Form 1041 U S Income Tax Return for Estates and Trusts 2024

What is the Form 1041 U S Income Tax Return For Estates And Trusts

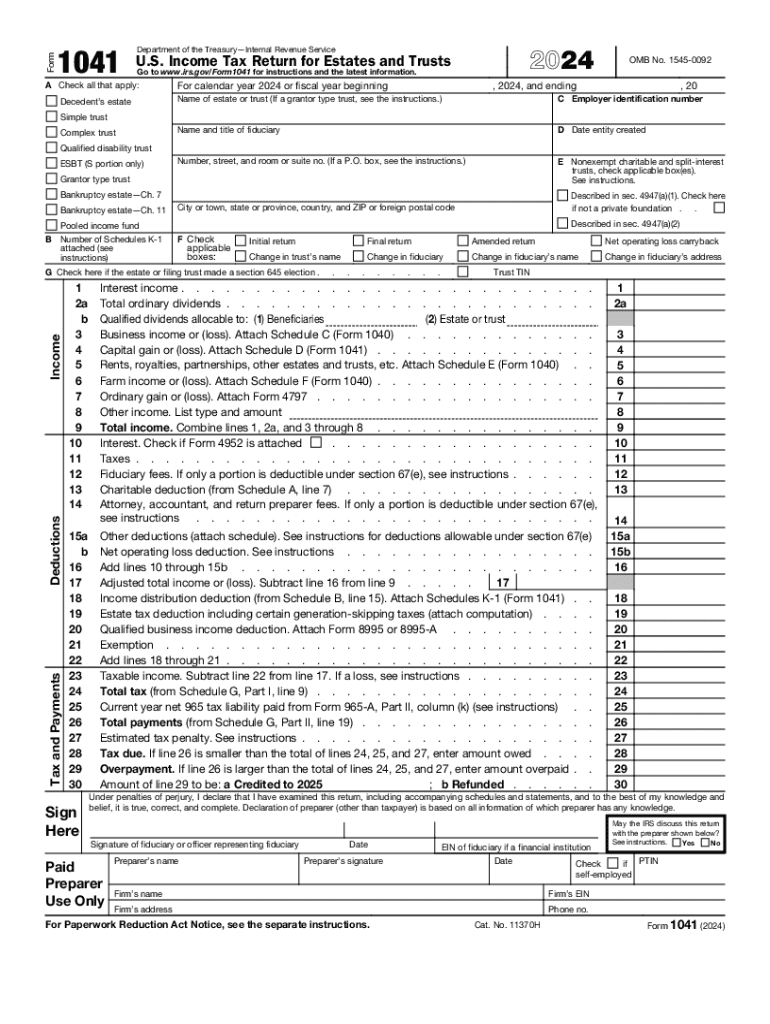

The Form 1041 is the U.S. Income Tax Return specifically designed for estates and trusts. This form is utilized to report the income, deductions, gains, and losses of estates and trusts, as well as to calculate the tax owed. It is essential for fiduciaries managing an estate or trust to file this form, as it ensures compliance with IRS regulations. The form allows estates and trusts to report their income and distribute any taxable income to beneficiaries, who may then report it on their individual tax returns.

How to use the Form 1041 U S Income Tax Return For Estates And Trusts

Using Form 1041 involves several steps that require careful attention to detail. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. Next, complete the form by inputting the estate or trust's income, deductions, and other relevant financial information. It is important to accurately report distributions made to beneficiaries, as these amounts affect both the estate's and beneficiaries' tax obligations. Finally, review the completed form for accuracy and submit it to the IRS by the designated deadline.

Steps to complete the Form 1041 U S Income Tax Return For Estates And Trusts

Completing Form 1041 requires a systematic approach:

- Gather all relevant financial documents, including income sources and expenses.

- Fill out the identification section with the estate or trust's name, address, and taxpayer identification number.

- Report income on the appropriate lines, including interest, dividends, and capital gains.

- Deduct any allowable expenses, such as administrative costs or legal fees.

- Calculate the taxable income and determine the tax owed using the IRS tax tables.

- Complete the distribution section to report amounts distributed to beneficiaries.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 are crucial to avoid penalties. Generally, the form is due on the 15th day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file for an extension if additional time is needed, which can provide an extra six months for filing.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1041. These guidelines outline the types of income that must be reported, allowable deductions, and the responsibilities of fiduciaries. It is important to refer to the IRS instructions for Form 1041, which detail the requirements for various situations, including how to handle distributions and the implications of different types of income. Adhering to these guidelines ensures compliance and helps avoid common mistakes that could lead to audits or penalties.

Required Documents

To accurately complete Form 1041, certain documents are necessary:

- Income statements, such as bank interest and dividend statements.

- Records of expenses incurred by the estate or trust.

- Documentation of distributions made to beneficiaries.

- Previous tax returns, if applicable, for reference.

- Any other financial statements relevant to the estate or trust's activities.

Handy tips for filling out Form 1041 U S Income Tax Return For Estates And Trusts online

Quick steps to complete and e-sign Form 1041 U S Income Tax Return For Estates And Trusts online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and share Form 1041 U S Income Tax Return For Estates And Trusts for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 u s income tax return for estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 u s income tax return for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form used 1041?

The form used 1041 is designed for reporting income, deductions, and credits for estates and trusts. It allows fiduciaries to file income tax returns on behalf of the estate or trust, ensuring compliance with IRS regulations. Using airSlate SignNow, you can easily eSign and send your form used 1041 securely.

-

How can airSlate SignNow help with the form used 1041?

airSlate SignNow streamlines the process of completing and submitting the form used 1041 by providing an intuitive platform for eSigning and document management. You can quickly fill out the necessary fields, gather signatures, and send the form directly to the IRS or other parties. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the form used 1041?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the eSigning process for documents like the form used 1041. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the form used 1041?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, which are beneficial for managing the form used 1041. These tools enhance efficiency and ensure that your documents are organized and easily accessible. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the form used 1041?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the form used 1041 into your existing workflows. Whether you use accounting software or document management systems, you can seamlessly connect airSlate SignNow to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the form used 1041?

Using airSlate SignNow for the form used 1041 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to eSign documents quickly and securely, minimizing delays in the filing process. This ensures that your estate or trust remains compliant with tax regulations.

-

How secure is airSlate SignNow when handling the form used 1041?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the form used 1041. Your data is stored securely in the cloud, and you can control access to sensitive information. This ensures that your documents are safe from unauthorized access.

Get more for Form 1041 U S Income Tax Return For Estates And Trusts

- Wildlife intake form rehab

- Chase profit and loss statement form

- Ministrio das relaes exteriores mre recibo de entrega de requerimento rer form

- How to fill up rural bank form

- Northeast arc payroll login form

- B10 form pdf

- New york commercial rent tax form

- Wayside kidz camp registration form k5 through 8th grade phone 305 5956550 fax 305 2739922 www

Find out other Form 1041 U S Income Tax Return For Estates And Trusts

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe