Form 990 Schedule J IRS Gov 2016

What is the Form 990 Schedule J IRS gov

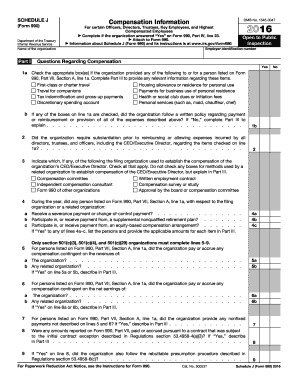

The Form 990 Schedule J is a supplementary document that nonprofit organizations in the United States must file with the IRS. This form provides detailed information about the compensation of the highest-paid employees, including officers, directors, and key employees. It aims to enhance transparency regarding the financial practices of tax-exempt organizations. By disclosing compensation packages, organizations help ensure accountability and provide stakeholders with insights into how funds are allocated.

How to use the Form 990 Schedule J IRS gov

Using the Form 990 Schedule J involves several key steps. First, organizations must gather relevant data regarding compensation for the reporting year. This includes salary, bonuses, and other forms of remuneration. Next, the information should be accurately entered into the form, ensuring compliance with IRS guidelines. Organizations must also cross-reference the data with their main Form 990 to ensure consistency. Finally, the completed Schedule J must be submitted alongside the main Form 990 by the designated filing deadline.

Steps to complete the Form 990 Schedule J IRS gov

Completing the Form 990 Schedule J requires careful attention to detail. Follow these steps for accurate completion:

- Collect compensation data for all relevant individuals, including salaries, bonuses, and benefits.

- Review the IRS instructions for Schedule J to understand the reporting requirements.

- Fill out the form, ensuring that all figures align with the organization’s financial records.

- Double-check for any discrepancies or missing information.

- Submit the completed Schedule J along with the main Form 990 by the deadline.

Legal use of the Form 990 Schedule J IRS gov

The legal use of the Form 990 Schedule J is essential for maintaining compliance with IRS regulations. Nonprofit organizations are required to file this form to provide transparency about their compensation practices. Failure to accurately report this information can lead to penalties, including fines and potential loss of tax-exempt status. It is crucial for organizations to ensure that the information disclosed is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule J align with the main Form 990 submission dates. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 and Schedule J would be due by May 15 of the following year. Organizations can apply for an extension, but they must still submit the Schedule J by the extended deadline.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 990 Schedule J can result in significant penalties. Organizations that fail to file on time may face automatic fines, which can escalate with continued non-compliance. Additionally, inaccuracies in reporting can lead to further scrutiny from the IRS, potentially resulting in audits or loss of tax-exempt status. It is vital for organizations to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 2016 form 990 schedule j irsgov

Effortlessly Prepare Form 990 Schedule J IRS gov on Any Device

The management of online documents has gained popularity among organizations and individuals alike. It offers a perfect environmentally-friendly substitute for traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Handle Form 990 Schedule J IRS gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Form 990 Schedule J IRS gov with Ease

- Obtain Form 990 Schedule J IRS gov and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, exhaustive form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 990 Schedule J IRS gov to ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 990 schedule j irsgov

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 990 schedule j irsgov

How to create an eSignature for the 2016 Form 990 Schedule J Irsgov online

How to create an eSignature for the 2016 Form 990 Schedule J Irsgov in Google Chrome

How to create an eSignature for signing the 2016 Form 990 Schedule J Irsgov in Gmail

How to generate an eSignature for the 2016 Form 990 Schedule J Irsgov right from your smartphone

How to create an eSignature for the 2016 Form 990 Schedule J Irsgov on iOS devices

How to generate an electronic signature for the 2016 Form 990 Schedule J Irsgov on Android devices

People also ask

-

What is Form 990 Schedule J IRS gov?

Form 990 Schedule J IRS gov is a supplemental form that certain tax-exempt organizations must complete as part of their annual information return. It provides detailed information about compensation and benefits for key employees, which helps the IRS assess compliance with tax regulations.

-

How can airSlate SignNow assist with Form 990 Schedule J IRS gov?

airSlate SignNow streamlines the process of preparing and signing Form 990 Schedule J IRS gov by allowing users to create, edit, and eSign documents quickly. This not only saves time but also ensures compliance and accuracy in reporting, making it easier for organizations to manage their tax filings.

-

What features does airSlate SignNow offer for managing documents like Form 990 Schedule J IRS gov?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure eSigning, all of which enhance the management of important documents like Form 990 Schedule J IRS gov. These tools ensure that your documents are accurate and easily accessible when filing.

-

Is airSlate SignNow a cost-effective solution for filing Form 990 Schedule J IRS gov?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses seeking efficient ways to manage their documentation, including Form 990 Schedule J IRS gov. Our competitive pricing plans allow organizations to choose the best option that fits their budget while accessing high-quality features.

-

Can airSlate SignNow integrate with other software for filing Form 990 Schedule J IRS gov?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier for users to manage and file Form 990 Schedule J IRS gov. This capability enhances workflow efficiency and reduces the chances of errors in documentation.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule J IRS gov preparations?

Using airSlate SignNow for Form 990 Schedule J IRS gov preparations offers several benefits, including improved accuracy, accelerated processing times, and enhanced security for sensitive information. It simplifies the paperwork involved, allowing organizations to focus more on their core operations.

-

Does airSlate SignNow provide customer support for inquiries related to Form 990 Schedule J IRS gov?

Yes, airSlate SignNow provides dedicated customer support to assist users with any inquiries related to Form 990 Schedule J IRS gov. Our knowledgeable support team is available to help you navigate document preparation and address any specific questions you may have.

Get more for Form 990 Schedule J IRS gov

Find out other Form 990 Schedule J IRS gov

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney