SCHEDULE J SCHEDULE JForm 990 Department of the 2021

Understanding the 2020 Schedule J Form 990

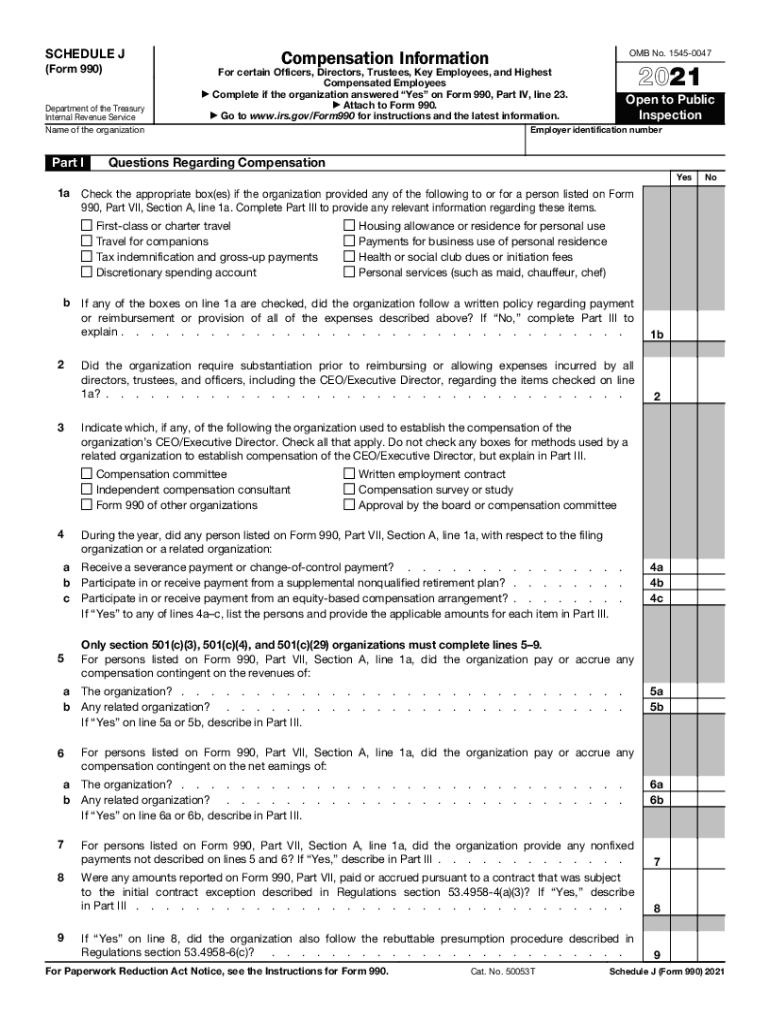

The 2020 Schedule J is a supplementary form to the IRS Form 990, used by tax-exempt organizations to report compensation information for their highest-paid employees and contractors. This form is essential for transparency regarding the financial dealings of nonprofit organizations, as it outlines compensation packages, including salaries, bonuses, and other benefits. The information provided helps the IRS and the public assess whether the organization is adhering to tax regulations and maintaining accountability.

Steps to Complete the 2020 Schedule J Form 990

Completing the 2020 Schedule J requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documentation, including previous years' forms, compensation agreements, and any relevant financial statements.

- Identify the individuals whose compensation will be reported, typically including top executives and board members.

- Document the total compensation for each individual, including salary, bonuses, and other forms of remuneration.

- Complete each section of the form accurately, ensuring that all figures are supported by your records.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form along with your Form 990 by the applicable deadline.

IRS Guidelines for the 2020 Schedule J Form 990

The IRS provides specific guidelines for completing the 2020 Schedule J. Organizations must adhere to these rules to ensure compliance and avoid penalties. Key guidelines include:

- Report compensation for all individuals earning over $100,000 in a fiscal year.

- Include detailed descriptions of the compensation structure, including any deferred compensation plans.

- Ensure that all reported figures align with the organization's financial statements and IRS Form 990.

Filing Deadlines for the 2020 Schedule J Form 990

It is crucial to be aware of the filing deadlines for the 2020 Schedule J. Generally, the form must be submitted by the 15th day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the deadline is May 15, 2021. Extensions may be available, but it is essential to file for an extension before the original deadline.

Legal Use of the 2020 Schedule J Form 990

The legal use of the 2020 Schedule J involves ensuring that all information reported is accurate and truthful. Misrepresentation of compensation data can lead to severe penalties, including fines and loss of tax-exempt status. Organizations must maintain thorough records to support the information reported on the form, as these documents may be reviewed during audits or investigations.

Examples of Using the 2020 Schedule J Form 990

Organizations may encounter various scenarios when using the 2020 Schedule J. For instance:

- A nonprofit organization may need to report a significant increase in compensation for its executive director due to a new performance bonus structure.

- A charity may need to disclose compensation for board members who receive stipends for their service.

- Organizations that provide housing or other benefits to employees must report the fair market value of those benefits on the form.

Quick guide on how to complete schedule j schedule jform 990 department of the

Effortlessly prepare SCHEDULE J SCHEDULE JForm 990 Department Of The on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage SCHEDULE J SCHEDULE JForm 990 Department Of The on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign SCHEDULE J SCHEDULE JForm 990 Department Of The with ease

- Locate SCHEDULE J SCHEDULE JForm 990 Department Of The and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign SCHEDULE J SCHEDULE JForm 990 Department Of The and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule j schedule jform 990 department of the

Create this form in 5 minutes!

How to create an eSignature for the schedule j schedule jform 990 department of the

How to create an e-signature for a PDF file online

How to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an e-signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2020 990 schedule and how does it affect my business?

The 2020 990 schedule is a tax form required for organizations to report their financial activities to the IRS. Understanding this schedule is crucial for maintaining compliance and ensuring transparency in your nonprofit or business operations. airSlate SignNow can facilitate the eSigning process of documents related to the 2020 990 schedule, streamlining your filing.

-

How can airSlate SignNow help with completing the 2020 990 schedule?

airSlate SignNow offers features that simplify the document management process for the 2020 990 schedule. You can easily gather signatures from stakeholders and ensure that all required information is correctly compiled. This not only saves time but also enhances the accuracy of your submissions.

-

What are the pricing options for using airSlate SignNow for the 2020 990 schedule?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs. You can choose a plan that fits your budget while ensuring you have all the necessary tools to manage documents related to the 2020 990 schedule effectively. Pricing transparency is central to our service.

-

What features does airSlate SignNow offer for managing the 2020 990 schedule?

Key features of airSlate SignNow for the 2020 990 schedule include eSignature capabilities, customizable templates, and secure cloud storage. These features enable you to prepare and submit essential tax forms with ease, reducing the burden of paperwork. Our platform is designed to enhance efficiency and compliance.

-

Is airSlate SignNow secure for handling sensitive information related to the 2020 990 schedule?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the 2020 990 schedule are encrypted and stored securely. We implement advanced security measures to protect your sensitive information and give you peace of mind while using our platform.

-

Can I integrate airSlate SignNow with other software for the 2020 990 schedule?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software that can aid in managing your 2020 990 schedule. These integrations allow for smoother workflows and better data accuracy, making it easier to handle your tax documentation.

-

How does eSigning with airSlate SignNow improve the process of filing the 2020 990 schedule?

ESigning with airSlate SignNow signNowly reduces the time and hassle associated with filing the 2020 990 schedule. It allows multiple users to sign documents quickly and securely from any device, ensuring efficient collaboration. This modern approach accelerates your filing process and improves overall productivity.

Get more for SCHEDULE J SCHEDULE JForm 990 Department Of The

- Notice to beneficiaries of being named in will delaware form

- Estate planning questionnaire and worksheets delaware form

- Document locator and personal information package including burial information form delaware

- Demand to produce copy of will from heir to executor or person in possession of will delaware form

- Bill of sale of automobile and odometer statement florida form

- Florida odometer form

- Promissory note in connection with sale of vehicle or automobile florida form

- Bill of sale for watercraft or boat florida form

Find out other SCHEDULE J SCHEDULE JForm 990 Department Of The

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form