Wage Verification Form 2001

What is the Wage Verification Form

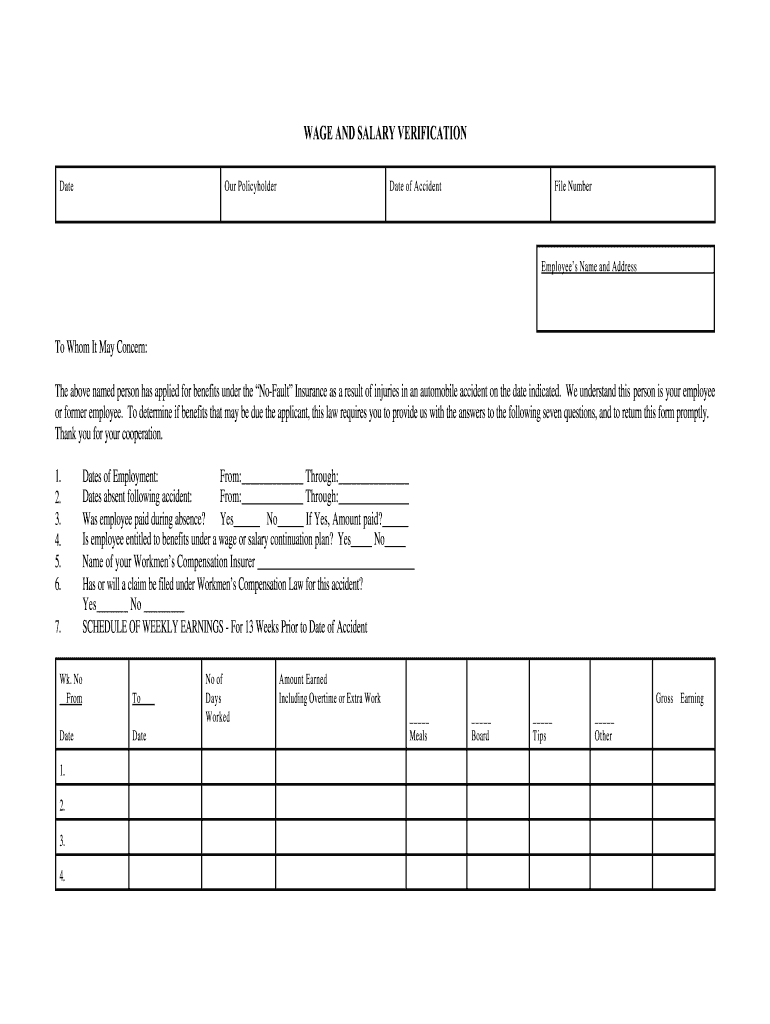

The wage verification form is a crucial document used to confirm an individual's income and employment status. This form is often required by lenders, landlords, and government agencies to assess financial stability. It typically includes details such as the employee's name, position, salary, and the duration of employment. Understanding the purpose of this form is essential for both employees and employers, as it plays a significant role in various financial transactions.

How to Use the Wage Verification Form

Using the wage verification form involves several steps. First, the employee must obtain the form, which can often be provided by the employer or downloaded from relevant websites. Next, the employee fills out their personal information, including their name and position. The employer then verifies this information, providing details about the employee's salary and employment duration. Once completed, the form can be submitted to the requesting party, such as a bank or landlord, to facilitate the verification process.

Key Elements of the Wage Verification Form

Several key elements must be included in a wage verification form to ensure its effectiveness. These elements typically consist of:

- Employee Information: Name, address, and job title.

- Employer Information: Company name, address, and contact details.

- Employment Details: Start date, current salary, and employment status (full-time or part-time).

- Signature: Both the employee's and employer's signatures are usually required to validate the document.

Steps to Complete the Wage Verification Form

Completing the wage verification form involves a systematic approach. First, gather all necessary information, including personal and employment details. Next, accurately fill out the form, ensuring that all sections are completed. After the employee's section is filled, the employer should review and verify the information, adding their details and signature. Finally, submit the completed form to the requesting entity, ensuring that it is sent through a secure method to protect sensitive information.

Legal Use of the Wage Verification Form

The wage verification form holds legal significance in various contexts. It serves as an official record of an individual's income and employment, which can be used in legal proceedings or financial assessments. To be legally binding, the form must be completed accurately and signed by both the employee and employer. Additionally, it must comply with relevant laws and regulations, such as those governing employment verification and data protection.

Form Submission Methods

There are multiple methods for submitting the wage verification form, depending on the requirements of the requesting party. Common submission methods include:

- Online Submission: Many organizations accept forms submitted electronically, allowing for quick processing.

- Mail: The form can be printed and sent via postal service, ensuring it reaches the intended recipient securely.

- In-Person Delivery: Some situations may require the form to be delivered directly to the requesting entity, allowing for immediate verification.

Quick guide on how to complete wage form

Execute Wage Verification Form effortlessly on any gadget

Online document management has gained traction among enterprises and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and safely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage Wage Verification Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to edit and eSign Wage Verification Form without hassle

- Locate Wage Verification Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Wage Verification Form and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wage form

FAQs

-

If a person is being sub contracted out for a job, and paid gross wages without any deductions, does he/she have to fill out the T2125 form?

If they are not on the company's payroll and are just being paid a gross amount with no deductions, that implies that they are a sub-contractor and have to report that income on the business statement (T2125). They would be responsible for paying their own taxes when they file their return.

-

Is it legal to have an unregistered off-the-grid (no birth certificate) baby in the USA?

I was actually roommates with someone in College whose parents decided to have him “off-grid”. Let me just say this: Stop even entertaining the idea of having a baby off-grid. It really makes your child’s life unnecessarily hard and your kid will forever resent you for putting that pain on them.I’ll get into the details in a moment, but first let me address the question proposed above. Yes, technically speaking it is not a crime to have your baby off-the-grid in the U.S.A. However, a lot of details surrounding the event would be illegal. First of all, any licensed midwife or doctor is required by law to file a birth certificate or they actually risk losing their license and getting a misdemeanor. If you forced them or threatened them to not file the birth certificate that would make you a likely accomplice and would not go over well with the authorities.But let’s ignore that for a moment and just assume you know how to birth a child on your own and can do it in your basement without any professional medical physician there to oversee you (which would be the only way you could pull this off). In this case you wouldn’t get thrown in jail for failing to get a birth certificate and no crime would have been committed. However you just set up a very difficult life for your child.These are some of the things I was told from by my roommate who didn’t have a social security number until he was 20 years old.No, he could not get a (legal) jobQuite literally he didn’t qualify to get even a job at McDonalds. If you remember the last job you got no matter how prestigious or demeaning it was, you had to fill out a bunch of paperwork. Most of these forms require you to have a SSN (social security number) to properly fill them out. However the important one is the form labeled I-9. This form is required to be submitted by every employer after hiring a new employee. This form serves only one purpose, to determine that you are eligible to work in the United States. Your child (and my roommate) would not be able to complete this form which every employer must get filled out before starting employment with a new employee. Your child will not be able to get a job because of this.Yes, he can evade paying taxes.Okay, so this sounds like a perk I guess. But my roommate did not have to pay taxes. The government basically didn’t know he existed, so they never knew he was not paying. But then again he didn’t have a job. So would you rather have a job and pay some taxes or not ever be able to work except under the table for below minimum wage? Given that choice, taxes sound pretty awesome! Keep in mind that this also means your child is not eligible for any tax benefits or credits such as those that students get while going to college.No, You as the parent can not claim him as a dependent on your taxesYou’re already dealing with a child, wouldn’t it be great to get that child tax credit? Every year you'll basically be paying out of pocket for deciding not to get them a SSN.Yes, he can attend public school through 12th gradeHe would be able to attend school through high school without a social security number.No, he can not attend collegeWhile high school and lower education is okay, your child will never be able to attend collegeYes, he can go to the doctorThe doctor will still see your child and provide him his shots. However…No, he will not be covered under your family insurance (or qualify for Medicare/Medicaid)So you’ll need to plan on paying for all doctor appointments out of pocket.No, he can not travel abroad (even to Canada)You’d best hope none of your child’s friends decide to go to Cancun for spring break. Your child will not be eligible to leave the country or return to the US if he manages to leave (unless he plans to climb Trump’s wall)No, he will not be able to drive a carOkay, well nothing is stopping him from physically driving a car, but he would not be able to get a driver’s license and thus, can not LEGALLY drive. Hope he doesn’t get pulled over.No, he will not be able to voteOnce old enough he will not be able to register to vote.Yes, he can avoid the draftWell the good news is that like taxes, he can skirt the requirement to join the draft when he turns 18.No, he can’t get a loanThis means no credit cards, no car loan, no home, nothing. I’m sure plenty of people will claim these are all evil anyway, but these have powerful impacts on someone’s life. There might be times he needs it. (and when used properly none of these are bad things).No, he will not have a credit scoreThis goes with the above one, but he will not be able to work on this which affects your entire life/future. This also will disqualify him from renting most homes or apartments he is looking at.Basically your child will be treated as an illegal immigrant. Why put them through this when they are entitled to the benefits that the United States provides its citizens? There are people in other countries dying to get what your child is entitled to and you are (considering) denying your child those abilities? It just doesn’t make sense.Get them a SSN and if your child decides at 20 that he wants to live off-the-grid than he can burn his Social Security Card and go in the woods and hide from the government. But don’t be selfish enough to make that decision for them.My roommate resents his parents for not giving him a SSN. While all his friends in high school were driving, he couldn’t. While his friends go to Cancun for spring break, he had golden handcuffs in the U.S. and can’t leave. And worst of all he said was that while all his friends were earning money from jobs in high school, he couldn’t get a job.The job part was the hardest for him. He couldn’t leave the house or move out when he turned 18. He was stuck at home.Him working on getting a social security number was difficult and took him two years. He started when he turned 18 to get one once he realized he couldn’t go to college, he couldn’t get a job, he couldn’t rent an apartment, and thus will never really be able to be independent from his parents. It took two years and then at 20 he was able to get one and start working and going to school.He forever resented his parents. Don’t be those parents…

-

What was the shortest interview you’ve had that led to a job offer?

The interviewer didn’t even ask my name.Yup, you read that right. I got a job as an Associate Software Engineer in Accenture and the interviewer didn’t even ask my name directly.Date: 14th Sept. 2014.Venue: CGC Chandigarh.It was a joint campus placement drive so there were hundreds (thousands?) of candidates. After the aptitude test on previous day everyone was waiting for their interview. The interviews were taken in a batch of 5 candidates. So in every room there were 5 candidates and 2 interviewers (I guess one was technical and other one an HR). So in my group, there were 4 boys and 1 girl sitting as Boy1, Boy2, Girl, Me and Boy4.Interviewer started from Boy1 asked something about him and some basic technical questions. Then came turn of Boy2 again some basic ‘about me’ questions and some technical questions related to his project.Now comes the Girl’s part. This girl was speaking in an American accent and the interviewer was not quite happy with that. So she told her that your accent is american. The girl replied thank you to which the interviewer said “that was not a compliment”. Everyone laughed. :PNow the interviewer (lady HR) asked the girl about her personality. She said “I am very talkative”.Interviewer: Ok, can you take the interview of him (pointing towards me).Girl: Yes, can I get his resume?Interviewer: No.Girl: Ok. (looking at my face) What’s your name?Me: My name is Abhishek.Girl: Ok, tell me about yourself.Me: *started telling about everything I could and stopped, then at last started talking about my project.*Interviewer: Nothing about the project keep telling about yourself.Me: *Poker face. I mean how much I can tell about myself? **After few seconds*Me: Ok, I love to read and doodle cartoons.Girl: Oh! can you draw mam? (pointing towards the HR).Me: Sure, can I get a pen and a paper.*got a pen and paper, sat there and started scribbing looking at the beautiful HR while she began interviewing the next candidate*.After few minutes the 5th candidate’s interview was also over. HR looked at me and I handed her the doodle I made about her.She smiled, I smiled. She signalled to leave.After half an hour or so: I was selected.

-

My son wants to rent the basement, I feel bad charging him because it’s my son and I don’t need to take his money. What are some options I can do to make him have responsibility without having to pay me?

This is what my son and I did when he wanted to live independently, but couldn't really afford to live out on his own.I live on the west coast of Canada. Rents are very high, so it is difficult for young people to work at the minimum wage jobs available to them, and live independently.We have a strong Provincial Landlord Tenant Act which governs both landlords and tenants. Everything is very clear, and life is easier for all concerned if landlords use the government forms, and follow the act.My son called me one day, after living away from home for maybe 3 years, saying he wasn't going to be able to pay the rent due in 3 or 4 days. Could he please move back home into his room?I rented a truck, about 3 hours was all I could get at that late date, and we moved him home.It turned out he was having trouble with having a consistent income with the minimum wage jobs he was qualified for at the time.He moved into his childhood room, which is tiny, and my living room became a storage room for the rest of his things. (I have a tenant paying market rent in a one bedroom suite in my basement. It pays the mortgage.)Not long after, we moved him into the master bedroom, which has an ensuite (master bath), and all his things moved from the living room into his room, which is very large.Next, he filled out a provincial government landlord tenant form, and began paying $200 each month.I put a full size fridge and microwave in his room. He did his own grocery shopping, and cooking. He did his own cleaning and laundry. We didn't share a bathroom, so that removed a source of friction.I certainly did not worry about the cleanliness of his room. That's what doors are for, although it turned out he cleaned more regularly than I did.I did not enter his room without permission or proper notice, as per the Landlord Tenant Act.I had already taken him grocery shopping a few times to show him how to shop and cook on a budget.I hired someone else to cut the lawn. My son had no time, and I didn't want to be arguing with him about chores.He was no longer a child. I had my chance raising him. That period of both our lives was over. He was trying his best to be an independent adult in a difficult financial climate, so I treated him like an adult. I also treated him like any other tenant I've had.My thinking was if I wouldn't say it to my tenant downstairs, I didn't say it to him.All of this meant that our only interaction was social, so we became good friends.It worked a treat. We get along great now.Your son is trying to be an adult, taking small steps. Let him. Make him a tenant, and treat him like any other tenant.Charge him $200 a month, which is low enough to keep him there, but high enough that he will have to budget to make sure he can pay it.Treat him the same way you would treat a tenant who is a stranger. Treat him like the adult he wants to be.Let him do his own laundry. Make up a schedule, if necessary. He gets the weekends, you get weekdays; he gets Wednesday and Sunday, you get the rest of the time.Hire someone to mow the grass. Do not expect “family chores" from him, just as you wouldn't from a tenant who is a stranger.Put a full size fridge, a microwave, and a hot plate in his suite if there isn't a kitchen. Then take him grocery shopping and show him how to shop, and cook, on a tight budget.Do not expect him at the family dinner table every night. You will find yourself chasing him to find out when he'll be home for dinner every day. Let him set his own schedule, cook for himself, eat what he wants. If he needs cooking lessons, teach him, or sign him up for a class. After he's settled, invite him for Sunday dinner, but not every week.If he needs to be driven when he drinks too much, pick him up. Ask no questions.Try very hard not to judge as he navigates the difficult time of young adulthood. Help him get through without any life altering issues — everyone alive, no one pregnant, no record.All of this will help him learn how to organize his life successfully in the adult world while he is in a safe place. It will also provide a foundation for your future relationship, and your respect for each other.He wants to be an independent adult. Let him, and help him.It has nothing to do with whether or not you need the rent money. It has everything to do with helping your son become an adult.My son stayed for 2.5 years. It was great having him here. When he left, he got in his car and drove, alone, across the country to live in Toronto, which he felt well prepared to do. I then offered his room to a young, aspiring musician who wanted to live semi-independently, with someone around. She pays market rent, I listen to beautiful music every day, and we both have someone to talk to.If you read my thread, you'll see some of my experiences with my son as he went through young adulthood, and how we navigated to what I now consider successful adulthood.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

I didn't file my taxes last year. What are the forms that I will have to fill out? When is the last day to do so?

If you are required to file a US return, you have until April 15 to file your Federal tax return.As far as "telling you how to" do it, or what forms you have to fill out - that's impossible without a review of your situation. It could be as simple as filing Form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents if you had no dependents, no income other than wages, interest, and/or unemployment compensation, no deductions other than the standard deduction, and no tax payments or credits other than withholding and the Earned Income Tax Credit (EITC). Every additional item of income, deduction, or credit can add an additional layer of complexity to the return you must file.You should consider a visit to a tax professional in your area - and you should do it quickly since you only have about two weeks left to file a return in the US.

-

What are some things you realized when you got your first paycheck?

That I needed to go to college.That no matter how many hours I worked, that number times my hourly (minimum) wage would never add up to much.That they take out taxes from your gross pay. What the F??? “What form do I have to fill out so that I don’t have to pay taxes? There must be some mistake here.”That I needed to open a checking account to deposit this check in to.That my parents would no longer give me an allowance, now that I was earning money on my own.That you need to ‘pace yourself’ in spending, so that you’ll have some money left over until your next paycheck comes.It is probably the same thing everybody thinks, upon receiving their first check.

-

How do I write a resume for my first job at Jack in the box with no work experience?

Look at you, heavy hitter! Your first resume should include your full name, your city, state, and ZIP code (no street address, save that for the application), your cell phone or your parent’s work phone if you’re a minor, and an email address. For your objective, of course, Food Service Worker at Jack in the Box. Now list your education, followed by school clubs and extracurricular activities. For want of job experience, mention volunteer work. I would hire someone who pulled donut duty at church over someone who didn’t. Fundraisers, ticket sales, carnival booths, you name it! I bet your life has been exciting enough already…Seize the day!

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the wage form

How to make an electronic signature for the Wage Form in the online mode

How to make an electronic signature for your Wage Form in Chrome

How to make an electronic signature for signing the Wage Form in Gmail

How to create an eSignature for the Wage Form right from your mobile device

How to make an eSignature for the Wage Form on iOS

How to generate an electronic signature for the Wage Form on Android devices

People also ask

-

What is a Wage Verification Form?

A Wage Verification Form is a document used by employers to confirm an employee's salary or hourly wage, often required for loan applications, rental agreements, or financial aid. With airSlate SignNow, you can easily create and send this form for eSignature, streamlining the verification process.

-

How does airSlate SignNow help with Wage Verification Forms?

airSlate SignNow allows you to efficiently create, send, and eSign Wage Verification Forms. Our platform simplifies document management by enabling real-time collaboration and secure storage, ensuring that your wage verification processes are both fast and reliable.

-

Is there a cost associated with using airSlate SignNow for Wage Verification Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that suits your requirements for managing Wage Verification Forms, with options that provide excellent value for the features offered.

-

Can I customize my Wage Verification Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Wage Verification Form to meet your specific needs. You can add fields, modify the layout, and include company branding, ensuring that your forms align with your organization's standards.

-

What are the benefits of using airSlate SignNow for Wage Verification Forms?

Using airSlate SignNow for Wage Verification Forms offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security features. Our platform ensures that your sensitive information is protected while allowing for quick and easy access to signed documents.

-

Does airSlate SignNow integrate with other applications for Wage Verification Forms?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRMs and HR software. This allows you to automate and streamline your workflow when managing Wage Verification Forms, enhancing overall efficiency.

-

How secure is the information on my Wage Verification Form with airSlate SignNow?

airSlate SignNow prioritizes security and compliance, implementing advanced encryption and authentication measures to protect your Wage Verification Forms. You can trust that your sensitive data is safe and secure on our platform.

Get more for Wage Verification Form

- Seller concession addendum form

- Driving licence download pdf west bengal form

- Patient health questionnaire phq 9 patient name date form

- Secretary performance evaluation sample

- Brownells return policy form

- Dnr form virginia

- Social work intake form

- Household member shelter utility verification job and family services forms

Find out other Wage Verification Form

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form