Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund 2024

What is the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

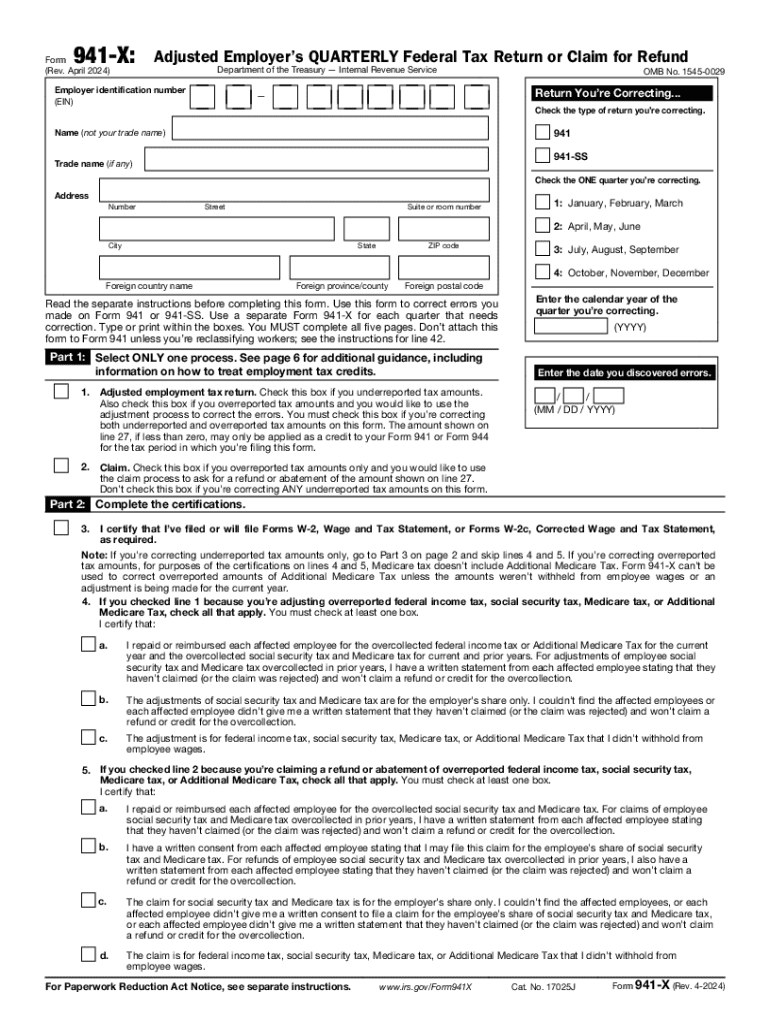

The Form 941 X is used by employers to amend their previously filed Form 941, the Employer's Quarterly Federal Tax Return. This form allows businesses to correct errors related to federal income tax withholding, Social Security tax, and Medicare tax. It can also be used to claim a refund for overreported amounts. The form is essential for maintaining accurate tax records and ensuring compliance with IRS regulations.

Steps to complete the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

Completing the Form 941 X involves several key steps:

- Begin by entering the employer's name, address, and Employer Identification Number (EIN).

- Indicate the quarter and year for which you are amending the return.

- Review the original Form 941 to identify the specific lines that require correction.

- Fill in the corrected amounts on the appropriate lines of Form 941 X.

- Provide a detailed explanation of the changes you are making in the designated section.

- Sign and date the form before submission.

How to obtain the Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

The Form 941 X can be obtained directly from the IRS website. It is available as a downloadable PDF, allowing users to print and complete the form manually. Alternatively, businesses may also find the form through tax preparation software that supports IRS forms. Ensure you are using the most current version of the form to comply with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 941 X. It is recommended to carefully review these guidelines to ensure accuracy. Key points include:

- Submit the form within three years of the original filing date to claim a refund.

- Use the form to correct any errors in tax liability or to report changes in employee wages.

- Keep copies of all documentation related to the corrections for your records.

Filing Deadlines / Important Dates

Timely filing of the Form 941 X is crucial to avoid penalties. The form should be submitted as soon as errors are identified, ideally within three years from the original due date of the Form 941. This allows for the possibility of claiming refunds for overreported taxes. Employers should also be aware of specific deadlines related to their tax obligations to avoid complications.

Penalties for Non-Compliance

Failure to file the Form 941 X when necessary can result in significant penalties from the IRS. These penalties may include fines for late filing or underpayment of taxes. Additionally, incorrect filings can lead to audits or further scrutiny of a business's tax practices. Maintaining accurate records and timely submissions is essential for compliance and to avoid financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form 941 x rev april adjusted employers quarterly federal tax return or claim for refund 737786266

Create this form in 5 minutes!

How to create an eSignature for the form 941 x rev april adjusted employers quarterly federal tax return or claim for refund 737786266

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 941 x in the context of airSlate SignNow?

The term '941 x' refers to a specific feature within airSlate SignNow that streamlines the eSigning process for documents. This feature allows users to easily manage and send documents for electronic signatures, ensuring compliance and efficiency in business operations.

-

How does airSlate SignNow's 941 x feature improve document management?

The 941 x feature enhances document management by providing a user-friendly interface that simplifies the process of sending and tracking documents. With this feature, businesses can reduce turnaround times and improve overall workflow efficiency.

-

What are the pricing options for using airSlate SignNow with 941 x?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options that utilize the 941 x feature. Pricing is competitive and designed to provide value for businesses looking to enhance their document signing processes.

-

Can I integrate 941 x with other software applications?

Yes, airSlate SignNow's 941 x feature can be seamlessly integrated with various software applications, including CRM and project management tools. This integration allows for a more cohesive workflow and enhances productivity across platforms.

-

What benefits does the 941 x feature provide for businesses?

The 941 x feature offers numerous benefits, including increased efficiency, reduced paper usage, and improved compliance with legal standards. By utilizing this feature, businesses can streamline their document workflows and focus on core operations.

-

Is the 941 x feature suitable for small businesses?

Absolutely! The 941 x feature is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. It helps them manage their document signing needs without the complexity and high costs associated with traditional methods.

-

How secure is the 941 x feature in airSlate SignNow?

The 941 x feature in airSlate SignNow is built with robust security measures to protect sensitive information. It includes encryption and compliance with industry standards, ensuring that your documents are safe during the signing process.

Get more for Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- Infant observation form

- Canada student visa application form imm 1294 canada student visa application form imm 1294 imm 1294 is an application form to

- 5th grade math minutes 51 100 pdf form

- Usa wrestling skin form

- Par q amp you usfweb2 usf form

- Compass buddies form

- Vendor application template word form

- Acl top 500 coagulation analyzer manual form

Find out other Form 941 X Rev April Adjusted Employer's QUARTERLY Federal Tax Return Or Claim For Refund

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement