Cocodoc Comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department of the Treasury Internal 2022

Understanding the 2021 Schedule J Form 990

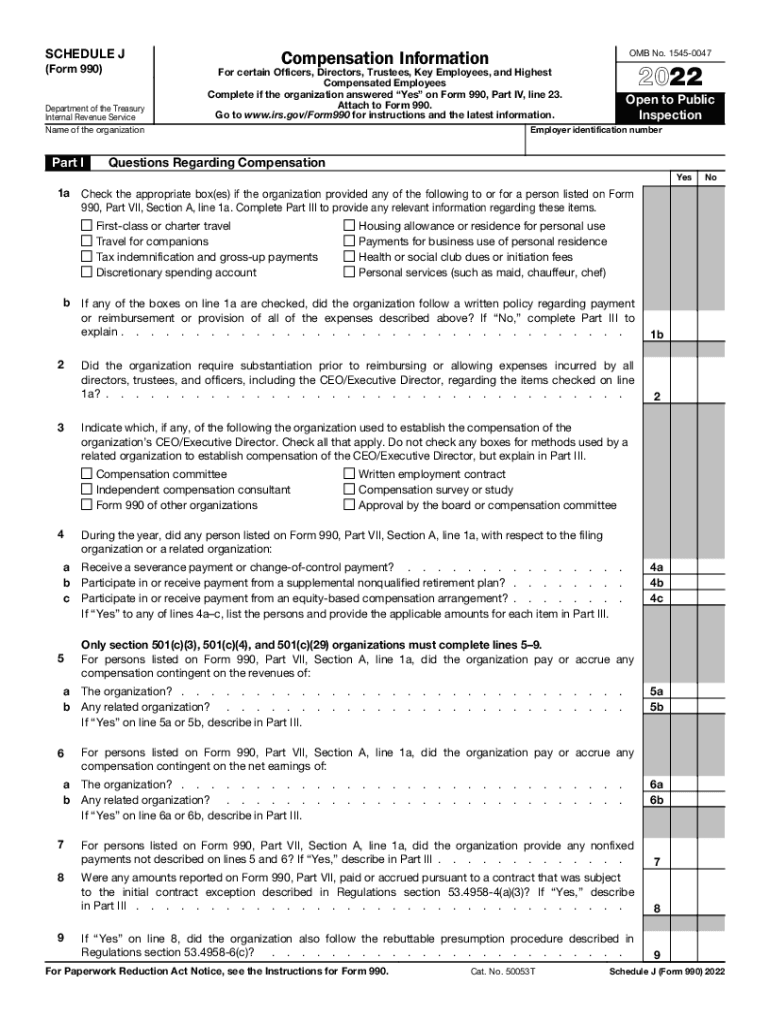

The 2021 Schedule J Form 990 is an essential document used by tax-exempt organizations to report compensation information for their highest-paid employees and contractors. This form provides transparency regarding how organizations allocate their financial resources, particularly in relation to salaries and benefits. It is crucial for maintaining compliance with IRS regulations and for ensuring public trust in nonprofit financial practices.

Steps to Complete the 2021 Schedule J Form 990

Completing the 2021 Schedule J Form 990 involves several key steps:

- Gather Required Information: Collect data on compensation, including salaries, bonuses, and other benefits for the highest-paid employees.

- Review IRS Guidelines: Familiarize yourself with the IRS instructions specific to Schedule J to ensure accurate reporting.

- Fill Out the Form: Input the gathered information into the appropriate sections of the form, ensuring all figures are accurate and complete.

- Review for Accuracy: Double-check all entries for errors or omissions before finalizing the form.

- Submit the Form: File the completed Schedule J Form 990 with the IRS by the designated deadline.

IRS Guidelines for Schedule J Form 990

The IRS provides specific guidelines for completing the 2021 Schedule J Form 990. These guidelines include detailed instructions on how to report compensation, including definitions of what constitutes reportable income. Organizations must ensure they are following these guidelines closely to avoid penalties and ensure compliance. Key points include:

- Identification of the highest-paid employees and contractors.

- Clear definitions of compensation, including deferred compensation and other benefits.

- Requirements for reporting compensation paid by related organizations.

Filing Deadlines for the 2021 Schedule J Form 990

Timely filing of the 2021 Schedule J Form 990 is critical for compliance. The standard deadline for filing is the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May 15, 2022. Extensions may be available, but organizations must apply for them before the original deadline.

Legal Use of the 2021 Schedule J Form 990

The 2021 Schedule J Form 990 is legally binding and must be completed accurately to reflect the organization’s compensation practices. Misreporting can lead to significant penalties from the IRS. Organizations must ensure that all information is truthful and complies with federal regulations to avoid legal repercussions.

Submission Methods for the 2021 Schedule J Form 990

Organizations have several options for submitting the 2021 Schedule J Form 990:

- Online Submission: Many organizations choose to file electronically through IRS-approved software, which can streamline the process and reduce errors.

- Mail Submission: Organizations can also print and mail the completed form to the appropriate IRS address based on their location.

- In-Person Submission: While less common, some organizations may opt to deliver their forms directly to an IRS office.

Quick guide on how to complete cocodoccomform1830421 schedule j form 990schedule j form 990 department of the treasury internal

Complete Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal with ease

- Find Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Alter and eSign Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cocodoccomform1830421 schedule j form 990schedule j form 990 department of the treasury internal

Create this form in 5 minutes!

People also ask

-

What is the 2021 990 schedule, and why is it important?

The 2021 990 schedule is a crucial document for tax-exempt organizations, as it provides detailed information about their financial activities. By accurately completing the 2021 990 schedule, organizations can ensure compliance with IRS requirements while maintaining transparency with stakeholders. This document is essential for securing funding and showcasing credibility.

-

How can airSlate SignNow help with the 2021 990 schedule?

airSlate SignNow offers an efficient platform for preparing and signing important documents, including the 2021 990 schedule. Our easy-to-use system allows organizations to gather and store necessary data electronically, streamlining the process and enhancing accuracy. With airSlate SignNow, you can ensure that your 2021 990 schedule is filled out correctly and submitted on time.

-

Are there features in airSlate SignNow tailored specifically for the 2021 990 schedule?

Yes, airSlate SignNow provides features tailored for handling the 2021 990 schedule, including customizable templates and secure electronic signatures. Our platform supports document collaboration, allowing multiple users to review and sign the schedule seamlessly. This ensures your organization remains compliant while saving valuable time.

-

What are the pricing options for using airSlate SignNow for the 2021 990 schedule?

AirSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes when managing their 2021 990 schedule. Our plans include a cost-effective solution suitable for both small organizations and large enterprises. You can explore our options to find the best fit for efficiently managing your tax-related documents.

-

Can I integrate airSlate SignNow with other software for managing the 2021 990 schedule?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your 2021 990 schedule. This integration provides a smooth workflow, enabling automatic transfer of data and reducing the chances of errors. Simplify your document management process with these powerful integrations.

-

What benefits does airSlate SignNow provide for the preparation of the 2021 990 schedule?

Using airSlate SignNow for your 2021 990 schedule preparation offers numerous benefits, including improved efficiency and accuracy in document creation. Our platform allows for real-time collaboration and electronic signing, reducing the need for printed paperwork. Additionally, airSlate SignNow enhances security, ensuring that sensitive financial data remains protected.

-

Is airSlate SignNow compliant with regulations related to the 2021 990 schedule?

Yes, airSlate SignNow is designed to comply with all relevant regulations concerning the preparation and submission of the 2021 990 schedule. We prioritize data security and regulatory adherence, ensuring that your documents are handled appropriately. You can trust airSlate SignNow to keep your organization in line with IRS requirements.

Get more for Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal

- Examination debtor form

- Ohio transfer form

- Transfer death affidavit form

- Release of garnishee ohio form

- Notice of furnishing corporation or llc ohio form

- Quitclaim deed from individual to two individuals in joint tenancy ohio form

- Quitclaim from individual to husband and wife as joint tenants with right of survivorship ohio form

- Renunciation and disclaimer of property from will by testate ohio form

Find out other Cocodoc comform1830421 SCHEDULE J Form 990Schedule J Form 990 Department Of The Treasury Internal

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online