Form 4137 H R Block

What is the Form 4137 H R Block

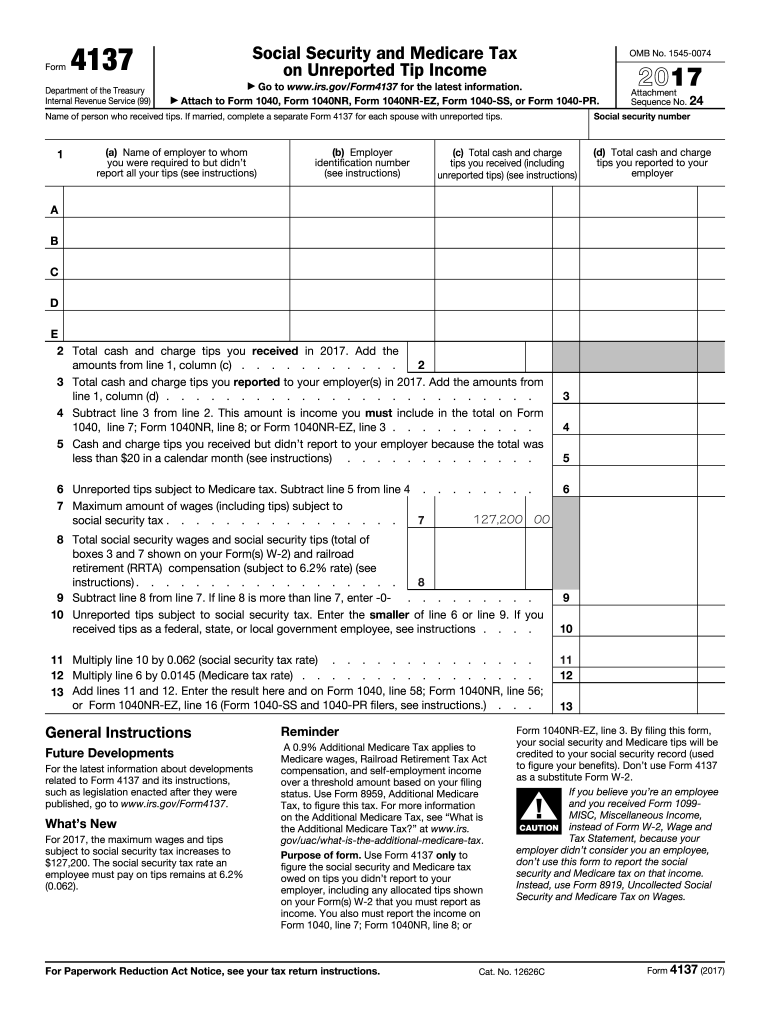

The Form 4137 is utilized for reporting unreported tips received by employees in the United States. It is primarily relevant for workers in industries where tipping is customary, such as restaurants and hospitality. This form helps ensure that individuals accurately report their income to the IRS, allowing them to fulfill their tax obligations effectively. By using Form 4137, employees can calculate the amount of tips they need to report, which is crucial for maintaining compliance with tax laws.

How to use the Form 4137 H R Block

Using Form 4137 involves a straightforward process. First, gather all necessary information regarding your tip income for the year. This includes any cash tips, tips received through credit cards, and other forms of gratuities. Next, fill out the form by entering your total tip income and any applicable adjustments. Once completed, the form should be attached to your tax return when filing with the IRS. This ensures that your reported income accurately reflects your earnings from tips, which is vital for both compliance and proper tax calculation.

Steps to complete the Form 4137 H R Block

Completing Form 4137 involves several key steps:

- Gather your records of all tips received during the tax year.

- Fill in your total tip income on the form.

- Calculate any adjustments if necessary, such as tips not reported to your employer.

- Ensure all entries are accurate and complete.

- Attach the completed form to your tax return.

Following these steps will help you accurately report your tip income, ensuring compliance with IRS regulations.

Legal use of the Form 4137 H R Block

The legal use of Form 4137 is critical for employees who receive tips. This form complies with IRS requirements, ensuring that all reported income is legitimate and accurately documented. By using Form 4137, individuals can avoid potential penalties associated with underreporting income. It is essential to complete the form correctly and submit it alongside your tax return to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 4137 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is crucial to stay informed about any changes to deadlines that may occur, especially during tax season.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 4137. It is essential to follow these instructions closely to ensure accurate reporting of tip income. The guidelines include details on how to calculate total tips, what constitutes reportable income, and how to handle tips not reported to employers. Familiarizing yourself with these guidelines can help prevent errors and ensure compliance with tax regulations.

Quick guide on how to complete form 4137 h r block

Complete Form 4137 H R Block effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals alike. It offers a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 4137 H R Block on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and electronically sign Form 4137 H R Block without any hassle

- Find Form 4137 H R Block and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 4137 H R Block and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4137 h r block

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 4137?

airSlate SignNow is a powerful eSignature solution that allows businesses to manage and send documents seamlessly. It streamlines the signing process, making transactions quicker and more secure. The mention of '4137' highlights its relevance in ensuring compliance and efficiency in digital document management.

-

How does airSlate SignNow pricing work for 4137 users?

The pricing for airSlate SignNow is designed to be cost-effective for all users, including those needing compliance with '4137.' Various plans are available, catering to different business sizes and needs, allowing you to choose a solution that fits your budget while complying with standards.

-

What features does airSlate SignNow offer to support the 4137 standard?

airSlate SignNow includes features like customizable templates, real-time tracking, and audit trails that align with the requirements of '4137.' These features ensure that your document signing process adheres to necessary regulations while enhancing user experience.

-

What are the benefits of using airSlate SignNow in relation to 4137?

Using airSlate SignNow in alignment with '4137' provides a streamlined document signing process that helps businesses reduce turnaround times. It enhances security and ensures compliance, making it easier to manage important documents efficiently.

-

Can airSlate SignNow integrate with other platforms while considering 4137 standards?

Yes, airSlate SignNow seamlessly integrates with various platforms, enabling users to maintain compliance with '4137' requirements. This flexibility allows businesses to incorporate their existing tools while ensuring that all document processes comply with industry standards.

-

Is airSlate SignNow user-friendly for addressing 4137 compliance?

Absolutely! airSlate SignNow is designed with the user experience in mind, making it easy for any user to navigate and utilize its features effectively. The platform simplifies compliance processes, including those related to '4137,' ensuring quick adoption and efficiency.

-

How does airSlate SignNow ensure security for documents related to 4137?

airSlate SignNow employs advanced security measures to protect documents, ensuring that all transactions adhere to the '4137' standards. Features like encryption, secure access, and audit trails help safeguard sensitive information throughout the signing process.

Get more for Form 4137 H R Block

- Relationships form

- Additional filing requirements economic injury disaster loan and military reservist economic injury disaster loan form

- Psychiatric review technique this form is used to supply medical information to ssa

- Form ssa 8510 06 2017 uf

- Application for supplemental security income ssi form

- Fill free fillable form ha 520 u5 request for review of

- Publication 957 internal revenue service form

- Arizona quarterly withholding tax return fillable az a1 form

Find out other Form 4137 H R Block

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online