Schedule J Form 990 2023-2026

What is the Schedule J Form 990

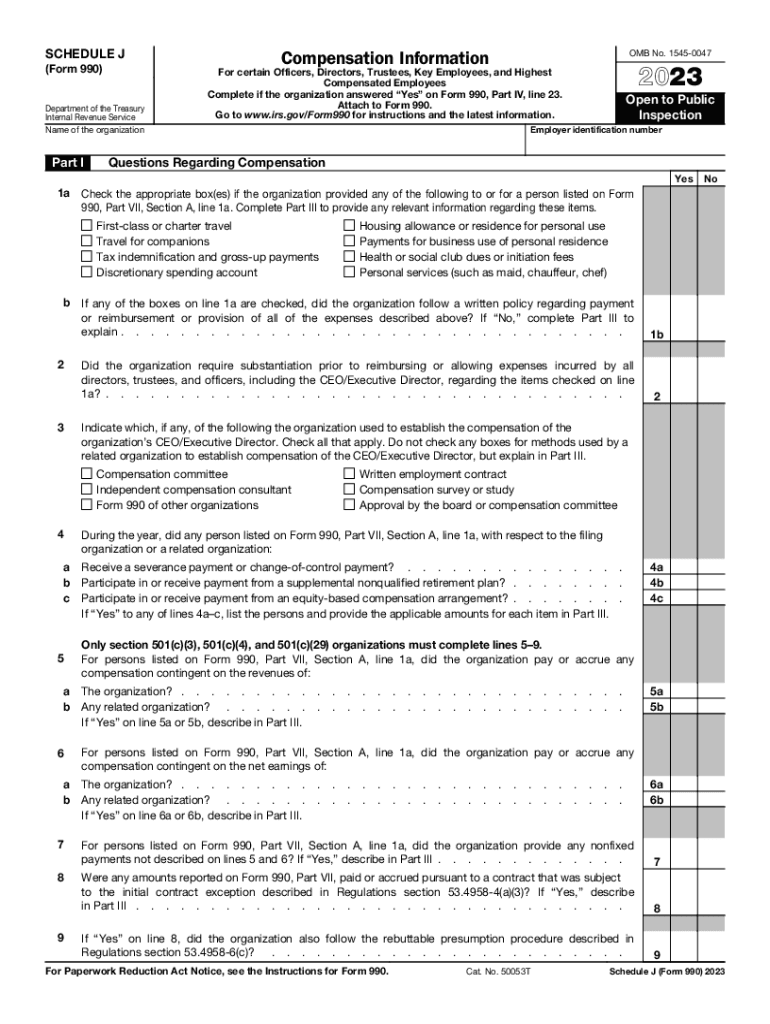

The Schedule J Form 990 is a supplemental form used by tax-exempt organizations to provide detailed information about compensation for their highest-paid employees and contractors. This form is part of the IRS Form 990, which is an annual reporting return that organizations must file to maintain their tax-exempt status. Schedule J specifically focuses on the compensation arrangements, including salaries, bonuses, and other forms of remuneration, ensuring transparency and compliance with IRS regulations.

How to use the Schedule J Form 990

To effectively use the Schedule J Form 990, organizations must gather comprehensive data regarding compensation for their key personnel. This includes reporting the total compensation paid, the method used to determine compensation, and any changes in compensation over time. Organizations should ensure that all figures are accurate and reflect the actual amounts paid during the reporting period. Proper use of this form not only ensures compliance but also helps organizations demonstrate accountability to stakeholders.

Steps to complete the Schedule J Form 990

Completing the Schedule J Form 990 involves several key steps:

- Gather necessary documentation, including payroll records and compensation agreements.

- Identify the highest-paid employees and contractors who need to be reported.

- Input total compensation figures for each individual, detailing salary, bonuses, and other benefits.

- Provide information on the process used to determine compensation, including any compensation committees or benchmarking practices.

- Review the completed form for accuracy and compliance with IRS guidelines before submission.

Key elements of the Schedule J Form 990

The Schedule J Form 990 includes several critical elements that organizations must address:

- Compensation Disclosure: Detailed reporting of total compensation for each listed individual.

- Compensation Determination: Explanation of how compensation was set, including any benchmarking against industry standards.

- Changes in Compensation: Reporting any significant changes in compensation from the previous year.

- Related Organizations: Information about any related organizations that may impact compensation reporting.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule J Form 990. Organizations must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Accurate reporting of compensation must reflect the total amounts paid during the fiscal year.

- Organizations must disclose any potential conflicts of interest related to compensation decisions.

- Documentation supporting compensation figures should be maintained and available for review by the IRS if requested.

Penalties for Non-Compliance

Failure to accurately complete and file the Schedule J Form 990 can result in significant penalties for organizations. The IRS may impose fines for late filings or incorrect information. Additionally, non-compliance can jeopardize an organization's tax-exempt status, leading to further financial and legal repercussions. Organizations should prioritize accurate reporting to mitigate these risks.

Quick guide on how to complete schedule j form 990

Effortlessly Prepare Schedule J Form 990 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without complications. Manage Schedule J Form 990 on any device with airSlate SignNow mobile applications for Android or iOS and enhance any document-based task today.

How to Edit and Electronically Sign Schedule J Form 990 with Ease

- Obtain Schedule J Form 990 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your edits.

- Select how you wish to deliver your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Schedule J Form 990 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form 990

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 990

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2020 990 schedule form?

The 2020 990 schedule form is a critical document for tax-exempt organizations required by the IRS for annual reporting. It includes detailed information about the organization's finances and operations, enabling transparency and compliance. Using airSlate SignNow, you can simplify the signing process for your 2020 990 schedule form digitally.

-

How can airSlate SignNow help with the 2020 990 schedule form?

AirSlate SignNow streamlines the process of completing and eSigning the 2020 990 schedule form, making it fast and efficient. Our platform offers templates and eSignature capabilities, ensuring your documents are completed accurately and securely. This ensures a hassle-free experience when submitting your annual IRS forms.

-

Is airSlate SignNow cost-effective for managing the 2020 990 schedule form?

Absolutely! AirSlate SignNow provides a cost-effective solution for managing the 2020 990 schedule form, reducing the need for paper and physical signatures. Our competitive pricing allows organizations of all sizes to access essential features without breaking the bank. You'll save time and money while ensuring compliance.

-

What features does airSlate SignNow offer for the 2020 990 schedule form?

AirSlate SignNow includes several features beneficial for the 2020 990 schedule form, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of document management and ensure all signatures are legally binding. With our intuitive interface, completing your forms becomes straightforward.

-

Can I integrate airSlate SignNow with other tools for the 2020 990 schedule form?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage your 2020 990 schedule form alongside your existing workflows. This means you can connect with platforms like Google Drive, Dropbox, and more. By integrating SignNow with your favorite tools, you can streamline your document processes even further.

-

How secure is the eSigning process for the 2020 990 schedule form?

The eSigning process for the 2020 990 schedule form using airSlate SignNow is highly secure. Our platform employs advanced encryption and complies with industry standards for data protection. You can rest assured that your signed documents are safe and accessible only to authorized parties.

-

What are the benefits of using airSlate SignNow for the 2020 990 schedule form?

Using airSlate SignNow for the 2020 990 schedule form offers numerous benefits, including faster processing times and reduced paperwork. The ease of eSigning allows for quicker submissions, which is crucial for meeting IRS deadlines. Additionally, our user-friendly platform enhances collaboration among team members.

Get more for Schedule J Form 990

- Form 103 n indy

- Form cf 1re indy

- Stormwater bcertificateb of obligation to observe city of indianapolis indy form

- Structural permit application city of indianapolis and marion county indy form

- Grant of perpetual drainage ease city of indianapolis indy form

- Application for contractoramp39s registration city of logansport form

- Permit application city of cedar rapids cedar rapids form

- 5h homeownership application city of des moines dmgov form

Find out other Schedule J Form 990

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer