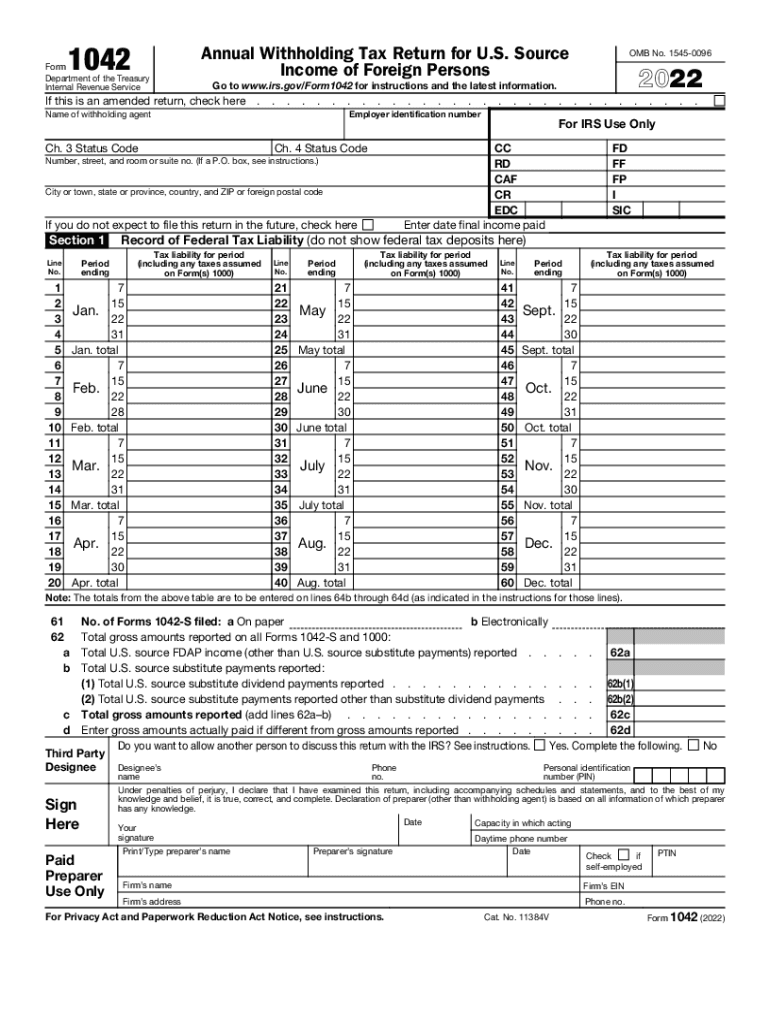

Form 1042, Annual Withholding Tax Return for U S Source 2022

What is the Form 1042, Annual Withholding Tax Return For U.S. Source

The Form 1042 is a crucial document used by foreign persons and entities to report and pay withholding tax on income received from U.S. sources. This form is specifically designed for non-resident aliens and foreign corporations that earn income in the United States, such as interest, dividends, royalties, and certain other types of income. The form helps the Internal Revenue Service (IRS) track and ensure compliance with U.S. tax laws regarding foreign entities. It is essential for those who have tax obligations in the U.S. to understand the purpose and requirements of this form to avoid potential penalties.

Steps to Complete the Form 1042, Annual Withholding Tax Return For U.S. Source

Completing the Form 1042 involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documentation related to the income earned and the recipients. This includes identifying the type of income and the appropriate withholding rates. Next, fill out the form by providing detailed information such as the name and address of the withholding agent, the amount of income paid, and the total tax withheld. It is important to review all entries for accuracy before submission. Finally, submit the completed form to the IRS by the specified deadline, along with any required payment for the withheld taxes.

Legal Use of the Form 1042, Annual Withholding Tax Return For U.S. Source

The legal use of Form 1042 is governed by U.S. tax laws, which mandate that foreign entities must report and remit withholding taxes on U.S. source income. By filing this form, withholding agents fulfill their legal obligations to the IRS, ensuring that taxes are collected on behalf of foreign recipients. It is important to note that failure to file the Form 1042 or inaccuracies in reporting can lead to significant penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for compliance and to maintain good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 are critical to avoid penalties. Generally, the form must be filed annually by March 15 of the year following the tax year in which the income was paid. If this date falls on a weekend or holiday, the due date is extended to the next business day. Additionally, any tax payments associated with the form are typically due at the same time. It is advisable to keep track of these important dates to ensure timely compliance and avoid unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The Form 1042 can be submitted to the IRS through various methods. While electronic filing is encouraged for efficiency and accuracy, paper submissions are still accepted. For electronic filing, taxpayers can use IRS-approved software or services that facilitate the submission process. If opting for a paper submission, the completed form should be mailed to the appropriate IRS address based on the taxpayer's location. In-person submissions are generally not available for this form, making it essential to choose the method that best suits your needs while ensuring compliance with submission guidelines.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 1042 can result in significant penalties. The IRS imposes fines for late filings, inaccuracies, and failure to pay the required withholding taxes. Penalties can range from a percentage of the unpaid tax to fixed amounts based on the length of delay in filing. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is crucial for withholding agents to understand these penalties and take proactive steps to ensure compliance with all filing requirements.

Quick guide on how to complete form 1042 annual withholding tax return for us source

Fulfill Form 1042, Annual Withholding Tax Return For U S Source effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute to conventional printed and signed files, allowing you to locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without hindrances. Handle Form 1042, Annual Withholding Tax Return For U S Source on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The simplest method to alter and eSign Form 1042, Annual Withholding Tax Return For U S Source with ease

- Find Form 1042, Annual Withholding Tax Return For U S Source and then click Retrieve Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign function, which takes seconds and carries the same legal weight as a conventional handwritten signature.

- Review all the details and then click on the Finished button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or missing documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1042, Annual Withholding Tax Return For U S Source and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1042 annual withholding tax return for us source

Create this form in 5 minutes!

How to create an eSignature for the form 1042 annual withholding tax return for us source

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2016 income tax calculator and how does it work?

A 2016 income tax calculator is a tool designed to help you estimate your tax liabilities for the 2016 tax year. By inputting your income and deductions, you can quickly generate an estimate of your tax refund or amount owed. This can simplify the filing process and help you budget accordingly.

-

Is the 2016 income tax calculator free to use?

Many online platforms offer a free 2016 income tax calculator, including airSlate SignNow's services. By utilizing our calculator, you can assess your tax situation without any hidden charges. It's a cost-effective way to ensure you're financially prepared for tax season.

-

What features should I look for in a 2016 income tax calculator?

When selecting a 2016 income tax calculator, look for features such as accuracy, ease of use, and the ability to handle various tax scenarios. Additionally, a good calculator should support multiple input methods and provide clear explanations of how calculations are made, ensuring transparency and trust.

-

How can using the 2016 income tax calculator benefit me?

Utilizing a 2016 income tax calculator can save you time and reduce stress during tax preparation. By providing an accurate estimate of taxes owed or refunds expected, you can make informed financial decisions. This also allows you to take advantage of tax strategies that may maximize your savings.

-

Can I use the 2016 income tax calculator for different filing statuses?

Yes, many 2016 income tax calculators, including ours, allow you to choose from various filing statuses such as single, married filing jointly, or head of household. This flexibility ensures that you receive the most accurate estimate based on your unique circumstances. Always check for specific options based on your needs.

-

Does the 2016 income tax calculator account for deductions and credits?

Absolutely! The 2016 income tax calculator takes into account various deductions and credits available for that tax year. By inputting relevant information, you can see how different deductions can affect your overall tax liability, ensuring you maximize your tax benefits.

-

Are there integrations available with the 2016 income tax calculator?

Yes, our 2016 income tax calculator can integrate with various accounting software and platforms to streamline your tax preparation process. This ensures that your financial data is up-to-date and accurately reflected in your calculations. Look for integrations that best fit your accounting needs.

Get more for Form 1042, Annual Withholding Tax Return For U S Source

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497313845 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497313846 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497313847 form

- Mississippi letter in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497313849 form

- Letter landlord tenant notice template form

- Mississippi about law form

- Mississippi landlord notice form

Find out other Form 1042, Annual Withholding Tax Return For U S Source

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter