Vermont Gift Tax Exemption Form 2013

What is the Vermont Gift Tax Exemption Form

The Vermont Gift Tax Exemption Form is a legal document used by individuals to report gifts made to others that may be exempt from state gift taxes. This form helps ensure compliance with Vermont state tax regulations, allowing taxpayers to declare gifts that fall within the exemption limits set by the state. Understanding this form is crucial for anyone looking to transfer assets without incurring tax liabilities.

How to use the Vermont Gift Tax Exemption Form

Using the Vermont Gift Tax Exemption Form involves several key steps. First, individuals must determine if their gifts qualify for exemption under state law. Next, they should accurately fill out the form, providing details about the donor, recipient, and the nature of the gift. Once completed, the form should be submitted to the appropriate state tax authority. It is essential to retain a copy for personal records.

Steps to complete the Vermont Gift Tax Exemption Form

Completing the Vermont Gift Tax Exemption Form requires careful attention to detail. Follow these steps:

- Gather necessary information about the donor and recipient.

- Detail the nature of the gift, including its value.

- Complete all sections of the form accurately.

- Review the form for errors and omissions.

- Submit the form to the Vermont Department of Taxes.

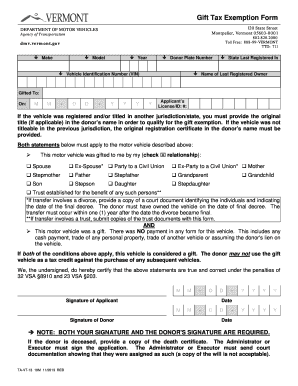

Key elements of the Vermont Gift Tax Exemption Form

Several key elements are essential to the Vermont Gift Tax Exemption Form. These include:

- Donor Information: Name, address, and Social Security number of the person giving the gift.

- Recipient Information: Name, address, and Social Security number of the person receiving the gift.

- Gift Description: A detailed description of the gift, including its fair market value.

- Exemption Claim: A statement asserting that the gift qualifies for exemption under Vermont law.

Legal use of the Vermont Gift Tax Exemption Form

The Vermont Gift Tax Exemption Form is legally binding when completed and submitted according to state regulations. It serves as a formal declaration to the state regarding the nature and value of gifts exchanged. Proper use of this form can protect individuals from potential tax liabilities and ensure compliance with Vermont tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Vermont Gift Tax Exemption Form are crucial for compliance. Generally, the form should be submitted within a specific timeframe following the date of the gift. It is advisable to check the Vermont Department of Taxes website or consult a tax professional for the most current deadlines to avoid penalties.

Quick guide on how to complete vermont gift tax exemption form

Prepare Vermont Gift Tax Exemption Form seamlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an ideal green alternative to conventional printed and signed documents, as you can access the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without interruptions. Manage Vermont Gift Tax Exemption Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to adjust and electronically sign Vermont Gift Tax Exemption Form effortlessly

- Find Vermont Gift Tax Exemption Form and click Get Form to initiate.

- Make use of the tools we provide to fill out your document.

- Highlight important parts of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Vermont Gift Tax Exemption Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont gift tax exemption form

Create this form in 5 minutes!

How to create an eSignature for the vermont gift tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont gift tax exemption form?

The Vermont gift tax exemption form is a document that allows individuals to report taxable gifts made within the state. This form is essential for ensuring compliance with Vermont's tax regulations on gifts and helps in claiming applicable exemptions. Understanding how to correctly fill out the Vermont gift tax exemption form can signNowly benefit your tax situation.

-

How do I obtain the Vermont gift tax exemption form?

You can obtain the Vermont gift tax exemption form through the Vermont Department of Taxes website or directly from airSlate SignNow's platform. Our platform offers an easy way to access, complete, and eSign the form digitally. Utilizing airSlate SignNow can simplify your document management process.

-

Are there any fees associated with filing the Vermont gift tax exemption form?

There are no fees specifically for filing the Vermont gift tax exemption form itself; however, other related tax obligations may apply. Using airSlate SignNow incurs a nominal fee that provides you with a hassle-free and cost-effective method for managing all your eSigning needs, including tax forms. Make sure to consult a tax professional for any additional costs related to gifts.

-

What benefits does airSlate SignNow offer for handling the Vermont gift tax exemption form?

airSlate SignNow provides an intuitive interface that streamlines the process of filling out and submitting your Vermont gift tax exemption form. Key benefits include the ability to eSign documents securely, access templates for guidance, and track submission statuses. This can save you time and reduce errors when dealing with important tax documents.

-

Can I integrate airSlate SignNow with other software for the Vermont gift tax exemption form?

Yes, airSlate SignNow can integrate with various applications to enhance the management of your Vermont gift tax exemption form. This integration allows for seamless document sharing and storage, increasing overall efficiency. Check our integrations page to see how we can connect with the tools you already use.

-

What features make airSlate SignNow ideal for eSigning the Vermont gift tax exemption form?

airSlate SignNow offers features like secure cloud storage, multi-user access, and customizable eSigning workflows that simplify the process of completing the Vermont gift tax exemption form. Additionally, our platform ensures compliance with legal standards, making it a trustworthy solution for your signing needs. Experience increased productivity with our user-friendly tools.

-

How secure is airSlate SignNow when using the Vermont gift tax exemption form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the Vermont gift tax exemption form. Our platform utilizes encryption and secure access controls to protect your data. You can confidently sign and store your documents without worrying about unauthorized access.

Get more for Vermont Gift Tax Exemption Form

Find out other Vermont Gift Tax Exemption Form

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile