Ga Laws Concerning Person Claiming Refund Due a Deceased Taxpayer Form

What is the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form

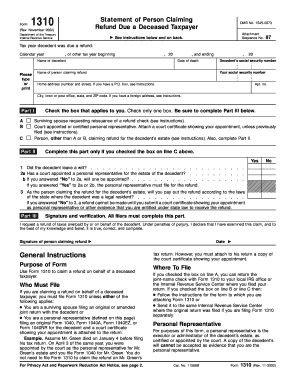

The Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form is a legal document used to request a tax refund on behalf of a deceased individual. This form is essential for the executor or administrator of the deceased's estate, allowing them to claim any refunds owed to the taxpayer. The form ensures that the rightful person can access the funds and fulfill their responsibilities regarding the estate. Understanding the legal implications and requirements of this form is crucial for proper execution and compliance with state laws.

Steps to complete the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form

Completing the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form involves several important steps:

- Gather necessary information, including the deceased's Social Security number, tax identification details, and any relevant financial documents.

- Identify yourself as the executor or administrator by providing appropriate documentation, such as a death certificate and letters of administration.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for accuracy and completeness before submission.

- Submit the form through the appropriate channels, which may include electronic filing, mailing, or in-person delivery, depending on state regulations.

Legal use of the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form

The legal use of the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form is governed by state tax laws and regulations. This form must be utilized by individuals who have the legal authority to act on behalf of the deceased taxpayer. Proper execution of the form ensures that the claim for a refund is valid and recognized by tax authorities. It is important to adhere to all legal requirements, including providing supporting documentation, to avoid potential disputes or delays in processing the refund.

Required Documents

To successfully complete the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form, certain documents are required:

- A certified copy of the death certificate to verify the taxpayer's passing.

- Letters of administration or probate documents that establish the executor's authority.

- Previous tax returns of the deceased, if applicable, to support the refund claim.

- Any other relevant financial documents that may assist in the refund process.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form. It is essential to follow these guidelines to ensure compliance and proper processing of the refund claim. The IRS outlines the eligibility criteria for claiming a refund, the necessary documentation, and the procedures for submission. Familiarizing oneself with these guidelines can help streamline the process and mitigate potential issues.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form can be done through various methods, depending on state regulations:

- Online: Many states offer electronic filing options for tax forms, allowing for quicker processing.

- Mail: The form can be printed and mailed to the appropriate tax authority. Ensure that it is sent to the correct address to avoid delays.

- In-Person: Some individuals may choose to submit the form in person at their local tax office, which can provide immediate confirmation of receipt.

Quick guide on how to complete ga laws concerning person claiming refund due a deceased taxpayer form

Complete Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an optimal eco-conscious alternative to traditional printed and signed documents, allowing you to access the accurate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form effortlessly

- Find Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga laws concerning person claiming refund due a deceased taxpayer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form?

The Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form outline the legal requirements for individuals seeking to claim tax refunds on behalf of a deceased taxpayer. It involves specific procedures and documentation to ensure compliance with state regulations. Understanding these laws is crucial for a smooth refund claim process.

-

How can airSlate SignNow assist with tax documents related to deceased taxpayers?

airSlate SignNow provides an efficient platform for managing and eSigning tax documents, including the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form. With our user-friendly interface, you can quickly prepare and send necessary documents, reducing delays in the refund process. Our solution ensures that all signatures are collected legally and securely.

-

What pricing options does airSlate SignNow offer for tax document management?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs. Whether you're a small business or a larger enterprise, our transparent pricing ensures you can choose a plan that fits your budget while empowering you to manage Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form effectively. Check our website for current pricing details and any special offers.

-

Are there features that support compliance with Ga laws regarding deceased taxpayer refunds?

Yes, airSlate SignNow includes features designed to ensure compliance with Ga laws concerning the claiming of refunds for deceased taxpayers. Our platform provides audit trails, secure document storage, and templates specifically for deceased taxpayer filings, which streamline your compliance efforts. This makes handling the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form much simpler.

-

Can I integrate airSlate SignNow with existing accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software that can help facilitate the management of tax-related documents. This ensures that you can seamlessly incorporate the eSigning capabilities into your workflow while adhering to the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form. Check out our integrations page for details on compatible software.

-

How does airSlate SignNow enhance the speed of processing tax refund claims?

By utilizing airSlate SignNow for your documentation needs, you signNowly speed up the process of claiming refunds due to deceased taxpayers. Our platform allows for quick eSigning, secure document sharing, and streamlined workflows, which greatly reduce turnaround times. This efficiency is especially beneficial when complying with the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form.

-

What benefits can I expect from using airSlate SignNow for estate tax documents?

Using airSlate SignNow for estate tax documents provides notable benefits such as secure eSigning, easy document tracking, and enhanced compliance with regulatory requirements. You can efficiently manage the Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form, ensuring that all necessary parties can sign documents securely online. This leads to quicker resolutions and satisfaction for all stakeholders involved.

Get more for Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form

- Instructions for form g 28 uscis uscis

- Bank of hawaii form bb 39 e

- Production audition form theatre and dance missouri state

- California los angeles county form

- Form 2751

- Membership calabasas chamber of commerce application form

- Camo approved official bout agreement camo mma form

- Mobile food facility mff application san mateo county form

Find out other Ga Laws Concerning Person Claiming Refund Due A Deceased Taxpayer Form

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe