Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

What is the Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

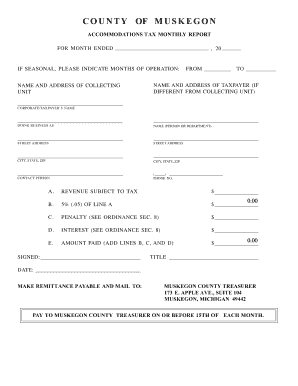

The Accommodations Tax Reporting Forms for Muskegon County, Michigan, are essential documents used by businesses that provide lodging services within the county. These forms facilitate the reporting of accommodations tax collected from guests, which is a tax levied on short-term rentals, hotels, and other lodging establishments. The revenue generated from this tax supports local tourism initiatives and community projects. Understanding the purpose and structure of these forms is crucial for compliance with local tax regulations.

How to use the Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

Using the Accommodations Tax Reporting Forms involves a straightforward process. First, businesses must accurately calculate the total accommodations tax collected over a specific reporting period. This includes all taxable transactions related to lodging. Next, the form must be filled out with the required information, such as the business name, address, and total tax amount. Once completed, the form can be submitted electronically or via mail to the appropriate county office. Ensuring accuracy in reporting is vital to avoid potential penalties.

Steps to complete the Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

Completing the Accommodations Tax Reporting Forms requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records, including guest invoices and tax collected.

- Calculate the total accommodations tax collected during the reporting period.

- Fill out the form with accurate business information and tax figures.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline, either electronically or by mail.

Legal use of the Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

The legal use of the Accommodations Tax Reporting Forms is governed by local tax laws and regulations. These forms must be completed accurately to ensure compliance with the Muskegon County tax code. Failure to submit these forms or providing false information can result in penalties, including fines or legal action. It is important for businesses to stay informed about any changes in local tax laws that may affect the reporting process.

Filing Deadlines / Important Dates

Filing deadlines for the Accommodations Tax Reporting Forms are critical for compliance. Typically, these forms are due on a quarterly basis, with specific dates set by the Muskegon County tax authority. It is essential for businesses to mark these deadlines on their calendars to ensure timely submission. Late filings may incur penalties, so staying organized and aware of these dates helps maintain compliance and avoid unnecessary costs.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Accommodations Tax Reporting Forms. They can choose to file online through the Muskegon County tax authority's website, which often provides a more efficient and faster processing method. Alternatively, forms can be mailed directly to the county office or submitted in person. Each method has its advantages, and businesses should select the one that best fits their operational needs and preferences.

Quick guide on how to complete accommodations tax reporting forms muskegon county co muskegon mi

Complete Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal sustainable alternative to conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi on any device with airSlate SignNow Android or iOS applications, and streamline any document-related process today.

How to modify and eSign Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi effortlessly

- Find Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accommodations tax reporting forms muskegon county co muskegon mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi are legal documents required for reporting accommodations tax in Muskegon County. These forms ensure compliance with local regulations for businesses offering lodging services. They help in accurately reporting and remitting taxes collected from guests.

-

How can airSlate SignNow assist with Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

airSlate SignNow simplifies the process of managing Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi by providing an easy-to-use eSigning platform. You can quickly prepare, send, and sign these forms digitally, making compliance more efficient. This streamlines your operations and saves time.

-

What is the cost of using airSlate SignNow for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

airSlate SignNow offers competitive pricing for its services, including handling Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi. Pricing tiers are designed to fit the needs of various business sizes, ensuring you get a cost-effective solution. Check our website for detailed pricing information.

-

Are there any features specifically for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

Yes, airSlate SignNow includes features tailored for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi, such as customizable templates and automated reminders for deadlines. These features help ensure that your forms are always submitted on time and are filled out correctly. This makes tax reporting hassle-free.

-

Can I integrate airSlate SignNow with other tools for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

Absolutely! airSlate SignNow offers integrations with various applications and software, enhancing your workflow for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi. This allows you to seamlessly connect with accounting software, project management tools, and more for a streamlined process.

-

What benefits do I gain by using airSlate SignNow for my tax reporting?

Using airSlate SignNow for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi brings numerous benefits, including increased efficiency and compliance assurance. The platform reduces paperwork and manual processes, helping you avoid delays. Additionally, digital storage eliminates the risk of losing important documents.

-

Is airSlate SignNow user-friendly for all types of businesses needing Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi?

Yes, airSlate SignNow is designed to be user-friendly and accommodates businesses of all sizes needing Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi. Its intuitive interface allows anyone, regardless of technical expertise, to navigate easily and complete necessary tasks effortlessly. This inclusivity ensures that all users can benefit from the platform's capabilities.

Get more for Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

- Salary verification form for potential lease north carolina

- North carolina agreement form

- Notice of default on residential lease north carolina form

- Landlord tenant lease co signer agreement north carolina form

- Application for sublease north carolina form

- North carolina post form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out north carolina form

- Property manager agreement north carolina form

Find out other Accommodations Tax Reporting Forms Muskegon County Co Muskegon Mi

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF