Form 1042 2017

What is the Form 1042

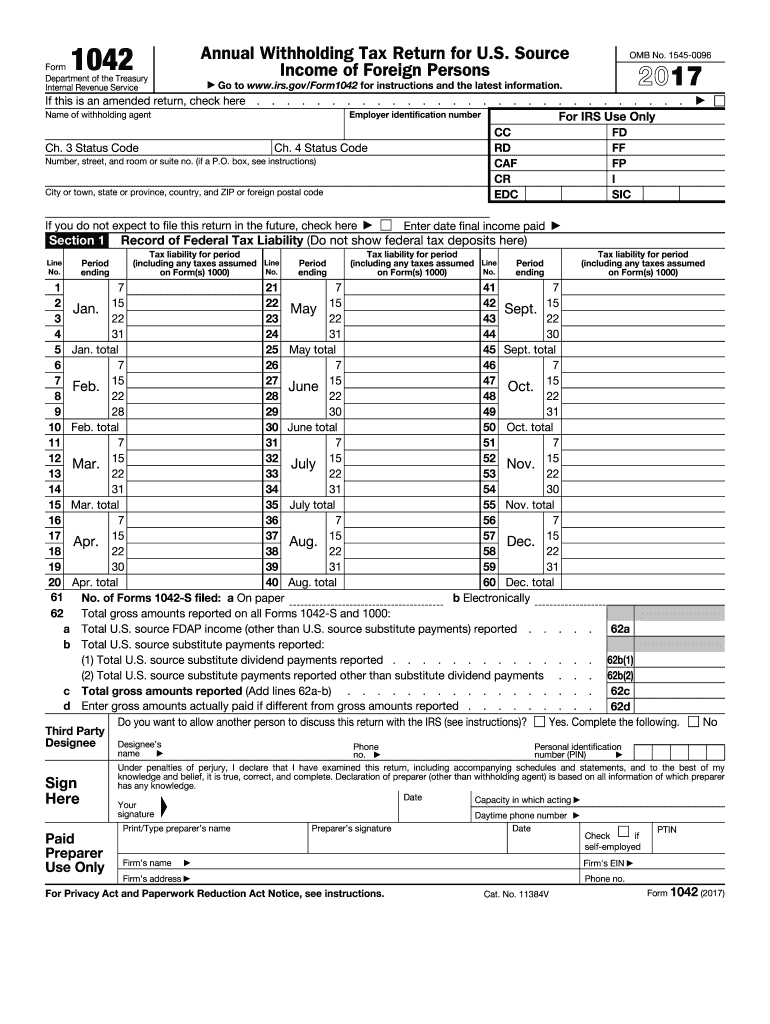

The Form 1042 is a U.S. tax form used by withholding agents to report income paid to foreign persons and the taxes withheld on that income. This form is essential for ensuring compliance with U.S. tax laws regarding payments made to non-resident aliens and foreign entities. It is primarily utilized by businesses and organizations that make payments subject to withholding, such as interest, dividends, rents, and royalties.

How to use the Form 1042

To effectively use the Form 1042, withholding agents must accurately report the payments made to foreign individuals or entities. This involves identifying the type of income, determining the correct withholding tax rate, and ensuring that all required information is included. The form must be filed annually, and it is crucial to keep detailed records of all payments and withholdings to support the information reported on the form.

Steps to complete the Form 1042

Completing the Form 1042 involves several key steps:

- Gather all relevant information, including the names and addresses of foreign recipients.

- Identify the types of income being reported and the corresponding withholding tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total amount of income paid and the total tax withheld.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The Form 1042 must be filed by March 15 of the year following the tax year in which the payments were made. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 1042 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the length of the delay and the amount of tax owed. Additionally, withholding agents may face further scrutiny and potential audits if compliance issues arise. It is crucial to ensure that all filings are accurate and timely to avoid these consequences.

Digital vs. Paper Version

With the advancement of technology, the Form 1042 can be completed and submitted electronically or through paper methods. The digital version offers advantages such as faster processing times and reduced chances of errors. However, some may prefer the traditional paper method for record-keeping. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete form 1042 2017

Discover the simplest method to complete and endorse your Form 1042

Are you still wasting time preparing your official documents on paper instead of handling them online? airSlate SignNow provides a superior approach to fill out and endorse your Form 1042 and similar forms for public services. Our advanced eSignature solution equips you with all necessary tools to manage documents swiftly and in accordance with formal standards - comprehensive PDF editing, organizing, securing, endorsing, and sharing options readily available within a user-friendly interface.

Just a few steps are required to complete and endorse your Form 1042:

- Upload the editable template to the editor via the Get Form button.

- Identify the information you need to input in your Form 1042.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Highlight what is essential or Blackout sections that are no longer relevant.

- Press Sign to create a legally binding eSignature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finalized Form 1042 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our service also supports versatile file sharing. There’s no need to print your forms when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct form 1042 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the form 1042 2017

How to make an electronic signature for your Form 1042 2017 online

How to create an eSignature for your Form 1042 2017 in Chrome

How to generate an eSignature for signing the Form 1042 2017 in Gmail

How to generate an electronic signature for the Form 1042 2017 straight from your smart phone

How to create an electronic signature for the Form 1042 2017 on iOS devices

How to create an electronic signature for the Form 1042 2017 on Android devices

People also ask

-

What is Form 1042 and who needs to file it?

Form 1042 is a tax form used by withholding agents to report tax withheld on certain payments made to foreign persons. If your business makes payments to non-resident aliens or foreign entities, it's essential to file Form 1042 to comply with IRS regulations.

-

How can airSlate SignNow assist with completing Form 1042?

airSlate SignNow offers features that streamline the process of preparing and signing Form 1042. With our electronic signature capabilities, you can easily gather necessary signatures and ensure that all relevant parties have access to the completed form.

-

Is there a cost associated with using airSlate SignNow for Form 1042?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. We provide a cost-effective solution for managing and eSigning documents, including Form 1042, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for managing Form 1042?

airSlate SignNow includes features such as customizable templates, document sharing, and secure storage, all of which simplify the management of Form 1042. These tools ensure that your documents are organized and easily accessible when you need to file.

-

Can I integrate airSlate SignNow with other software for Form 1042 processing?

Absolutely! airSlate SignNow seamlessly integrates with various software tools, making the processing of Form 1042 more efficient. Whether you use accounting software or CRM systems, our integrations allow for smooth workflows and enhanced productivity.

-

What are the benefits of using airSlate SignNow for Form 1042?

Using airSlate SignNow for Form 1042 provides numerous benefits, including speed, efficiency, and accuracy. Our platform reduces the time spent on manual processes, minimizes errors, and helps ensure compliance with IRS requirements.

-

How does airSlate SignNow ensure the security of Form 1042 documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure cloud storage to protect your Form 1042 documents, ensuring that sensitive information remains confidential and safe from unauthorized access.

Get more for Form 1042

- Volunteer appreciation letter form

- 5471 schedule o form

- Official government id and certificates ontario ca form

- Petition for resentencing or reduction to penal code 1170 form

- Reciprocal nonresident indiana individual income tax return in gov form

- 4 acentuacin de diptongos triptongos e hiatos ies vega de mar form

- Vsp member reimbursement form docs vaceinsurance com

- Instructions for pit 1 new mexico personal in form

Find out other Form 1042

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile