Schedule J Form 2017

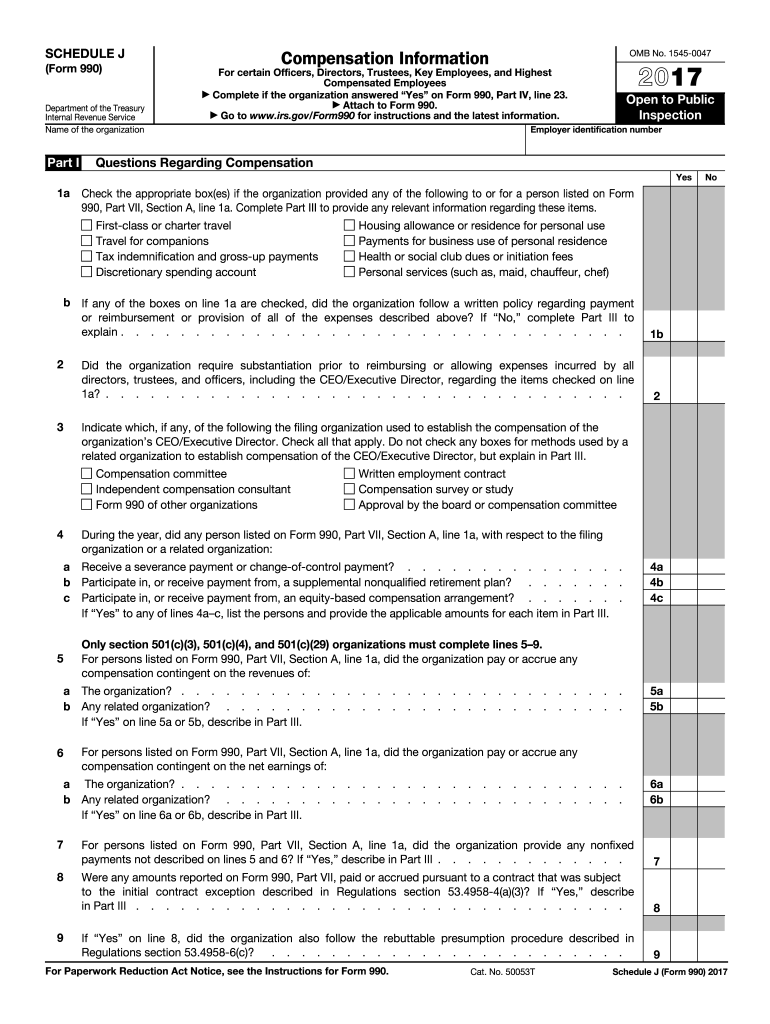

What is the Schedule J Form

The Schedule J Form is a tax document used by certain taxpayers in the United States to report income and deductions related to farming operations. This form is specifically designed for farmers and ranchers to calculate their taxable income based on their agricultural activities. It allows for the reporting of income from various sources, including crop sales, livestock sales, and other farm-related income. Understanding the purpose of this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule J Form

Using the Schedule J Form involves several steps to ensure accurate reporting of agricultural income. Taxpayers should first gather all relevant financial records, including sales receipts, expense invoices, and any other documentation related to farm operations. Once the necessary information is collected, the taxpayer can begin filling out the form by entering income details and applicable deductions. It is important to follow IRS guidelines closely to avoid errors that could lead to penalties or audits.

Steps to complete the Schedule J Form

Completing the Schedule J Form requires careful attention to detail. Here are the steps to follow:

- Gather all financial records related to farming activities.

- Enter your total income from farming on the appropriate lines of the form.

- List all allowable deductions, including operating expenses and depreciation.

- Calculate your net income by subtracting total deductions from total income.

- Review the form for accuracy and completeness before submission.

Legal use of the Schedule J Form

The Schedule J Form must be used in accordance with IRS regulations to ensure its legal validity. Taxpayers should only use the most current version of the form and ensure that all information is accurate and complete. Submitting outdated forms or providing incorrect information can result in penalties and legal issues. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule J Form typically align with the annual tax filing deadline for individual taxpayers. Generally, this date is April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should be aware of any changes to these deadlines and plan accordingly to avoid late filing penalties. It is also important to consider any state-specific deadlines that may apply.

Examples of using the Schedule J Form

Examples of situations where the Schedule J Form is applicable include:

- A farmer who sells crops at a local market and needs to report that income.

- A rancher who raises livestock and incurs expenses related to feed and veterinary care.

- A small-scale agricultural business that combines various income sources from farming activities.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule J Form. These guidelines include instructions on what constitutes allowable income and expenses, as well as how to calculate net income accurately. Taxpayers should refer to the IRS instructions for the Schedule J Form for detailed information on eligibility, required documentation, and any updates to the filing process. Adhering to these guidelines is crucial for compliance and avoiding potential issues with the IRS.

Quick guide on how to complete 2017 schedule j form

Discover the easiest approach to complete and sign your Schedule J Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior method to finalize and sign your Schedule J Form and other similar forms for public services. Our advanced eSignature platform equips you with all the necessary tools to manage documentation swiftly and in compliance with official standards - comprehensive PDF editing, handling, securing, signing, and sharing functionalities available within a user-friendly interface.

Only a few steps are needed to fill out and sign your Schedule J Form:

- Load the editable template into the editor using the Get Form button.

- Identify the information required for your Schedule J Form.

- Move between fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the toolbar above.

- Emphasize what is important or Cover fields that are no longer relevant.

- Select Sign to generate a legally valid eSignature using whichever method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finalized Schedule J Form in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers versatile file sharing options. There's no need to print your forms when submitting to the appropriate public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule j form

FAQs

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the JEE Advanced form 2017 if I have taken the improvement CBSE board test in 2017?

For this it will be better if you contact the office people directly or sent them a mail . Please note do federally do not answer the mail so it is always better to make a phone call .

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule j form

How to create an eSignature for your 2017 Schedule J Form online

How to create an eSignature for your 2017 Schedule J Form in Chrome

How to make an electronic signature for signing the 2017 Schedule J Form in Gmail

How to generate an electronic signature for the 2017 Schedule J Form straight from your smart phone

How to generate an electronic signature for the 2017 Schedule J Form on iOS devices

How to make an eSignature for the 2017 Schedule J Form on Android

People also ask

-

What is the Schedule J Form and why is it important?

The Schedule J Form is a crucial tax document that helps taxpayers report income and deductions related to farming activities. It is important for ensuring accurate tax filings and compliance with IRS regulations. Utilizing tools like airSlate SignNow can streamline the eSigning process for your Schedule J Form, making it easier to manage.

-

How can airSlate SignNow help with the Schedule J Form?

airSlate SignNow offers an efficient platform for sending and eSigning the Schedule J Form. With its user-friendly interface, you can quickly prepare, send, and track your Schedule J Form, ensuring that all parties can sign it electronically and securely.

-

Is airSlate SignNow cost-effective for managing the Schedule J Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Schedule J Form. With affordable pricing plans, businesses can save time and resources while ensuring that their important tax documents are handled efficiently.

-

What features does airSlate SignNow offer for the Schedule J Form?

airSlate SignNow offers a variety of features for the Schedule J Form, including customizable templates, secure eSigning, and document tracking. These features allow users to manage their Schedule J Form seamlessly, ensuring that all signatures are collected and stored securely.

-

Can I integrate airSlate SignNow with other software for my Schedule J Form?

Absolutely! airSlate SignNow integrates with various software platforms, making it easy to incorporate the Schedule J Form into your existing workflows. Whether you use accounting software or document management systems, you can streamline the process of handling the Schedule J Form.

-

What are the benefits of using airSlate SignNow for the Schedule J Form?

Using airSlate SignNow for the Schedule J Form offers several benefits, including improved efficiency, enhanced security, and reduced paperwork. The platform allows you to sign documents from anywhere, saving time and making it easier to manage your tax filings.

-

Is it easy to share the Schedule J Form with others using airSlate SignNow?

Yes, sharing the Schedule J Form with others is easy using airSlate SignNow. You can send the form directly through the platform, allowing recipients to review and eSign it quickly, ensuring everyone has access to the latest version of the document.

Get more for Schedule J Form

Find out other Schedule J Form

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy