Mount Vernon Transfer Tax Form

What is the Mount Vernon Transfer Tax

The Mount Vernon transfer tax is a local tax imposed on the transfer of real property within the city of Mount Vernon, New York. This tax is typically calculated as a percentage of the sale price of the property. The revenue generated from this tax is often used to support local infrastructure and community services. Understanding this tax is crucial for both buyers and sellers in real estate transactions, as it impacts the overall cost of property transfer.

How to use the Mount Vernon Transfer Tax

Using the Mount Vernon transfer tax involves several steps, primarily focused on calculating the tax owed during a property transaction. First, determine the sale price of the property. Next, apply the applicable tax rate to this amount to calculate the total transfer tax due. This calculation is essential for accurate budgeting and ensuring compliance with local regulations. It is advisable to consult with a real estate professional or tax advisor to ensure correct application and understanding of any exemptions that may apply.

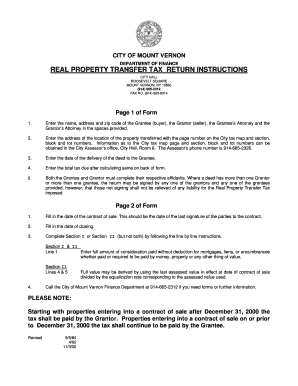

Steps to complete the Mount Vernon Transfer Tax

Completing the Mount Vernon transfer tax form requires several key steps. Begin by gathering necessary information, including the property address, sale price, and details of the buyer and seller. Next, accurately fill out the transfer tax form, ensuring all fields are completed. After completing the form, review it for accuracy before submitting it to the appropriate local authority. Payment of the transfer tax must also be arranged, which can often be done at the time of filing. Keeping a copy of the completed form and payment receipt is advisable for your records.

Legal use of the Mount Vernon Transfer Tax

The legal use of the Mount Vernon transfer tax is governed by local laws and regulations. It is essential for property buyers and sellers to comply with these laws to avoid penalties. The transfer tax must be paid at the time of property transfer, and failure to do so can result in fines or delays in the transaction process. Understanding the legal framework surrounding this tax ensures that all parties involved in a real estate transaction are aware of their responsibilities and obligations.

Required Documents

To complete the Mount Vernon transfer tax form, several documents are typically required. These include the property deed, proof of sale price, and identification for both the buyer and seller. Additional documentation may be necessary depending on the specifics of the transaction, such as any exemptions or special circumstances. Having all required documents ready can streamline the process and help ensure compliance with local regulations.

Penalties for Non-Compliance

Non-compliance with the Mount Vernon transfer tax regulations can result in significant penalties. Failing to file the transfer tax form or pay the tax owed can lead to fines, interest on unpaid amounts, and potential legal action. It is crucial for both buyers and sellers to understand these risks and ensure timely compliance to avoid any financial repercussions. Consulting with a legal or tax professional can provide guidance on maintaining compliance and navigating any complexities related to the transfer tax.

Form Submission Methods

The Mount Vernon transfer tax form can typically be submitted through various methods, including online, by mail, or in person. Each submission method may have different requirements and processing times. For online submissions, ensure that you have access to the necessary digital tools and that your form is completed accurately. If submitting by mail, it is advisable to use certified mail for tracking purposes. In-person submissions may require an appointment or specific hours of operation, so checking with local authorities is recommended.

Quick guide on how to complete mount vernon transfer tax form

Prepare mount vernon transfer tax form effortlessly on any device

Web-based document management has grown increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the needed form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle mount vernon transfer tax form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign mount vernon transfer tax with minimal effort

- Locate mount vernon transfer tax form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign mount vernon transfer tax and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to mount vernon transfer tax form

Create this form in 5 minutes!

How to create an eSignature for the mount vernon transfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask mount vernon transfer tax

-

What is the Mount Vernon transfer tax form?

The Mount Vernon transfer tax form is a document required for the transfer of property ownership in Mount Vernon. This form helps municipalities track property transactions and ensure that all applicable taxes are collected during the transfer process. Understanding its requirements is essential for both buyers and sellers.

-

How do I fill out the Mount Vernon transfer tax form?

Filling out the Mount Vernon transfer tax form involves providing specific details about the property, the parties involved in the transaction, and the sale price. It's important to ensure that all information is accurate to avoid any delays in the transfer process. Utilizing airSlate SignNow simplifies this process with its easy-to-use eSigning features.

-

Where can I obtain the Mount Vernon transfer tax form?

You can obtain the Mount Vernon transfer tax form from the official Mount Vernon city website or through local government offices. Additionally, airSlate SignNow provides accessibility to various forms, including the Mount Vernon transfer tax form, making it easy to complete and submit online.

-

Is there a fee associated with the Mount Vernon transfer tax form?

Yes, there may be fees associated with the Mount Vernon transfer tax form, often determined by the sale price of the property being transferred. It's advisable to check with local authorities for the exact rates. airSlate SignNow can help you ensure all accompanying fees are calculated and paid accurately.

-

Can I electronically sign the Mount Vernon transfer tax form?

Absolutely! airSlate SignNow allows users to electronically sign the Mount Vernon transfer tax form, streamlining the document submission process. This feature enhances convenience as you can sign and send the form from anywhere, eliminating the need for printing and scanning.

-

What are the benefits of using airSlate SignNow for the Mount Vernon transfer tax form?

Using airSlate SignNow for the Mount Vernon transfer tax form offers several benefits, including time savings and ease of use. Users can fill out, sign, and store their forms securely online, simplifying the entire property transfer process. Additionally, it provides tracking options for enhanced document management.

-

Does airSlate SignNow integrate with other platforms for handling the Mount Vernon transfer tax form?

Yes, airSlate SignNow integrates with various platforms, allowing you to streamline the handling of the Mount Vernon transfer tax form across your existing workflows. These integrations facilitate seamless document sharing and signing directly from tools you already use, increasing efficiency.

Get more for mount vernon transfer tax form

- Form 8689 allocation of individual income tax to the us

- Form 8846 credit for employer social security and

- Fillable online 2008 form 990 schedule n liquidation

- Appsirsgov app picklistforms and publications pdf irs tax forms

- Boone county ky occupational tax jobs ecityworks form

- Revenuekygovforms62a300062a3000 4 20 original to ky department of revenue

- Revenuekygovforms62a500 wcommonwealth of kentucky tangible personal t property tax

- Pdf 4317 mail in driver license application missouri department of form

Find out other mount vernon transfer tax

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document