Tax Return Canada Form

What is the T1 General Tax Return?

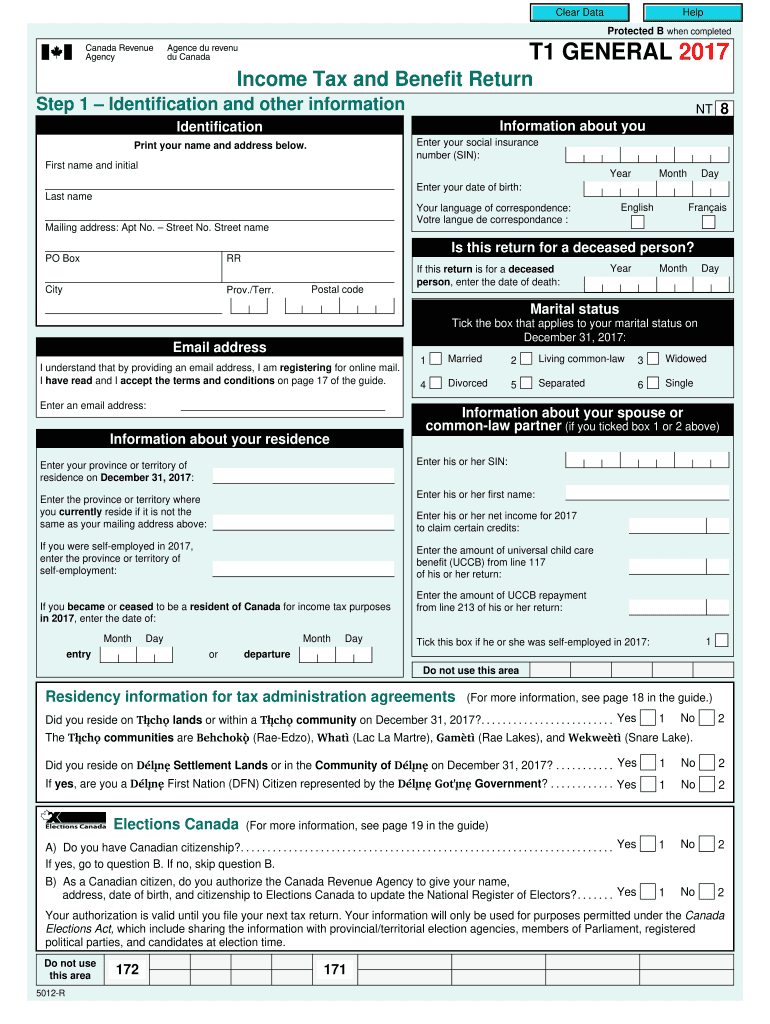

The T1 General tax return is the primary form used by individuals in Canada to file their personal income taxes. This form is essential for reporting income, calculating taxes owed, and claiming various credits and deductions. The T1 General form encompasses various sections that allow taxpayers to provide detailed information about their financial situation, including employment income, investment income, and eligible expenses. Understanding the T1 General is crucial for ensuring compliance with Canadian tax laws and maximizing potential refunds or minimizing tax liabilities.

Steps to Complete the T1 General Tax Return

Completing the T1 General tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including T4 slips, receipts for deductions, and any other relevant financial statements. Next, fill out the form by entering your personal information, income details, and deductions in the appropriate sections. It's important to double-check all entries for accuracy. After completing the form, review it thoroughly to ensure that all required information is included. Finally, submit the T1 General either online through the CRA's secure portal or by mailing a printed copy to the appropriate tax center.

Legal Use of the T1 General Tax Return

The T1 General tax return is legally required for individuals who earn income in Canada. Filing this form accurately and on time is crucial to comply with the Income Tax Act. Failure to file can result in penalties, interest on unpaid taxes, and potential legal action by the Canada Revenue Agency (CRA). It is essential to understand the legal implications of submitting the T1 General, including the responsibility to report all income and claim only eligible deductions. Utilizing a reliable eSignature solution can help ensure that electronic submissions are legally binding and secure.

How to Obtain the T1 General Tax Return

The T1 General tax return can be obtained from the Canada Revenue Agency (CRA) website. Taxpayers can download the form in PDF format, allowing for easy printing and completion. Alternatively, individuals can use tax preparation software that includes the T1 General form, streamlining the process of filling it out. For those who prefer a physical copy, the CRA also provides options to request the form by mail. It is important to ensure you are using the most current version of the T1 General, as tax laws and forms may change annually.

Required Documents for the T1 General Tax Return

To complete the T1 General tax return accurately, several documents are required. These include:

- T4 slips from employers, detailing employment income.

- Receipts for deductible expenses, such as medical expenses or charitable donations.

- Statements of investment income, including T5 slips.

- Any other relevant tax documents, such as rental income statements or pension slips.

Having all necessary documents organized before starting the T1 General will facilitate a smoother filing process and help ensure compliance with tax regulations.

Filing Deadlines for the T1 General Tax Return

Filing deadlines for the T1 General tax return are crucial for avoiding penalties and interest. Generally, the deadline for most individuals to file their tax return is April 30 of the following year. If April 30 falls on a weekend or holiday, the deadline is extended to the next business day. Self-employed individuals have until June 15 to file, but any taxes owed are still due by April 30. It is important to stay informed about these deadlines to ensure timely submission and compliance with Canadian tax laws.

Quick guide on how to complete tax return canada

Complete Tax Return Canada effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a great eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents swiftly without delays. Manage Tax Return Canada on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tax Return Canada with ease

- Locate Tax Return Canada and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Make your eSignature with the Sign tool, which takes moments and carries the same legal validity as a standard ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Return Canada and ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1 general sample offered by airSlate SignNow?

The t1 general sample is a versatile and user-friendly document template provided by airSlate SignNow. It simplifies the process of eSigning and managing documents, making it an essential tool for businesses looking to streamline their workflows.

-

How much does airSlate SignNow cost for accessing the t1 general sample?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including access to the t1 general sample. You can choose a plan that suits your budget, and benefit from a cost-effective solution for document management and eSigning.

-

What are the key features of the t1 general sample in airSlate SignNow?

The t1 general sample comes with several key features, including customizable fields, eSigning options, and document tracking. These features enhance efficiency and ensure that your document management processes are seamless and organized.

-

How can the t1 general sample enhance my business processes?

Using the t1 general sample can signNowly enhance your business processes by reducing the time spent on paperwork. With airSlate SignNow’s intuitive interface, you can quickly send, sign, and store essential documents, thereby increasing productivity and collaboration.

-

Is the t1 general sample customizable to fit my needs?

Yes, airSlate SignNow allows users to customize the t1 general sample to meet specific business requirements. You can modify fields, add company branding, and adjust the layout to align with your organizational standards.

-

What integrations are available with the t1 general sample on airSlate SignNow?

airSlate SignNow supports a variety of integrations that complement the functionalities of the t1 general sample. Whether you use CRM systems, cloud storage, or other software, you can easily connect these tools to enhance your efficiency.

-

Can the t1 general sample be used on mobile devices?

Absolutely! The t1 general sample is fully accessible on mobile devices through the airSlate SignNow app. This versatility ensures that you can manage and eSign documents anytime, anywhere, providing a flexible solution for busy professionals.

Get more for Tax Return Canada

- The outsiders quiz chapters 1 3 pdf form

- Umesh dhande gate academy form

- Quiktrip insurance form

- Man young rhee internet security cryptographic principles form

- J dtr2574tnq is hiring engineering freshers20152016 for coimbatore kindly check your mail for further detailstnqto apply fwd form

- Official usda letter head form

- Department of revenue services state of connecticu 772031429 form

- Debt payment agreement template form

Find out other Tax Return Canada

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple