Form 4797 Sales of Business Property Also Involuntary Conversions and Recapture Amounts under Sections 179 and 280Fb2 2024-2026

Understanding IRS Form 4797 for Sales of Business Property

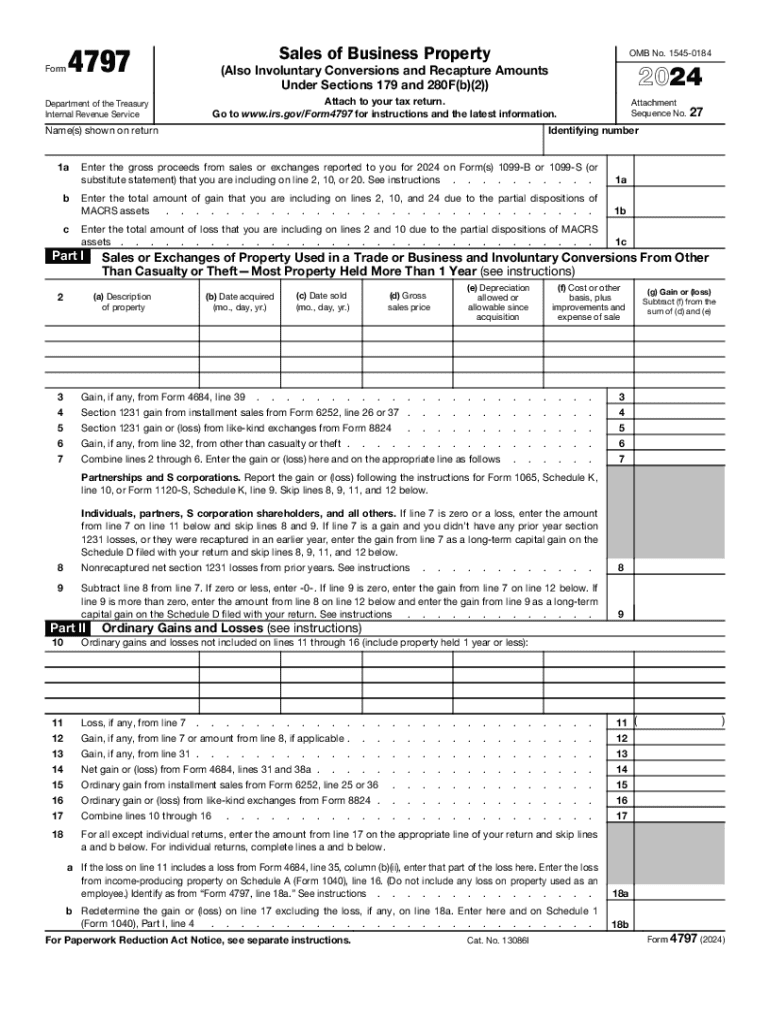

IRS Form 4797 is used to report the sale of business property, including involuntary conversions and recapture amounts under Sections 179 and 280F(b)(2). This form is essential for taxpayers who have sold or exchanged property used in a trade or business, as it helps determine the gain or loss from the transaction. The form also addresses specific scenarios such as the sale of rental property, which is crucial for accurate tax reporting.

Steps to Complete IRS Form 4797

Filling out IRS Form 4797 involves several steps to ensure accurate reporting of the sale of business property. Here are the key steps:

- Gather necessary documentation, including details of the property sold, purchase price, and any improvements made.

- Determine the adjusted basis of the property, which includes the original cost plus any capital improvements.

- Calculate the amount realized from the sale, which is the selling price minus any selling expenses.

- Complete the relevant sections of Form 4797, including Part I for sales of property, Part II for involuntary conversions, and Part III for recapture amounts.

- Transfer the calculated gain or loss to your individual tax return.

Legal Uses of IRS Form 4797

The legal use of IRS Form 4797 is primarily for reporting the sale of business property for tax purposes. This form is crucial for taxpayers who need to comply with IRS regulations regarding the reporting of gains or losses from property sales. Accurate completion of this form helps prevent potential legal issues with the IRS, including audits or penalties for underreporting income.

Filing Deadlines for IRS Form 4797

IRS Form 4797 must be filed with your tax return by the due date of that return. For most individual taxpayers, this is typically April 15 of the following year. If you are unable to file by the deadline, you may request an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest.

Key Elements of IRS Form 4797

Understanding the key elements of IRS Form 4797 is essential for accurate reporting. The form includes sections for:

- Part I: Sales of Business Property, where you report gains or losses from the sale.

- Part II: Involuntary Conversions, for reporting property lost due to events like theft or natural disasters.

- Part III: Recapture Amounts, which addresses recapture of depreciation on property sold.

Each part requires specific information, so careful attention to detail is necessary to ensure compliance with IRS regulations.

Obtaining IRS Form 4797

IRS Form 4797 is available for download from the official IRS website. Taxpayers can access the most recent version of the form, including any updates for the current tax year. It is advisable to ensure you are using the correct version, such as the 2024 Form 4797, to avoid any issues during filing.

Create this form in 5 minutes or less

Find and fill out the correct form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and 280fb2

Create this form in 5 minutes!

How to create an eSignature for the form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and 280fb2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4797 printable used for?

The IRS Form 4797 printable is used to report the sale of business property. It helps taxpayers calculate gains or losses from the sale of assets, ensuring compliance with tax regulations. By using airSlate SignNow, you can easily eSign and send this form securely.

-

How can I obtain the IRS Form 4797 printable?

You can obtain the IRS Form 4797 printable directly from the IRS website or through airSlate SignNow. Our platform allows you to access, fill out, and eSign the form seamlessly. This makes it convenient for you to manage your tax documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the IRS Form 4797 printable?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to explore its features for the IRS Form 4797 printable. Our cost-effective solutions cater to businesses of all sizes, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for the IRS Form 4797 printable?

airSlate SignNow provides features such as eSigning, document templates, and secure cloud storage for the IRS Form 4797 printable. These tools streamline the process of completing and submitting your tax forms, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for handling the IRS Form 4797 printable?

Yes, airSlate SignNow integrates with various software applications, enhancing your workflow for the IRS Form 4797 printable. You can connect it with popular tools like Google Drive, Salesforce, and more, ensuring a seamless experience across your business operations.

-

What are the benefits of using airSlate SignNow for the IRS Form 4797 printable?

Using airSlate SignNow for the IRS Form 4797 printable offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring your tax documents are handled efficiently.

-

Is airSlate SignNow secure for submitting the IRS Form 4797 printable?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the IRS Form 4797 printable. With encryption and secure cloud storage, you can trust that your sensitive information is safe and compliant with industry standards.

Get more for Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2

- Weekly progress report welcome to ms sanchez form

- Schedule 2 form 8849

- Taxi scrapping forms

- Blank credit report 100060961 form

- How to fill antrag auf steuerklassenwechsel bei ehegatten form

- Pediatric occupational therapy parent consent to treat form

- Instrument data form forms bahamas gov

- Foreign worker medical examination registration formv2 15062023

Find out other Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple