Form 940 Employer's Annual Federal Unemployment FUTA Tax Return 2024

What is the Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

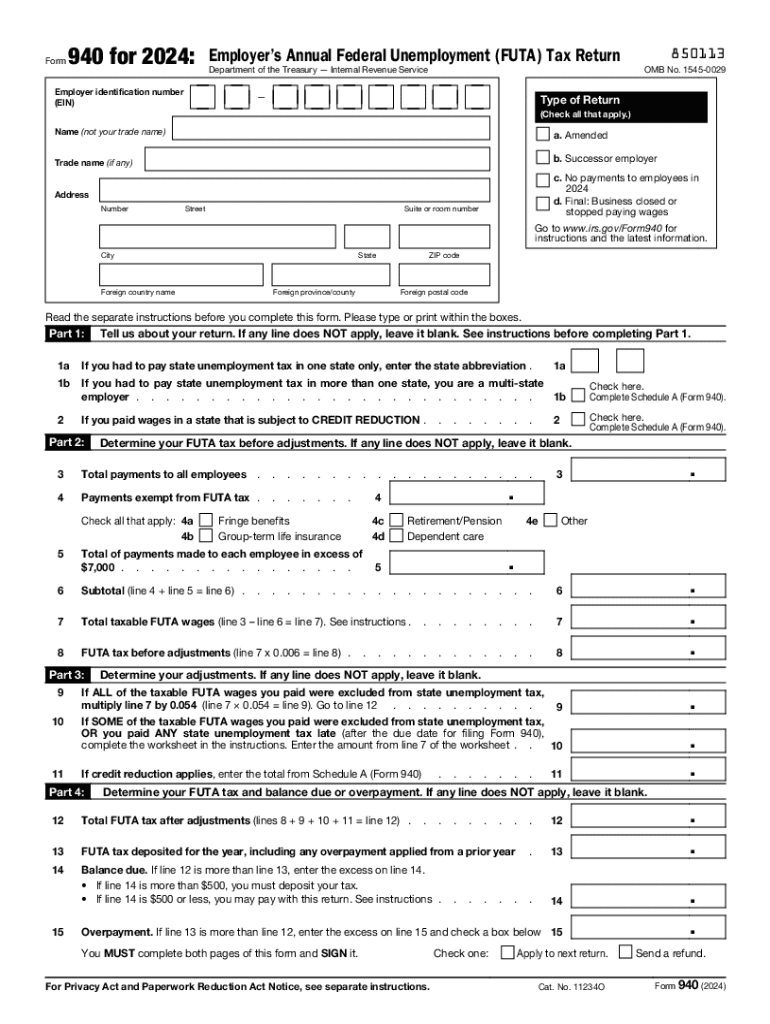

The Form 940 is a crucial document for employers in the United States, specifically designed for reporting annual Federal Unemployment Tax Act (FUTA) taxes. This form helps employers calculate and report their unemployment tax liability based on employee wages. The FUTA tax is essential for funding unemployment benefits, ensuring that employees have financial support during periods of unemployment. Employers are required to file this form annually if they meet specific criteria, including having paid wages to employees during the year.

How to use the Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Using Form 940 involves several steps, starting with gathering necessary payroll information. Employers must determine the total wages paid to employees, the amount of FUTA tax owed, and any credits that may apply. The form is divided into sections that guide employers through the calculation of their tax liability. Accurate completion of this form is vital to ensure compliance with federal tax regulations and to avoid penalties. Employers can file the form electronically or via mail, depending on their preference.

Steps to complete the Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Completing Form 940 requires careful attention to detail. Here are the key steps:

- Gather all payroll records for the year, including total wages and any applicable deductions.

- Calculate the total FUTA tax owed based on the wages paid to employees.

- Complete each section of the form, ensuring all information is accurate and matches your payroll records.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail by the designated deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with Form 940 to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. If an employer has made timely deposits of all FUTA taxes due, they may have until February 10 to file the form. It is essential to keep track of these dates to ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 940 on time or accurately can result in significant penalties for employers. The IRS may impose fines for late filing, which can add up quickly. Additionally, if an employer underreports their FUTA tax liability, they may face further penalties and interest on the unpaid tax amount. It is crucial for employers to understand these risks and ensure timely and accurate filing of the form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 940. Employers should refer to the latest IRS instructions for the form, which outline the requirements, eligibility criteria, and any updates for the current tax year. Following these guidelines helps ensure compliance and reduces the risk of errors during the filing process.

Handy tips for filling out Form 940 Employer's Annual Federal Unemployment FUTA Tax Return online

Quick steps to complete and e-sign Form 940 Employer's Annual Federal Unemployment FUTA Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to e-sign and send Form 940 Employer's Annual Federal Unemployment FUTA Tax Return for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 940 employers annual federal unemployment futa tax return

Create this form in 5 minutes!

How to create an eSignature for the form 940 employers annual federal unemployment futa tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022form 940 and why is it important?

The 2022form 940 is an annual federal tax form used by employers to report their Federal Unemployment Tax Act (FUTA) liability. It is important for businesses to accurately complete this form to ensure compliance with federal tax regulations and avoid penalties.

-

How can airSlate SignNow help with the 2022form 940?

airSlate SignNow simplifies the process of completing and eSigning the 2022form 940 by providing an intuitive platform for document management. With our solution, you can easily fill out, sign, and send the form securely, ensuring that your submissions are timely and accurate.

-

What are the pricing options for using airSlate SignNow for the 2022form 940?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions allow you to manage the 2022form 940 and other documents without breaking the bank, ensuring you get the best value for your investment.

-

Are there any features specifically designed for the 2022form 940?

Yes, airSlate SignNow includes features tailored for the 2022form 940, such as customizable templates, automated reminders, and secure eSigning. These features streamline the process, making it easier for businesses to manage their tax documentation efficiently.

-

Can I integrate airSlate SignNow with other software for the 2022form 940?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, allowing you to manage the 2022form 940 alongside your other business processes. This integration enhances efficiency and ensures that all your documents are in sync.

-

What are the benefits of using airSlate SignNow for the 2022form 940?

Using airSlate SignNow for the 2022form 940 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and that you can access them anytime, anywhere.

-

Is airSlate SignNow user-friendly for completing the 2022form 940?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our platform allows users to easily navigate through the process of completing the 2022form 940, making it accessible for individuals with varying levels of technical expertise.

Get more for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Find out other Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now