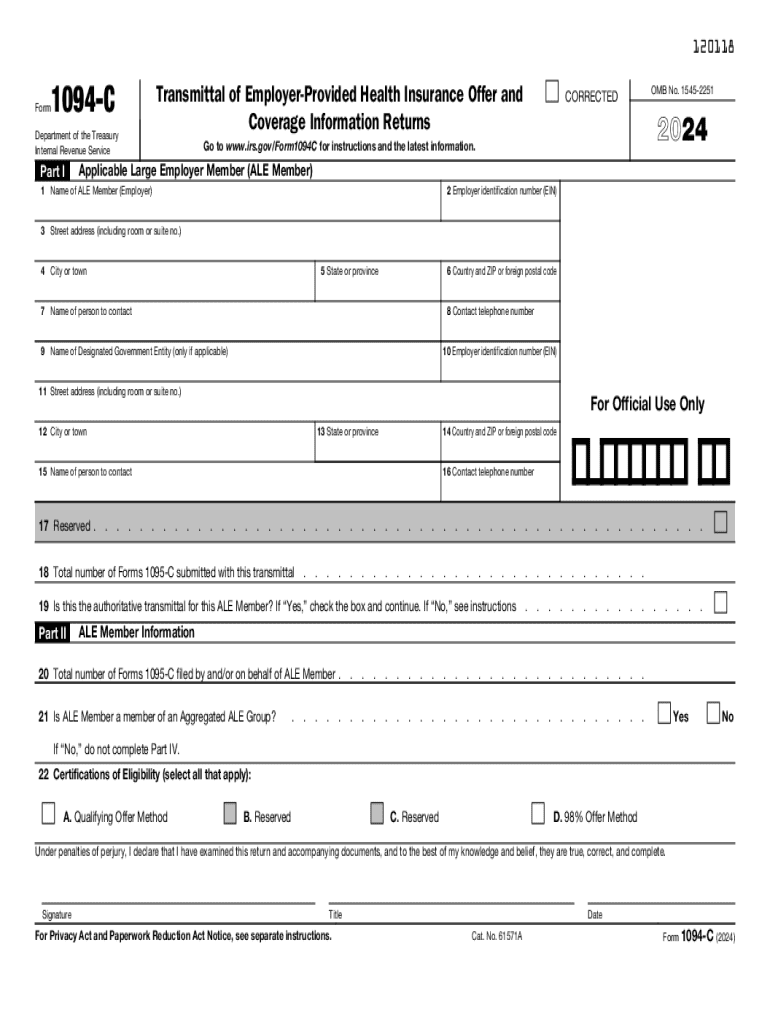

Requesting Comments on Form 1094 C, Form 1095 2024-2026

Understanding Form 1095-C Codes

Form 1095-C is a crucial document for employers that provides information about health coverage offered to employees. The form includes specific codes that indicate the type of coverage provided, the months of coverage, and whether the employee was eligible for health insurance. Understanding these codes is essential for accurate reporting and compliance with the Affordable Care Act (ACA).

The codes on Form 1095-C are divided into several categories, including:

- Code 1A: Indicates that the employer offered minimum essential coverage to the employee and their dependents.

- Code 1H: Signifies that the employer did not offer coverage.

- Code 2C: Indicates that the employee was enrolled in the coverage offered.

These codes help the IRS determine whether the employer met the ACA's employer shared responsibility provisions.

Filing Requirements for Form 1095-C

Employers are required to file Form 1095-C if they are considered an Applicable Large Employer (ALE), which generally means they have fifty or more full-time employees, including full-time equivalent employees. The form must be filed annually and is used to report information to the IRS and provide a copy to employees.

Filing requirements include:

- Providing accurate information about the health coverage offered.

- Ensuring that employees receive their copies by the specified deadline.

- Submitting the form electronically if filing one hundred or more forms.

Failure to comply with these requirements may result in penalties.

Steps to Complete Form 1095-C

Completing Form 1095-C involves several key steps to ensure accuracy and compliance:

- Gather Employee Information: Collect necessary details about each employee, including their full name, Social Security number, and the months they were covered.

- Determine Coverage Offered: Identify the type of health coverage provided to each employee and the corresponding codes.

- Fill Out the Form: Accurately complete each section of Form 1095-C, ensuring that all codes and information are correctly entered.

- Review for Accuracy: Double-check the completed form for any errors or omissions before submission.

- Distribute Copies: Provide copies of Form 1095-C to employees by the required deadline.

Following these steps helps ensure compliance with IRS regulations and provides employees with the necessary information regarding their health coverage.

IRS Guidelines for Form 1095-C

The IRS provides specific guidelines for completing and filing Form 1095-C. These guidelines outline the requirements for reporting health coverage offered to employees and detail the codes used on the form. Employers must adhere to these guidelines to avoid penalties and ensure accurate reporting.

Key points from the IRS guidelines include:

- Understanding the definitions of minimum essential coverage.

- Knowing the filing deadlines for both electronic and paper submissions.

- Being aware of the penalties for non-compliance, which can be significant.

Employers should regularly consult the IRS website for updates and changes to these guidelines.

Examples of Form 1095-C Usage

Form 1095-C is used in various scenarios to report health coverage. Here are a few examples:

- Example One: An employer offers health insurance to all full-time employees. They will use codes indicating the coverage provided and the months of coverage.

- Example Two: An employer who does not offer coverage will report this using Code 1H, indicating no health insurance was provided to the employee.

- Example Three: An employee who is enrolled in the employer's health plan will have their coverage reported using Code 2C.

These examples illustrate how the form is utilized to convey important information regarding health insurance offerings.

Penalties for Non-Compliance

Employers who fail to comply with the requirements for Form 1095-C may face significant penalties. The IRS imposes fines for incorrect or late filings, which can accumulate quickly. Understanding these penalties is vital for employers to avoid unnecessary costs.

Potential penalties include:

- A fine for each form that is not filed correctly or on time.

- Additional penalties for failing to provide copies to employees.

- Increased scrutiny from the IRS for repeated non-compliance.

Employers should prioritize accurate and timely filing to mitigate these risks.

Create this form in 5 minutes or less

Find and fill out the correct requesting comments on form 1094 c form 1095

Create this form in 5 minutes!

How to create an eSignature for the requesting comments on form 1094 c form 1095

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1095 C codes and why are they important?

1095 C codes are used to report health insurance coverage provided by employers to their employees. Understanding these codes is crucial for compliance with the Affordable Care Act (ACA) and for ensuring that employees receive the correct tax information. airSlate SignNow simplifies the process of managing these documents, making it easier for businesses to stay compliant.

-

How can airSlate SignNow help with 1095 C codes?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to 1095 C codes. Our solution streamlines the documentation process, ensuring that all necessary forms are completed accurately and on time. This helps businesses avoid penalties and maintain compliance with ACA regulations.

-

What features does airSlate SignNow offer for managing 1095 C codes?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically designed for 1095 C codes. These features enhance efficiency and reduce the risk of errors in documentation. Additionally, our user-friendly interface makes it easy for businesses to manage their compliance needs.

-

Is airSlate SignNow cost-effective for handling 1095 C codes?

Yes, airSlate SignNow offers a cost-effective solution for managing 1095 C codes. Our pricing plans are designed to fit various business sizes and needs, ensuring that you only pay for what you use. By streamlining the documentation process, businesses can save both time and money while ensuring compliance.

-

Can airSlate SignNow integrate with other software for 1095 C codes?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for easy management of 1095 C codes alongside your existing systems. This integration capability enhances workflow efficiency and ensures that all relevant data is synchronized across platforms, making compliance easier.

-

What are the benefits of using airSlate SignNow for 1095 C codes?

Using airSlate SignNow for 1095 C codes offers numerous benefits, including improved accuracy, faster processing times, and enhanced security. Our platform ensures that all documents are securely stored and easily accessible, reducing the risk of data loss. Additionally, the ease of use allows businesses to focus on their core operations rather than paperwork.

-

How does airSlate SignNow ensure the security of 1095 C codes?

airSlate SignNow prioritizes the security of your documents, including those related to 1095 C codes. We implement advanced encryption protocols and secure data storage to protect sensitive information. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

Get more for Requesting Comments On Form 1094 C, Form 1095

- Motor vehicle defect notification form

- Hospice face to face template form

- Chiller log sheet excel 153896 form

- Hixny consent form

- What does a personal data sheet have on it form

- Usaace form 10 e jul

- Missing person form template

- Wisconsin application for absentee ballot confidential elector id svrs id hindi sequential office use only office use only form

Find out other Requesting Comments On Form 1094 C, Form 1095

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free