Schedule J Form 990 Compensation Information 2020

What is the Schedule J Form 990 Compensation Information

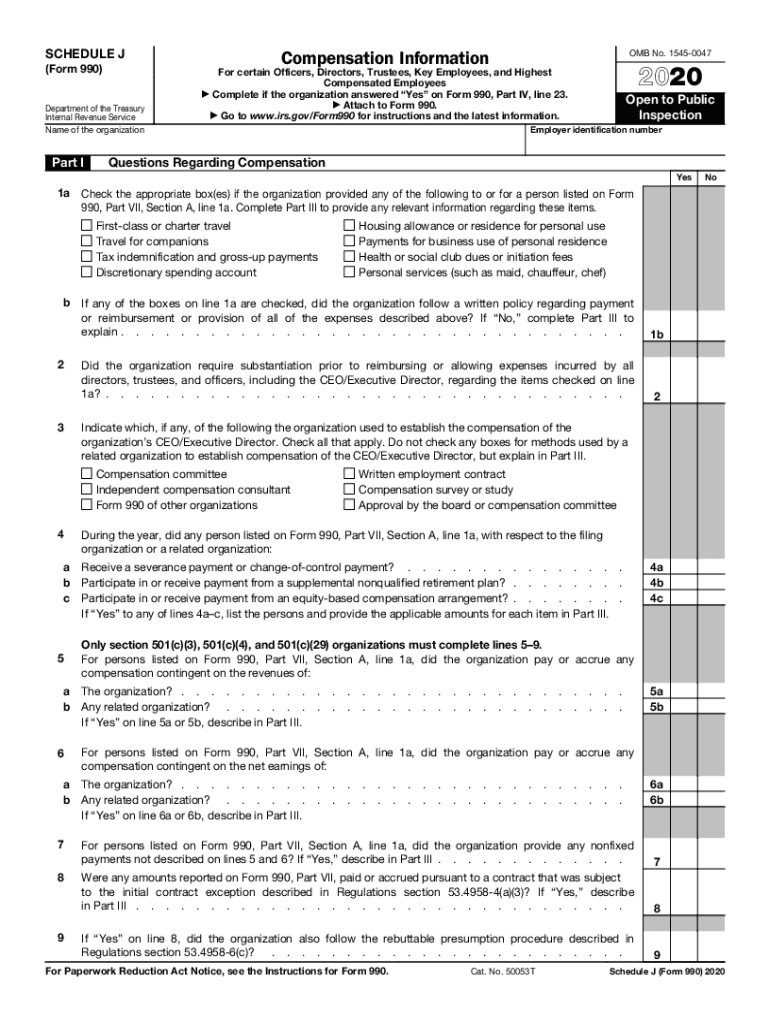

The Schedule J Form 990 is a critical document used by tax-exempt organizations to report compensation information for their highest-paid employees, officers, and directors. This form provides detailed insights into how compensation is structured, including base salary, bonuses, and other forms of remuneration. The information collected helps the IRS and the public assess whether compensation practices align with industry standards and ensure transparency in financial reporting.

How to use the Schedule J Form 990 Compensation Information

Utilizing the Schedule J Form 990 involves accurately reporting compensation data for individuals within the organization. Organizations must ensure that they gather all necessary information regarding salaries, bonuses, and other compensatory benefits. This data should be organized and presented clearly in the form, following the IRS guidelines. Proper use of this form not only aids in compliance with federal regulations but also enhances the organization’s credibility and trustworthiness.

Steps to complete the Schedule J Form 990 Compensation Information

Completing the Schedule J Form 990 requires several key steps:

- Gather all relevant compensation data for the reporting period.

- Identify the individuals whose compensation needs to be reported, including officers, directors, and highest-paid employees.

- Fill out the form accurately, ensuring that all figures reflect actual compensation received.

- Review the completed form for accuracy and completeness before submission.

- File the form alongside the main Form 990 by the designated deadline.

Legal use of the Schedule J Form 990 Compensation Information

The Schedule J Form 990 is legally required for certain tax-exempt organizations to disclose compensation practices. Compliance with this requirement is essential to avoid penalties and ensure transparency. Organizations must adhere to IRS regulations regarding the accuracy of the information reported, as inaccuracies can lead to legal repercussions and loss of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must file the Schedule J Form 990 by the due date of their Form 990, which is typically the fifteenth day of the fifth month after the end of their fiscal year. For example, if an organization operates on a calendar year, the form is due on May fifteenth. It is crucial to be aware of these deadlines to maintain compliance and avoid potential penalties.

Penalties for Non-Compliance

Failure to file the Schedule J Form 990 or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late filings or for providing incorrect information. Additionally, non-compliance can lead to increased scrutiny from the IRS and damage the organization’s reputation. It is essential for organizations to prioritize accurate and timely reporting to mitigate these risks.

Quick guide on how to complete 2020 schedule j form 990 compensation information

Handle Schedule J Form 990 Compensation Information effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule J Form 990 Compensation Information on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Schedule J Form 990 Compensation Information with ease

- Locate Schedule J Form 990 Compensation Information and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Schedule J Form 990 Compensation Information and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule j form 990 compensation information

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule j form 990 compensation information

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the 2018 Form 990 Schedule J and why is it important?

The 2018 Form 990 Schedule J is used by organizations to provide information about their compensation practices for key employees and the organization's highest paid staff. It's important for maintaining transparency and compliance with IRS regulations, ensuring that nonprofits disclose relevant compensation information to the public.

-

How can airSlate SignNow assist with completing the 2018 Form 990 Schedule J?

airSlate SignNow streamlines the document signing process by allowing users to eSign forms securely and efficiently. You can upload the 2018 Form 990 Schedule J, gather signatures, and manage the entire workflow online, making compliance and submission easier.

-

Is there a cost associated with using airSlate SignNow for the 2018 Form 990 Schedule J?

airSlate SignNow offers various pricing plans that cater to different business needs, including nonprofit organizations. By choosing the right plan, you can benefit from cost-effective features to help complete the 2018 Form 990 Schedule J without unnecessary expenses.

-

What features does airSlate SignNow provide for completing IRS forms like the 2018 Form 990 Schedule J?

airSlate SignNow provides features like customizable templates, in-person signing, and advanced security options to help users prepare and sign the 2018 Form 990 Schedule J seamlessly. These features are designed to optimize efficiency and ensure that sensitive data is protected.

-

Can airSlate SignNow integrate with accounting software used for filing the 2018 Form 990 Schedule J?

Yes, airSlate SignNow offers integrations with popular accounting and nonprofit management software. This allows for a smooth workflow when managing financial documents, making it easier to file the 2018 Form 990 Schedule J alongside your other accounting needs.

-

What are the benefits of using airSlate SignNow for nonprofit organizations filing the 2018 Form 990 Schedule J?

Using airSlate SignNow helps nonprofit organizations save time and resources when filing the 2018 Form 990 Schedule J. The platform simplifies the eSign process, allows for secure document storage, and enhances collaboration among team members.

-

How does airSlate SignNow ensure the security of documents like the 2018 Form 990 Schedule J?

airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your documents like the 2018 Form 990 Schedule J. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Schedule J Form 990 Compensation Information

- Special durable power of attorney for bank account matters vermont form

- Vermont small business startup package vermont form

- Vermont property management package vermont form

- New resident guide vermont form

- Satisfaction release or cancellation of mortgage by corporation vermont form

- Satisfaction release or cancellation of mortgage by individual vermont form

- Partial release of property from mortgage for corporation vermont form

- Partial release of property from mortgage by individual holder vermont form

Find out other Schedule J Form 990 Compensation Information

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document