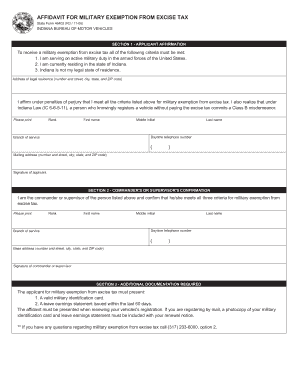

Affidavit of Tax Exemption Form 2006

What is the Affidavit Of Tax Exemption Form

The Affidavit Of Tax Exemption Form is a legal document that allows individuals or entities to claim an exemption from certain taxes. This form is often used by nonprofit organizations, religious institutions, or educational entities to assert their tax-exempt status. By completing this affidavit, the filer attests that they meet the criteria established by state or federal tax laws, which can vary depending on the jurisdiction.

How to use the Affidavit Of Tax Exemption Form

Steps to complete the Affidavit Of Tax Exemption Form

Completing the Affidavit Of Tax Exemption Form involves several key steps:

- Gather necessary documentation, such as proof of nonprofit status or other relevant certifications.

- Obtain the form from the appropriate tax authority.

- Fill out the form accurately, providing all required information.

- Review the form for completeness and accuracy.

- Sign the affidavit, ensuring that all signatures are valid and in compliance with legal requirements.

- Submit the completed form to the designated tax authority, either online, by mail, or in person, as specified.

Legal use of the Affidavit Of Tax Exemption Form

The legal use of the Affidavit Of Tax Exemption Form is crucial for ensuring that the claims made are recognized by tax authorities. This form must be completed in accordance with state and federal regulations to be deemed valid. Failure to comply with the legal requirements can result in penalties or denial of the tax-exempt status. It is advisable to consult legal counsel if there are any uncertainties regarding the form's completion or submission.

Key elements of the Affidavit Of Tax Exemption Form

Key elements of the Affidavit Of Tax Exemption Form typically include:

- Name and address of the organization or individual claiming the exemption.

- Description of the nature of the exemption being claimed.

- Legal basis for the exemption, referencing specific statutes or regulations.

- Signature of the authorized representative or individual.

- Date of signing.

Eligibility Criteria

Eligibility for using the Affidavit Of Tax Exemption Form generally depends on the type of organization or individual claiming the exemption. Common criteria include:

- Nonprofit status as recognized by the IRS.

- Being a religious, charitable, or educational institution.

- Compliance with specific state laws regarding tax exemptions.

Quick guide on how to complete affidavit of tax exemption form

Complete Affidavit Of Tax Exemption Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow offers you all the resources required to produce, modify, and eSign your documents promptly without obstacles. Manage Affidavit Of Tax Exemption Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Affidavit Of Tax Exemption Form with ease

- Find Affidavit Of Tax Exemption Form and then click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Signature tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and then click the Finish button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Affidavit Of Tax Exemption Form and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct affidavit of tax exemption form

Create this form in 5 minutes!

How to create an eSignature for the affidavit of tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Affidavit Of Tax Exemption Form?

An Affidavit Of Tax Exemption Form is a legal document used to claim tax exemption status for certain purchases. This form provides the necessary proof to federal or state authorities that a buyer is eligible for tax-free transactions. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring compliance and efficiency in your tax-related processes.

-

How can airSlate SignNow help me with an Affidavit Of Tax Exemption Form?

airSlate SignNow provides a streamlined platform for creating and managing your Affidavit Of Tax Exemption Form. The solution allows you to customize your form, add eSignatures, and track the status of the document all in one place. This ease of use saves time and enhances the accuracy of your tax exemption claims.

-

Is there a cost associated with using airSlate SignNow for Affidavit Of Tax Exemption Forms?

Yes, airSlate SignNow operates on a subscription-based pricing model, which caters to various business sizes and needs. Pricing plans are designed to be cost-effective, making it affordable for businesses to manage their Affidavit Of Tax Exemption Forms. Review our pricing page for more details on feature availability under each plan.

-

Can I integrate airSlate SignNow with other applications for managing the Affidavit Of Tax Exemption Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications like CRM systems, cloud storage, and accounting software. This ensures that your Affidavit Of Tax Exemption Form workflow is efficient and centralized, allowing for better data management and communication across your platforms.

-

What features does airSlate SignNow offer for handling Affidavit Of Tax Exemption Forms?

airSlate SignNow comes with features such as customizable templates, eSignature capabilities, document tracking, and automated reminders. These features help streamline the preparation and submission of your Affidavit Of Tax Exemption Form, enhancing overall productivity and minimizing the chances of errors.

-

How secure is my data when using airSlate SignNow for Affidavit Of Tax Exemption Forms?

Your data security is a top priority at airSlate SignNow. We employ industry-leading encryption protocols and secure servers to protect your Affidavit Of Tax Exemption Form and other sensitive information. With our robust security measures, you can confidently manage your documents without compromising privacy.

-

Can I track the status of my Affidavit Of Tax Exemption Form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Affidavit Of Tax Exemption Form. You will receive notifications when the document is opened, signed, or completed, allowing you to stay updated and manage your timelines effectively. This feature helps ensure that your tax exemption claims are processed without delays.

Get more for Affidavit Of Tax Exemption Form

Find out other Affidavit Of Tax Exemption Form

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer