T2201 Disability Tax Credit Certificate 2022

What is the T2201 Disability Tax Credit Certificate

The T2201 Disability Tax Credit Certificate is an official form used in the United States to certify a person's eligibility for disability tax credits. This form is essential for individuals who have a severe and prolonged impairment that significantly restricts their ability to perform daily activities. The T2201 form serves as a declaration from a qualified medical professional, confirming the individual's disability status and providing the necessary documentation to support their claim for tax relief.

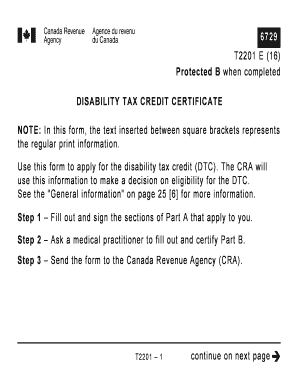

Steps to Complete the T2201 Disability Tax Credit Certificate

Completing the T2201 Disability Tax Credit Certificate involves several key steps to ensure accuracy and compliance with IRS requirements. Begin by gathering personal information, including your name, address, and Social Security number. Next, consult with a qualified healthcare provider who can assess your condition and fill out the appropriate sections of the form. It is crucial to provide detailed information about your disability, including its nature and the extent to which it affects your daily life. Once completed, review the form for any errors before submitting it to the IRS.

Eligibility Criteria

To qualify for the T2201 Disability Tax Credit Certificate, individuals must meet specific eligibility criteria set forth by the IRS. The disability must be severe and long-lasting, meaning it has lasted or is expected to last for at least twelve months. Additionally, the impairment must significantly hinder the individual's ability to perform basic daily activities, such as walking, dressing, or managing personal care. It is essential to provide thorough documentation from a healthcare professional to support your claim and demonstrate how the disability affects your life.

How to Obtain the T2201 Disability Tax Credit Certificate

The T2201 Disability Tax Credit Certificate can be obtained directly from the IRS website or through a tax professional. It is available as a downloadable form that can be printed and completed. After filling out the necessary information, including the medical certification section, the form must be submitted to the IRS as part of your tax return. It is advisable to keep a copy for your records and to ensure that all supporting documentation is included to avoid delays in processing.

Form Submission Methods

Submitting the T2201 Disability Tax Credit Certificate can be done in several ways. Individuals can file the form electronically when submitting their tax return through approved e-filing services. Alternatively, the form can be mailed directly to the IRS along with the tax return. For those who prefer in-person submissions, visiting a local IRS office may also be an option. Regardless of the method chosen, it is important to follow the IRS guidelines for submission to ensure timely processing.

Legal Use of the T2201 Disability Tax Credit Certificate

The T2201 Disability Tax Credit Certificate holds legal significance as it serves as proof of disability for tax purposes. When completed accurately and submitted according to IRS regulations, the form can provide individuals with access to valuable tax credits that reduce their overall tax liability. It is vital to ensure that all information provided is truthful and supported by appropriate medical documentation to avoid penalties or legal issues related to fraudulent claims.

Quick guide on how to complete t2201 disability tax credit certificate

Effortlessly Complete T2201 Disability Tax Credit Certificate on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle T2201 Disability Tax Credit Certificate on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign T2201 Disability Tax Credit Certificate with Ease

- Obtain T2201 Disability Tax Credit Certificate and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your document, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious searches for forms, or errors that necessitate the printing of new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign T2201 Disability Tax Credit Certificate to ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2201 disability tax credit certificate

Create this form in 5 minutes!

How to create an eSignature for the t2201 disability tax credit certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2201 form, and why do I need it?

The t2201 form, also known as the Disability Tax Credit Certificate, is essential for individuals seeking tax credits for disabilities in Canada. It must be completed by a qualified medical practitioner and submitted to the Canada Revenue Agency. Understanding the significance of the t2201 form can help you maximize your tax savings.

-

How does airSlate SignNow help in signing the t2201 form?

airSlate SignNow streamlines the process of signing the t2201 form by offering an easy-to-use platform for electronic signatures. Users can prepare, send, and eSign the t2201 form securely and efficiently, ensuring compliance with legal requirements. This saves time and simplifies document management for individuals and businesses alike.

-

Is there a cost associated with using airSlate SignNow for the t2201 form?

Yes, while airSlate SignNow offers various pricing plans, the cost can vary based on your needs and the number of users. Each plan provides tools tailored for effective document signing, including the t2201 form. Reviewing the pricing options can help you find the most cost-effective solution for your requirements.

-

What features does airSlate SignNow offer for managing the t2201 form?

airSlate SignNow includes features such as customizable templates, advanced security measures, and real-time tracking that facilitate the management of the t2201 form. These features ensure that every document is handled efficiently and securely throughout the signing process. Additionally, it integrates seamlessly with other tools to enhance productivity.

-

Can I integrate airSlate SignNow with other applications for the t2201 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect workflows efficiently. This means you can easily incorporate the t2201 form into your existing systems, enhancing productivity and ensuring that your documents are processed without interruption.

-

What are the benefits of using airSlate SignNow for the t2201 form?

Using airSlate SignNow for the t2201 form enhances efficiency by simplifying the signing process and reducing turnaround times. It provides a secure, legally binding method for signing documents electronically, which can signNowly reduce the stress associated with traditional paper methods. Additionally, it helps maintain organization and accessibility of important documents.

-

How secure is the signing process for the t2201 form with airSlate SignNow?

The signing process for the t2201 form through airSlate SignNow is highly secure, utilizing industry-leading encryption and authentication protocols. This ensures that your personal information and signed documents remain confidential and protected against unauthorized access. Trust in airSlate SignNow for a safe online document signing experience.

Get more for T2201 Disability Tax Credit Certificate

- Form ct 3 a general business corporation combined franchise tax return tax year 2020

- Every california stock agricultural cooperative and registered foreign corporation must file a statement of information with

- Section i see instruction sheet for filing fees and form

- 2019 schedule nj dop amp schedule nj wwc 2019 schedule nj dop amp schedule nj wwc form

- 2020 application for extension of time to file form nj 630

- Nj division of taxation gross income tax new jersey form

- Cbt 100 njgov form

- Monthly state revenue watch home comptrollertexasgov form

Find out other T2201 Disability Tax Credit Certificate

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer