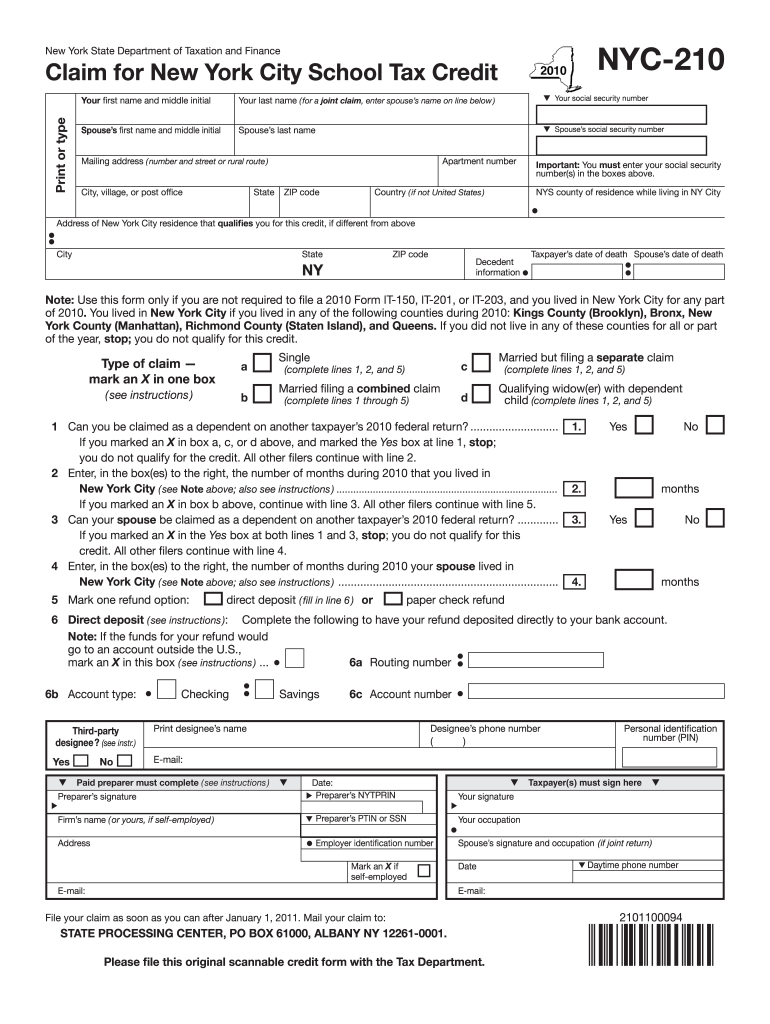

The Tax Form 210, also known as the NYC-210, is a document used for claiming the New York City School Tax Credit. This form is specifically designed for eligible residents who want to receive a tax benefit based on their income and residency status. The form plays a significant role in helping taxpayers reduce their overall tax liability, particularly in the context of New York City's unique tax structure.

How to use the Tax Form 210

To effectively use the Tax Form 210, taxpayers must first determine their eligibility based on income and residency requirements. Once eligibility is confirmed, the form must be filled out accurately, providing necessary personal information and income details. After completing the form, it should be submitted along with the appropriate tax return, ensuring that all supporting documents are included to validate the claim.

Steps to complete the Tax Form 210

Completing the Tax Form 210 involves several key steps:

- Gather necessary documents, including proof of income and residency.

- Download the form from a reliable source, ensuring you have the correct version for the applicable tax year.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Provide details regarding your income and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

Legal use of the Tax Form 210

The legal use of the Tax Form 210 is governed by New York City tax regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the NYC Department of Finance. This includes using the form only for its intended purpose and accurately reporting all required information. Failure to comply with these regulations may result in penalties or denial of the tax credit.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 210 typically align with the overall tax filing deadlines in New York City. Taxpayers should be aware of the following important dates:

- Tax Form 210 must be submitted by the same deadline as the personal income tax return, usually April 15.

- Extensions may be available, but they must be requested in accordance with IRS guidelines.

Required Documents

When completing the Tax Form 210, several documents are required to support the claim. These may include:

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, including W-2s or 1099 forms.

- Any additional forms that may be necessary to substantiate deductions or credits claimed.

Quick guide on how to complete tax form 210

Prepare Tax Form 210 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Tax Form 210 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign Tax Form 210 with ease

- Obtain Tax Form 210 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in several clicks from any device you prefer. Modify and electronically sign Tax Form 210 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nyc 210 for 2019?

The term 'nyc 210 for 2019' refers to the New York City Department of Finance's updated property tax forms for the year 2019. These forms help ensure compliance with local tax regulations and provide essential information on property assessments. Understanding nyc 210 for 2019 is crucial for property owners in managing their financial obligations effectively.

-

How can airSlate SignNow help with filling out nyc 210 for 2019 forms?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign documents like the nyc 210 for 2019 forms. The user-friendly interface ensures that individuals can complete their paperwork quickly and accurately, preventing potential errors that could lead to compliance issues.

-

What are the pricing options for using airSlate SignNow for nyc 210 for 2019?

airSlate SignNow offers various pricing plans that cater to different business needs when dealing with documents such as the nyc 210 for 2019 forms. Plans are affordable and designed for scalability, ensuring that both small businesses and larger enterprises can efficiently manage their document signing processes without breaking the bank.

-

What features does airSlate SignNow offer for managing nyc 210 for 2019?

Key features of airSlate SignNow include customizable templates, multi-party signing, and secure cloud storage, all of which can enhance the processing of nyc 210 for 2019 forms. With these tools, users can track document status, automate workflows, and ensure data security while managing their forms effectively.

-

Is airSlate SignNow compliant with regulations for nyc 210 for 2019?

Yes, airSlate SignNow is compliant with eSignature laws and regulations, making it suitable for processes involving documents such as the nyc 210 for 2019. This compliance ensures that your electronic signatures are legally binding and recognized across various jurisdictions, including New York.

-

Can I integrate airSlate SignNow with other tools for managing nyc 210 for 2019?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications that can help in managing documents like the nyc 210 for 2019. This allows users to streamline their processes by incorporating tools they already use, enhancing efficiency in document management.

-

What benefits does airSlate SignNow provide for businesses dealing with nyc 210 for 2019?

Using airSlate SignNow for handling nyc 210 for 2019 forms streamlines the signing process, reduces turnaround times, and minimizes paper usage. These benefits lead to increased productivity and cost savings, making it an ideal solution for businesses looking to manage their documentation more effectively.

Get more for Tax Form 210

Find out other Tax Form 210

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now