Form 8689, Allocation of Individual Income Tax to the U S 2021

What is the Form 8689, Allocation Of Individual Income Tax To The U S

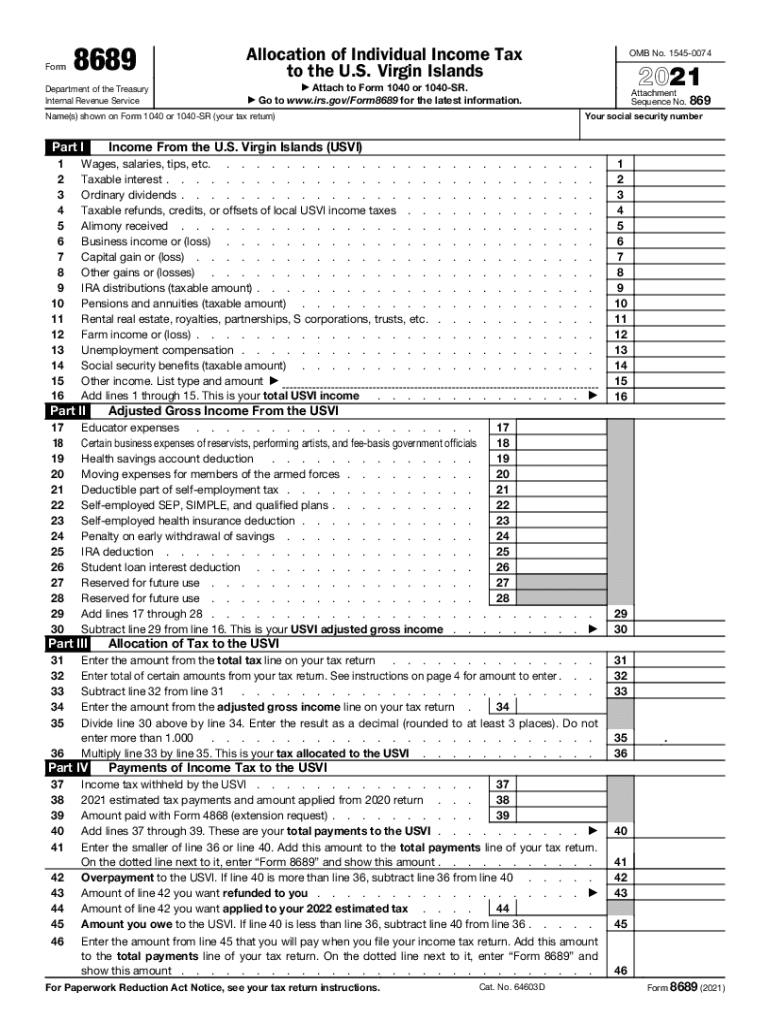

The Form 8689 is a tax document used by individuals to allocate their income tax liability between the United States and other jurisdictions. This form is particularly relevant for U.S. citizens or residents who earn income in multiple locations. It helps ensure that taxpayers pay the correct amount of tax to the appropriate authorities, thereby preventing double taxation on the same income. Understanding the purpose and function of Form 8689 is crucial for compliance with U.S. tax laws.

How to use the Form 8689, Allocation Of Individual Income Tax To The U S

Using Form 8689 involves several steps that must be followed carefully to ensure accurate tax allocation. First, gather all necessary income documents, including W-2s and 1099s, that reflect your earnings from different sources. Next, complete the form by entering your total income, followed by the allocation of that income to the appropriate jurisdictions. It is essential to provide accurate figures to avoid discrepancies that could lead to penalties. Once completed, the form should be submitted alongside your tax return.

Steps to complete the Form 8689, Allocation Of Individual Income Tax To The U S

Completing Form 8689 requires attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name and Social Security number.

- List all sources of income, ensuring to categorize them based on where they were earned.

- Calculate the total income for each jurisdiction and enter these figures in the designated sections.

- Determine the tax liability for each jurisdiction based on the allocated income.

- Review the completed form for accuracy before submission.

Key elements of the Form 8689, Allocation Of Individual Income Tax To The U S

Form 8689 consists of several key elements that are essential for proper completion. These include:

- Personal Information: This section requires your identifying details, such as name and Social Security number.

- Income Allocation: Here, you will categorize and report your income based on where it was earned.

- Tax Calculation: This part involves calculating the tax owed for each jurisdiction based on the allocated income.

- Signature: Your signature certifies that the information provided is accurate and complete.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8689. It is important to refer to the latest IRS publications and instructions to ensure compliance with current tax laws. The guidelines outline how to properly fill out the form, what documentation is required, and the filing deadlines. Adhering to these guidelines helps mitigate the risk of errors and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 8689 align with the standard tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you are filing for an extension, it is crucial to ensure that Form 8689 is submitted by the extended deadline. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Quick guide on how to complete form 8689 allocation of individual income tax to the us

Effortlessly Complete Form 8689, Allocation Of Individual Income Tax To The U S on Any Device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without interruptions. Handle Form 8689, Allocation Of Individual Income Tax To The U S on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Form 8689, Allocation Of Individual Income Tax To The U S with Ease

- Obtain Form 8689, Allocation Of Individual Income Tax To The U S and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize key sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 8689, Allocation Of Individual Income Tax To The U S and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8689 allocation of individual income tax to the us

Create this form in 5 minutes!

How to create an eSignature for the form 8689 allocation of individual income tax to the us

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the significance of the number 8689 in airSlate SignNow?

The number 8689 represents a unique identifier for our pricing plans, making it easy for potential customers to reference specific features and benefits. By understanding 8689, businesses can access tailored eSigning solutions that meet their needs, ensuring seamless document management.

-

How does airSlate SignNow pricing work with the 8689 plan?

The 8689 plan offers competitive pricing tailored for businesses of all sizes. It includes a variety of features designed to enhance the eSigning experience while keeping costs low. Prospective customers can explore flexible options to find a plan that fits their budget.

-

What features are included in the airSlate SignNow 8689 package?

The 8689 package includes robust features such as customizable templates, advanced security options, and real-time tracking. These elements empower businesses to streamline their document signing processes efficiently. Customers can leverage these features to boost productivity in their operations.

-

What benefits does the airSlate SignNow 8689 plan offer to businesses?

Choosing the 8689 plan enables businesses to enhance workflow efficiency while reducing turnaround time for document signing. This plan fosters collaboration and improves client relationships by making the eSigning process quick and user-friendly. Additionally, companies can expect improved compliance and secure transactions.

-

Can I integrate airSlate SignNow with existing software using the 8689 plan?

Yes, the 8689 plan allows for integrations with popular CRM and productivity tools, which enhances functionality. This flexibility enables businesses to work within their preferred software ecosystems without disruptions. Custom integrations can help streamline workflows further.

-

Is there a free trial available for the airSlate SignNow 8689 service?

Absolutely! We offer a free trial for the 8689 service, allowing prospective customers to explore our features before committing. During this trial period, users can experience the ease of eSigning and document management without any obligations. Sign up today to see how 8689 can improve your workflow.

-

Are there any limitations to the airSlate SignNow 8689 plan?

While the 8689 plan provides extensive features, some limitations may apply based on user tier, such as the number of users and document sends per month. Businesses should review the plan details to ensure it aligns with their expected usage. This transparency helps clients choose the best plan for their needs.

Get more for Form 8689, Allocation Of Individual Income Tax To The U S

- Quitclaim deed from corporation to two individuals connecticut form

- Warranty deed from corporation to two individuals connecticut form

- Connecticut trust 497300956 form

- Warranty deed from husband and wife to a trust connecticut form

- Ct revocable trust form

- Warranty deed from husband to himself and wife connecticut form

- Connecticut husband wife form

- Quitclaim deed from husband and wife to husband and wife connecticut form

Find out other Form 8689, Allocation Of Individual Income Tax To The U S

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation