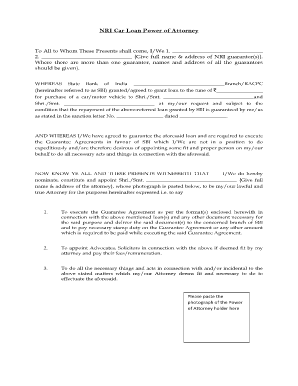

Power of Attorney for Car Loan Form

What is the power of attorney for car loan

The special power of attorney for car loan is a legal document that authorizes one person to act on behalf of another in financial matters related to a car loan. This document is particularly useful when the principal (the person granting the authority) cannot be present to sign documents or make decisions regarding the car loan process. It allows the agent (the person receiving the authority) to handle tasks such as signing loan agreements, negotiating terms, and managing payments. This document must clearly outline the scope of authority granted to ensure that the agent acts within the defined limits.

Key elements of the power of attorney for car loan

Several key elements must be included in a special power of attorney for car loan to ensure its validity and effectiveness:

- Principal's Information: The full name and address of the person granting the authority.

- Agent's Information: The full name and address of the person receiving the authority.

- Scope of Authority: A detailed description of the powers granted, specifically related to the car loan.

- Effective Date: The date when the power of attorney becomes effective, which can be immediate or upon a specified event.

- Signatures: The principal's signature, and in some cases, the agent's signature, along with a witness or notary acknowledgment.

Steps to complete the power of attorney for car loan

Completing a special power of attorney for car loan involves several important steps:

- Identify the Need: Determine if a power of attorney is necessary for the car loan process.

- Gather Information: Collect the required details about the principal and agent, including names and addresses.

- Draft the Document: Use a template or legal service to create the document, ensuring all key elements are included.

- Review the Document: Carefully check the document for accuracy and completeness.

- Sign the Document: The principal must sign the document in the presence of a notary or witness, depending on state requirements.

- Distribute Copies: Provide copies of the signed document to the agent and any relevant financial institutions.

How to use the power of attorney for car loan

Once the special power of attorney for car loan is executed, the agent can begin to act on behalf of the principal. This includes tasks such as:

- Signing Loan Documents: The agent can sign all necessary paperwork related to the car loan.

- Negotiating Terms: The agent may negotiate the terms of the loan with the lender.

- Making Payments: The agent can manage payments and any related financial transactions.

It is important for the agent to keep the principal informed of all actions taken on their behalf and to operate within the authority granted by the power of attorney.

Legal use of the power of attorney for car loan

The legal use of a special power of attorney for car loan is governed by state laws, which can vary significantly. It is essential to ensure that the document complies with local regulations to be considered valid. This includes adhering to specific signing requirements, such as the presence of a notary or witnesses. Additionally, the agent must act in the best interest of the principal and within the scope of authority granted. Failure to comply with these legal standards can result in the document being deemed invalid, which may complicate the car loan process.

State-specific rules for the power of attorney for car loan

Each state in the U.S. has its own regulations regarding the creation and use of a special power of attorney for car loan. Some states may require specific language or additional clauses to be included in the document. It is advisable to consult state statutes or a legal professional to ensure compliance with local laws. Additionally, some states may have different requirements for notarization or witnessing, which can affect the validity of the document. Understanding these state-specific rules is crucial for ensuring that the power of attorney is legally enforceable.

Quick guide on how to complete power of attorney for car loan

Complete Power Of Attorney For Car Loan seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly without any holdups. Manage Power Of Attorney For Car Loan on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Power Of Attorney For Car Loan with ease

- Locate Power Of Attorney For Car Loan and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for submitting your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Power Of Attorney For Car Loan to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the power of attorney for car loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a special power of attorney for car loan?

A special power of attorney for car loan is a legal document that allows one person to act on behalf of another in managing car loan matters. This can include signing loan documents, making payments, or negotiating terms. It's important for those who may be unable to attend to their car loan affairs personally.

-

How does airSlate SignNow streamline the special power of attorney for car loan process?

airSlate SignNow offers a user-friendly platform that simplifies the creation, signing, and management of your special power of attorney for car loan documents. With features like templates and eSignature capabilities, users can efficiently handle all necessary paperwork without the hassle of traditional methods. This saves time and reduces the complexity involved in the process.

-

What are the benefits of using airSlate SignNow for my special power of attorney for car loan?

Using airSlate SignNow for your special power of attorney for car loan brings several benefits including cost-effectiveness, security, and accessibility. With cloud-based storage, you can access and manage your documents from anywhere, ensuring that all parties can quickly engage in the process. Additionally, the platform enhances collaboration by allowing multiple users to access the document simultaneously.

-

Is there a cost associated with creating a special power of attorney for car loan using airSlate SignNow?

Yes, while airSlate SignNow is cost-effective, there are fees associated with its usage. Pricing may vary based on the features you choose and the volume of documents you need to handle. It's recommended to review our pricing plans to find the best fit for your needs regarding the special power of attorney for car loan.

-

Can I integrate airSlate SignNow with other software for my special power of attorney for car loan?

Absolutely! airSlate SignNow offers seamless integrations with various popular business tools and software. This functionality allows users to automate their workflows and manage their special power of attorney for car loan alongside other essential applications, enhancing overall productivity.

-

What features should I look for in a special power of attorney for car loan document?

When creating a special power of attorney for car loan, look for features such as customizable templates, eSignature capability, and secure storage options. These features ensure that your document is legally valid, easily sharable, and safely stored to prevent unauthorized access or alterations.

-

How long does it take to complete a special power of attorney for car loan using airSlate SignNow?

The time it takes to complete a special power of attorney for car loan using airSlate SignNow can vary depending on your familiarity with the platform and the complexity of your document. However, the streamlined process typically allows users to create, eSign, and finalize documents in just a few minutes, signNowly reducing processing time.

Get more for Power Of Attorney For Car Loan

Find out other Power Of Attorney For Car Loan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors