Nj 1040v Form

What is the Nj 1040v Form

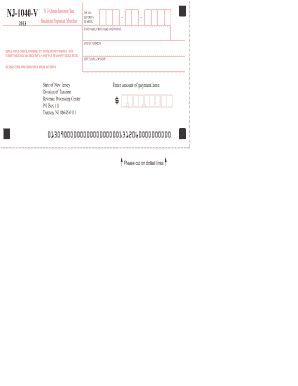

The Nj 1040v Form is a payment voucher used by residents of New Jersey when filing their state income tax returns. This form is essential for ensuring that any tax payments due are processed correctly and efficiently. It serves as a cover sheet for payments made with the New Jersey 1040 tax return, allowing taxpayers to submit their payments alongside their return in a streamlined manner. Properly completing the Nj 1040v Form helps to avoid delays in processing and ensures compliance with state tax regulations.

How to use the Nj 1040v Form

Using the Nj 1040v Form involves a few straightforward steps. First, ensure you have completed your New Jersey 1040 tax return. Next, fill out the Nj 1040v Form with your personal information, including your name, address, and Social Security number. Indicate the amount you are paying and include any necessary payment method details. Once completed, attach the Nj 1040v Form to your tax return and submit both documents together, either through the mail or electronically, depending on your filing method.

Steps to complete the Nj 1040v Form

Completing the Nj 1040v Form requires careful attention to detail. Follow these steps:

- Gather your New Jersey 1040 tax return and any relevant financial documents.

- Enter your name, address, and Social Security number in the designated fields.

- Specify the payment amount you are submitting.

- Choose your payment method, whether by check or electronic payment.

- Review the form for accuracy before submission.

Legal use of the Nj 1040v Form

The Nj 1040v Form is legally binding when completed correctly and submitted according to New Jersey state tax laws. It is important to ensure that all information provided is accurate and truthful to avoid potential penalties. The form must be submitted by the tax filing deadline to comply with state regulations. Failure to do so may result in interest charges or other penalties imposed by the New Jersey Division of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Nj 1040v Form align with the New Jersey state income tax return deadlines. Typically, the deadline for filing your state tax return and submitting the Nj 1040v Form is April fifteenth. However, taxpayers should verify specific dates each tax year, as they may vary due to weekends or holidays. Timely submission is crucial to avoid late fees and ensure compliance with state tax obligations.

Form Submission Methods

The Nj 1040v Form can be submitted through various methods. Taxpayers may choose to file their forms electronically via approved online platforms or submit a paper version through the mail. If filing by mail, it is important to send the form to the correct address as specified by the New Jersey Division of Taxation. Electronic submission is often faster and may provide immediate confirmation of receipt, while paper submissions may take longer to process.

Quick guide on how to complete nj 1040v form

Complete Nj 1040v Form with ease on any device

Digital document management has become widely accepted by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Handle Nj 1040v Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nj 1040v Form effortlessly

- Locate Nj 1040v Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your updates.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nj 1040v Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1040v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nj 1040v Form and why is it important?

The Nj 1040v Form is a payment voucher that residents of New Jersey use when submitting their state income tax. This form ensures that your tax payment is correctly applied to your account, helping to avoid penalties or interest on late payments. Using the Nj 1040v Form accurately can streamline your filing process and ensure compliance with state tax laws.

-

How can airSlate SignNow help with the Nj 1040v Form?

airSlate SignNow allows you to easily eSign and send the Nj 1040v Form securely, ensuring that your tax documents are processed efficiently. With its intuitive interface, you can fill out, sign, and send the form directly from your device. This eliminates the hassle of printing and mailing, saving you time and reducing the chances of delays.

-

Are there any costs associated with using airSlate SignNow for the Nj 1040v Form?

Yes, airSlate SignNow offers various pricing plans that cater to both individuals and businesses needing to process documents like the Nj 1040v Form. The cost is based on the features you choose, but the platform remains cost-effective for its robust functionalities. You can even start with a free trial to see how it meets your needs for eSigning tax forms.

-

What features does airSlate SignNow provide for the Nj 1040v Form?

With airSlate SignNow, users can access features such as electronic signatures, document templates, and real-time status tracking. These features enhance your ability to complete the Nj 1040v Form efficiently and ensure that all necessary parties can sign without physical meetings. Additionally, the platform offers secure storage for easy retrieval and reference.

-

Can I integrate airSlate SignNow with other tools for processing the Nj 1040v Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more, allowing for streamlined workflows when processing the Nj 1040v Form. This integration means you can manage your documents and signatures in one central location, improving productivity and reducing the risk of errors.

-

Is airSlate SignNow compliant with New Jersey tax regulations for the Nj 1040v Form?

Yes, airSlate SignNow is committed to compliance with all relevant regulations, including those applicable to the Nj 1040v Form. The platform uses secure encryption measures to protect sensitive data and ensures that all signed documents meet legal standards for electronic signatures. This helps you feel confident when submitting your tax payments.

-

What are the benefits of using airSlate SignNow for eSigning the Nj 1040v Form?

Using airSlate SignNow for the Nj 1040v Form offers numerous benefits, including speed, security, and convenience. You can complete the signing process from anywhere, reducing turnaround time signNowly. Moreover, the platform provides a full audit trail, ensuring transparency and accountability for your tax submissions.

Get more for Nj 1040v Form

Find out other Nj 1040v Form

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template