Form 1099 R 2024

What is the Form 1099-R

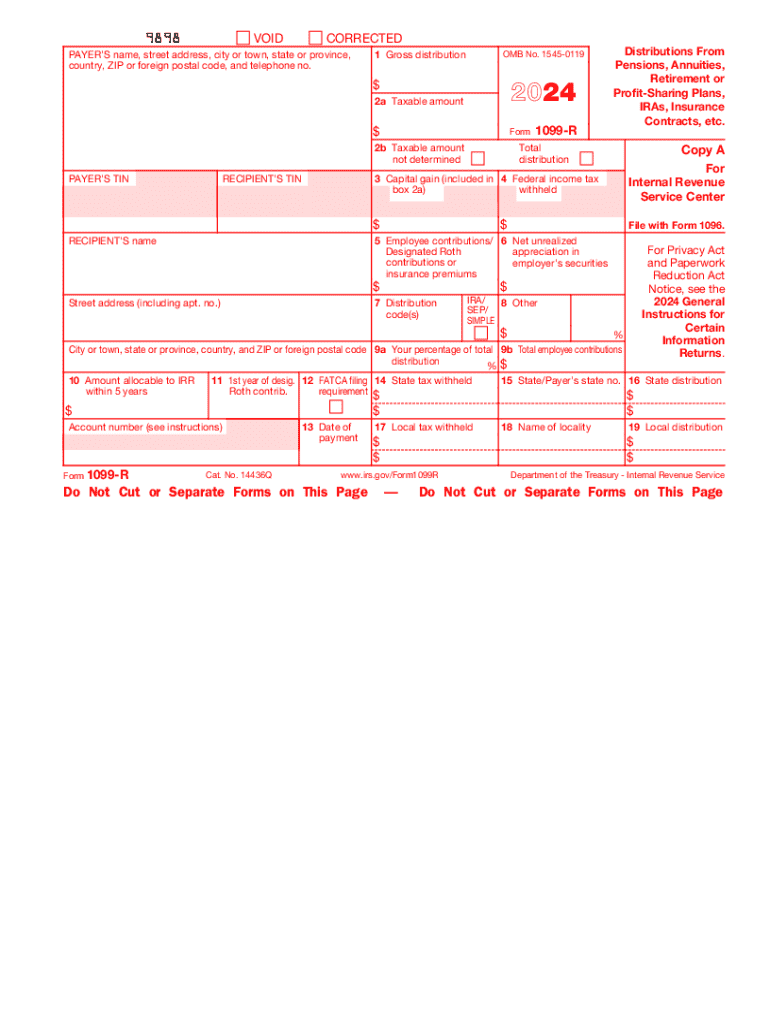

The Form 1099-R is a tax document used to report distributions from pensions, annuities, retirement plans, IRAs, and other similar sources. This form is essential for individuals who have received taxable distributions during the tax year. The information provided on the 1099-R helps the IRS track income that may be subject to taxation. Recipients of this form must include the reported amounts in their tax returns, ensuring compliance with federal tax regulations.

How to Obtain the Form 1099-R

To obtain the Form 1099-R, individuals typically receive it from the financial institution or retirement plan administrator that issued the distribution. This form is usually sent out by January thirty-first of the following year. If you do not receive your form by this date, you can contact the issuer directly to request a copy. Additionally, many financial institutions provide digital access to tax forms through their online portals, allowing users to download their 1099-R forms securely.

Steps to Complete the Form 1099-R

Completing the Form 1099-R involves several key steps. First, ensure you have all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately report the total distribution amount in Box 1 and any taxable amount in Box 2a. It's also important to include any distribution codes in Box 7, which indicate the type of distribution made. After filling out the form, review all entries for accuracy before submitting it to the IRS and providing a copy to the recipient.

Key Elements of the Form 1099-R

The Form 1099-R contains several key elements that are crucial for accurate reporting. These include:

- Box 1: Total distribution amount.

- Box 2a: Taxable amount of the distribution.

- Box 7: Distribution codes that specify the nature of the distribution.

- Recipient's Information: Name, address, and TIN.

- Issuer's Information: Name, address, and TIN of the entity issuing the form.

Understanding these elements is vital for both the issuer and recipient to ensure proper tax reporting and compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the use and reporting of Form 1099-R. These guidelines outline who is required to issue the form, the deadlines for distribution, and how to report the information accurately. Issuers must ensure that the form is filled out correctly to avoid penalties. Recipients should also familiarize themselves with the IRS instructions for Form 1099-R to understand how to report the income on their tax returns.

Filing Deadlines / Important Dates

Filing deadlines for Form 1099-R are critical for compliance. The form must be sent to recipients by January thirty-first of the year following the distribution. Additionally, issuers must file the form with the IRS by February twenty-eighth if filing by paper, or by March thirty-first if filing electronically. Missing these deadlines can result in penalties, so it's important for both issuers and recipients to be aware of these dates.

Penalties for Non-Compliance

Failure to comply with the requirements for Form 1099-R can lead to significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide a copy to the recipient. The penalties can vary based on how late the form is filed and whether the issuer made a reasonable attempt to comply. Understanding these penalties can help encourage timely and accurate reporting, reducing the risk of financial repercussions.

Handy tips for filling out Form 1099 R online

Quick steps to complete and e-sign Form 1099 R online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and share Form 1099 R for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 r

Create this form in 5 minutes!

How to create an eSignature for the form 1099 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 r form and why is it important?

A 1099 r form is used to report distributions from pensions, annuities, retirement plans, and other similar sources. It is important for tax purposes as it helps individuals accurately report their income to the IRS. Understanding how to manage your 1099 r can simplify your tax filing process.

-

How can airSlate SignNow help with 1099 r forms?

airSlate SignNow provides an efficient platform for electronically signing and sending 1099 r forms. With its user-friendly interface, you can easily manage your documents, ensuring that your 1099 r forms are completed and submitted on time. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for 1099 r forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for handling 1099 r forms. Each plan provides access to essential features that make document management cost-effective. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for managing 1099 r forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your 1099 r forms. These integrations allow for automatic data transfer, reducing manual entry and enhancing accuracy. This ensures that your financial records are always up-to-date.

-

What features does airSlate SignNow offer for 1099 r document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for 1099 r forms. These features enhance the efficiency of your document workflow, ensuring that you can manage your forms quickly and securely. This makes it easier to stay compliant with tax regulations.

-

Can I store my 1099 r forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your 1099 r forms, ensuring that your sensitive information is protected. With advanced encryption and access controls, you can rest assured that your documents are safe from unauthorized access. This adds an extra layer of security to your financial data.

-

Is it easy to share 1099 r forms with clients or partners using airSlate SignNow?

Yes, sharing 1099 r forms with clients or partners is straightforward with airSlate SignNow. You can send documents directly through the platform, allowing for quick and efficient collaboration. This feature helps ensure that all parties have access to the necessary forms without delays.

Get more for Form 1099 R

Find out other Form 1099 R

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form