Form 8717 Rev May Internal Revenue Service Irs

What is the IRS Form 8717?

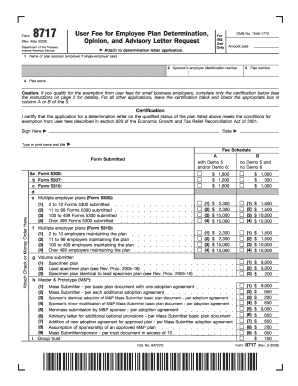

The IRS Form 8717, also known as the User Fee for Employee Plan Determination Letter Request, is a crucial document used by organizations seeking a determination letter from the Internal Revenue Service regarding their employee benefit plans. This form is primarily utilized by retirement plan sponsors to ensure their plans meet the necessary requirements for tax qualification under the Internal Revenue Code. The form helps the IRS assess whether a plan complies with federal regulations, making it essential for maintaining tax-exempt status.

How to Obtain the IRS Form 8717

To obtain the IRS Form 8717, individuals or organizations can visit the official IRS website, where the form is available for download. It is important to ensure that you are using the most recent version of the form, as updates may occur periodically. Additionally, the form can often be requested through tax professionals or financial advisors who assist with employee benefit plans.

Steps to Complete the IRS Form 8717

Completing the IRS Form 8717 involves several key steps:

- Begin by entering the name of the plan sponsor and the plan name at the top of the form.

- Fill in the Employer Identification Number (EIN) associated with the plan.

- Indicate the type of plan for which you are requesting a determination letter.

- Complete the user fee section, ensuring that the correct fee is submitted based on the plan type.

- Review the form for accuracy and completeness before submission.

Legal Use of the IRS Form 8717

The IRS Form 8717 serves a legal purpose in the realm of employee benefit plans. By submitting this form, plan sponsors are asserting their compliance with the Internal Revenue Code, which is essential for maintaining the tax-qualified status of their retirement plans. Failure to submit the form correctly or to comply with IRS regulations can lead to penalties or loss of tax-exempt status, making it vital for sponsors to understand the legal implications of this document.

Filing Deadlines for the IRS Form 8717

Filing deadlines for the IRS Form 8717 can vary based on the specific circumstances of the retirement plan. Generally, it is advisable to submit the form as early as possible in the plan year to avoid potential penalties. The IRS provides guidance on specific deadlines, which should be reviewed carefully to ensure compliance. Being aware of these deadlines helps plan sponsors avoid unnecessary complications and maintain their plans' tax-qualified status.

Form Submission Methods

The IRS Form 8717 can be submitted through various methods, including:

- Mailing the completed form to the appropriate IRS address as specified in the form's instructions.

- Submitting the form electronically, if applicable, through the IRS e-file system, which may streamline the process and provide quicker confirmation.

It is essential to follow the submission guidelines to ensure that the form is processed efficiently and accurately.

Quick guide on how to complete form 8717 rev may internal revenue service irs

Effortlessly prepare Form 8717 Rev May Internal Revenue Service Irs on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 8717 Rev May Internal Revenue Service Irs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form 8717 Rev May Internal Revenue Service Irs with ease

- Find Form 8717 Rev May Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or mask sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any chosen device. Modify and electronically sign Form 8717 Rev May Internal Revenue Service Irs to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8717 rev may internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 8717, and why is it important?

The IRS Form 8717 is used by organizations to apply for the exemption from certain taxes. Completing this form is essential for qualifying for tax-exempt status. airSlate SignNow simplifies this process, allowing businesses to eSign and submit the IRS Form 8717 electronically.

-

How does airSlate SignNow help with IRS Form 8717?

airSlate SignNow streamlines the eSigning and sharing process for IRS Form 8717. With its user-friendly interface, organizations can complete, sign, and send this crucial form quickly and securely. This not only saves time but also enhances compliance with IRS regulations.

-

Is airSlate SignNow compliant with IRS regulations for eSigning IRS Form 8717?

Yes, airSlate SignNow is fully compliant with IRS eSignature regulations. It ensures that your digitally signed IRS Form 8717 meets all necessary legal and regulatory standards. This compliance guarantees that your documents are legally binding and secure.

-

What are the pricing plans for using airSlate SignNow for IRS Form 8717?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Whether you are a small business or a large enterprise, you can find a plan that supports your filing of IRS Form 8717 affordably. Each plan includes features that enhance document management and eSigning.

-

Can I integrate airSlate SignNow with other software for handling IRS Form 8717?

Absolutely! airSlate SignNow easily integrates with numerous business software applications. This allows you to manage IRS Form 8717 and other documents seamlessly within your existing workflows, enhancing efficiency and collaboration.

-

What features does airSlate SignNow offer for managing IRS Form 8717?

With airSlate SignNow, you gain access to features like customizable templates, bulk sending, and real-time tracking. These features ensure that managing your IRS Form 8717 is straightforward and efficient. Plus, the platform allows for secure storage and sharing of your signed documents.

-

How does using airSlate SignNow benefit organizations filing IRS Form 8717?

Using airSlate SignNow benefits organizations by reducing paperwork and simplifying the filing process for IRS Form 8717. It enables faster turnaround times and mitigates the risk of errors, ensuring that your submissions are accurate and timely. This efficiency can signNowly enhance your operational effectiveness.

Get more for Form 8717 Rev May Internal Revenue Service Irs

- Mature fields development spe form

- Usra license 461634770 form

- E 7445 security questionnaire declaration for amway supply chain services suppliers form

- Time distribution report form

- Please print this form and include with your shipment

- Stockton ports agree to partnership with pscballpark digest form

- Knights of columbus form 1295

- Application form palau national communications corporation

Find out other Form 8717 Rev May Internal Revenue Service Irs

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure