Printable Vat 652 Form

What is the Printable Vat 652 Form

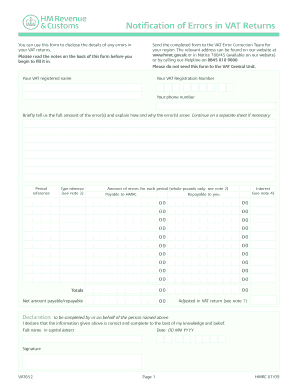

The vat652 form is a crucial document used primarily for tax purposes in the United States. It serves to report specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses alike, ensuring compliance with tax regulations. Understanding the vat652 form is vital for accurate reporting and avoiding potential penalties.

How to use the Printable Vat 652 Form

Using the vat652 form involves several key steps. First, you need to gather all necessary financial information relevant to the reporting period. Next, accurately fill out each section of the form, ensuring that all details are correct. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Printable Vat 652 Form

Completing the vat652 form requires attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and expense records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, as per IRS guidelines.

Legal use of the Printable Vat 652 Form

The vat652 form is legally binding when filled out correctly and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal repercussions. Compliance with tax laws not only protects individuals and businesses but also contributes to the overall integrity of the tax system.

Key elements of the Printable Vat 652 Form

The vat652 form consists of several key elements that must be completed accurately. These include:

- Identification information, such as your name and taxpayer identification number.

- Financial data relevant to the reporting period, including income and deductions.

- Signature and date fields, confirming the authenticity of the submission.

Each of these elements plays a crucial role in ensuring that the form is processed correctly by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The vat652 form can be submitted through various methods, offering flexibility based on user preference. Options include:

- Online Submission: Many taxpayers choose to file electronically, which can expedite processing times.

- Mail: The completed form can be printed and sent to the IRS via postal service.

- In-Person: Some individuals may opt to deliver the form directly to their local IRS office.

Each submission method has its own advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete printable vat 652 form

Easily Prepare Printable Vat 652 Form on Any Device

Managing documents online has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Printable Vat 652 Form on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign Printable Vat 652 Form Effortlessly

- Obtain Printable Vat 652 Form and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or incorrectly filed documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Printable Vat 652 Form and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable vat 652 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vat652 form and why is it important?

The vat652 form is a document used by businesses to report VAT information to the relevant tax authorities. It's important because it ensures compliance with tax regulations, helping businesses avoid penalties and maintain accurate financial records.

-

How can airSlate SignNow help with the vat652 form?

airSlate SignNow provides a seamless platform to electronically sign and manage the vat652 form. Our solution simplifies the process, allowing users to complete and submit their forms quickly and securely without the hassle of paper documents.

-

Is there a cost associated with using airSlate SignNow for the vat652 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those who frequently handle the vat652 form. The pricing is competitive, ensuring that businesses can access affordable eSignature solutions without compromising on features.

-

What features does airSlate SignNow offer for the vat652 form?

airSlate SignNow offers features like seamless eSigning, document templates, and real-time tracking specifically for forms like the vat652. These tools enhance efficiency and ensure that your forms are processed quickly and accurately.

-

Can I integrate airSlate SignNow with my current software for vat652 form management?

Absolutely! airSlate SignNow supports integrations with various software programs, allowing users to streamline their vat652 form management. This enhances productivity by enabling the seamless flow of data between systems.

-

What are the benefits of using airSlate SignNow for the vat652 form?

Using airSlate SignNow for the vat652 form brings efficiency and convenience to your business operations. It eliminates paperwork, reduces processing times, and ensures that documents are signed and stored securely in compliance with regulations.

-

How fast can the vat652 form be processed with airSlate SignNow?

With airSlate SignNow, the vat652 form can be processed in minutes, not days. The platform's intuitive interface and automated workflows minimize delays, ensuring that your form is submitted promptly so you can focus on your business.

Get more for Printable Vat 652 Form

- F4506tpdf form 4506 tjune 2019 department of the

- About form 1040 v payment voucherinternal revenue

- Deductions form 1040 itemized internal revenue service

- 2019 form 8962 premium tax credit ptc

- Attach to form 1040 1040 sr or 1040 nr

- Irs f4952 fill online printable fillable blank form

- About form 944 employers annual federal tax return

- Tax reform employee business expense form 2106

Find out other Printable Vat 652 Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF