941 Ss Form 2015

What is the 941 Ss Form

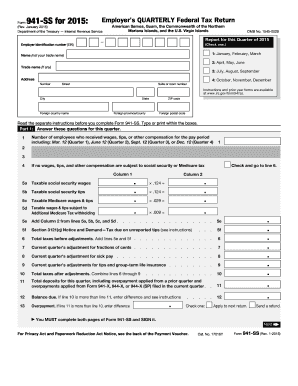

The 941 Ss Form is a tax document used by employers in the United States to report income taxes, Social Security taxes, and Medicare taxes withheld from employee wages. This form is specifically designed for employers who pay wages to employees in the U.S. Virgin Islands, American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. It serves as a crucial tool for ensuring compliance with federal tax obligations and helps the Internal Revenue Service (IRS) track employment tax liabilities.

How to use the 941 Ss Form

To effectively use the 941 Ss Form, employers must accurately fill out the required sections, which include information about the business, total wages paid, and taxes withheld. Employers should gather all necessary payroll records before starting the form. Each section must be completed with precise figures to ensure compliance and avoid potential penalties. It is also essential to review the form for accuracy before submission, as errors can lead to delays or complications with tax filings.

Steps to complete the 941 Ss Form

Completing the 941 Ss Form involves several key steps:

- Gather Documentation: Collect payroll records, tax withholding information, and any prior forms.

- Fill Out Business Information: Provide your business name, address, and Employer Identification Number (EIN).

- Report Wages and Taxes: Enter total wages paid, tips received, and the amounts withheld for federal income tax, Social Security, and Medicare.

- Complete Signature Section: Ensure that the form is signed by an authorized representative of the business.

- Review for Accuracy: Double-check all entries to avoid mistakes that could lead to penalties.

Legal use of the 941 Ss Form

The 941 Ss Form is legally binding when completed accurately and submitted on time. Employers must adhere to IRS guidelines, including deadlines for filing and payment of taxes. The form must be signed by an authorized individual, ensuring that the information provided is truthful and complete. Non-compliance with the legal requirements associated with this form can result in penalties, interest charges, and potential audits by the IRS.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the 941 Ss Form to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for 2023 are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The 941 Ss Form can be submitted through various methods. Employers have the option to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address based on the location of the business. In-person submissions are generally not available for this form, making electronic filing or mail the most practical options.

Quick guide on how to complete 941 ss 2015 form

Complete 941 Ss Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paper documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage 941 Ss Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to adjust and eSign 941 Ss Form effortlessly

- Obtain 941 Ss Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks on any device you prefer. Adjust and eSign 941 Ss Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 ss 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 941 ss 2015 form

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 941 Ss Form and its purpose?

The 941 Ss Form is a federal tax form used by employers to report income taxes withheld, Social Security, and Medicare tax. It is vital for businesses to accurately complete and submit this form to comply with IRS regulations.

-

How can airSlate SignNow help with the 941 Ss Form?

airSlate SignNow simplifies the process of filling out and eSigning the 941 Ss Form. Our platform ensures that your documents are securely managed, allowing you to efficiently complete your tax reporting requirements.

-

What features does airSlate SignNow offer for handling the 941 Ss Form?

With airSlate SignNow, you can easily create, edit, and eSign the 941 Ss Form. The platform also provides templates, automated workflows, and secure storage options, making it easier for businesses to manage their tax documents.

-

Is airSlate SignNow affordable for small businesses needing to file the 941 Ss Form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. This helps ensure that even companies with limited budgets can efficiently handle their tax forms like the 941 Ss Form without overspending.

-

Can I integrate airSlate SignNow with other software for managing the 941 Ss Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business software. This integration allows for easy data transfer and management, ensuring the 941 Ss Form and related documents are streamlined in your workflow.

-

What are the benefits of using airSlate SignNow for the 941 Ss Form?

Using airSlate SignNow for the 941 Ss Form provides efficiency and security. You can quickly eSign, store, and access your forms from anywhere, reducing paperwork and enhancing collaboration among team members.

-

How secure is the information submitted via the 941 Ss Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption technology to protect your data when submitting the 941 Ss Form, ensuring that your sensitive business information remains safe and confidential.

Get more for 941 Ss Form

Find out other 941 Ss Form

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe