New Jersey State Tax Filing 2022

What is the New Jersey State Tax Filing

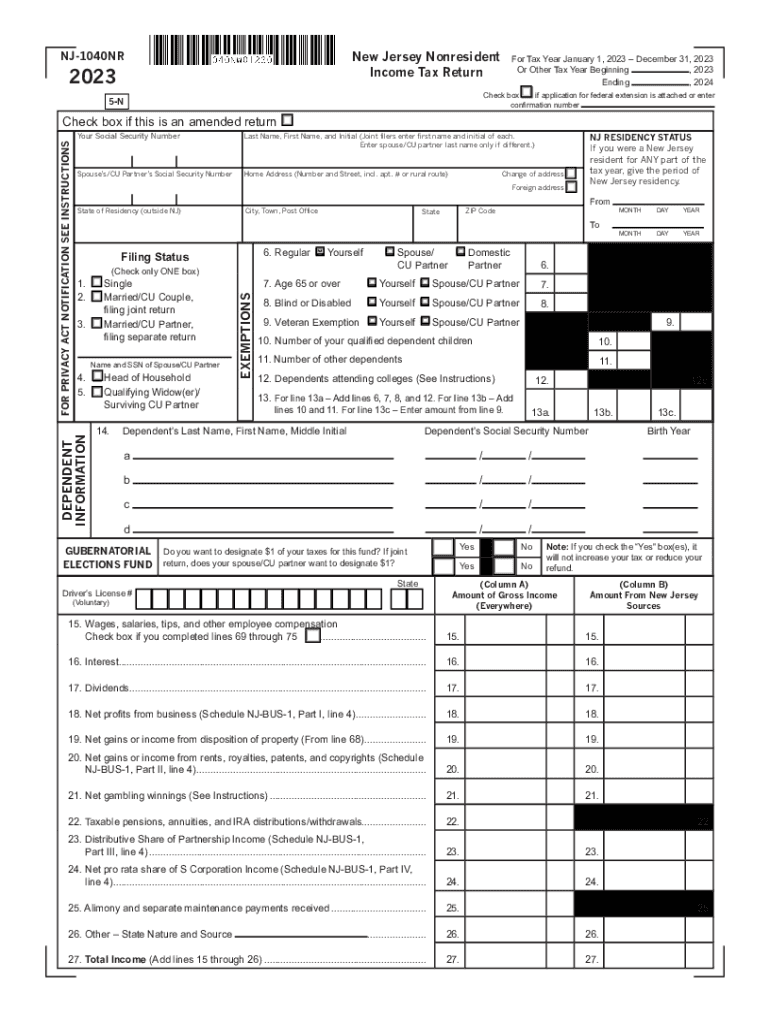

The New Jersey State Tax Filing is a crucial process for individuals and businesses in New Jersey to report their income and calculate their tax obligations to the state. It encompasses various forms that taxpayers must complete, depending on their specific circumstances, such as personal income, business income, or property tax. The state tax filing ensures compliance with New Jersey tax laws and helps fund essential public services.

Steps to complete the New Jersey State Tax Filing

Completing the New Jersey State Tax Filing involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which affects your tax rates and deductions.

- Choose the appropriate tax form, such as the NJ-1040 for individuals or the NJ-1065 for partnerships.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review your completed form for errors or omissions before submission.

- Submit your tax return by the deadline, either electronically or via mail.

Required Documents

To successfully file your New Jersey State Tax Filing, you will need several important documents:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Proof of deductions, including receipts for charitable donations and medical expenses.

- Any relevant tax credits documentation, such as for property taxes or education expenses.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the New Jersey State Tax Filing to avoid penalties:

- The standard deadline for individual tax returns is April 15 each year.

- If you need an extension, you must file for it by the original deadline.

- Estimated tax payments for the current year are typically due quarterly, with specific dates in April, June, September, and January of the following year.

Form Submission Methods

Taxpayers in New Jersey have several options for submitting their state tax filings:

- Online submission through the New Jersey Division of Taxation website, which offers a streamlined and efficient process.

- Mailing a paper form to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, which may be beneficial for those needing assistance.

Penalties for Non-Compliance

Failing to comply with New Jersey tax filing requirements can lead to significant penalties:

- Failure to file on time may incur late fees and interest on unpaid taxes.

- Underreporting income can result in additional assessments and penalties.

- Persistent non-compliance may lead to legal action or liens against property.

Quick guide on how to complete new jersey state tax filing

Complete New Jersey State Tax Filing effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle New Jersey State Tax Filing on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related task today.

The simplest way to edit and eSign New Jersey State Tax Filing with ease

- Locate New Jersey State Tax Filing and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign New Jersey State Tax Filing and ensure smooth communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey state tax filing

Create this form in 5 minutes!

How to create an eSignature for the new jersey state tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New Jersey State Tax Filing?

New Jersey State Tax Filing refers to the process of submitting tax returns to the state of New Jersey to report income, deductions, and credits. Utilizing reliable platforms can simplify this process, ensuring you comply with state regulations and deadlines. It is essential to stay updated on tax laws to optimize your filing experience.

-

How does airSlate SignNow simplify New Jersey State Tax Filing?

airSlate SignNow streamlines New Jersey State Tax Filing by offering an easy-to-use platform for sending and eSigning tax documents. With its efficient features, you can manage your documentation securely and ensure timely submission. This solution helps reduce paperwork and automates the filing process for maximum convenience.

-

What are the pricing options for airSlate SignNow for New Jersey State Tax Filing?

airSlate SignNow offers various pricing options tailored to different business needs for New Jersey State Tax Filing. Plans may include options for individual users or teams, providing features such as document templates and integrations. You can choose a plan that best fits your filing volumes and complexity.

-

Can I integrate airSlate SignNow with other tax preparation software for New Jersey State Tax Filing?

Yes, airSlate SignNow can integrate seamlessly with various tax preparation software to enhance your New Jersey State Tax Filing process. This integration allows for automatic document transfer and streamlined workflows, helping you save time and minimize errors. Compatible tools can make tax filing faster and more efficient.

-

What features does airSlate SignNow offer for New Jersey State Tax Filing?

airSlate SignNow provides a range of features specifically designed for New Jersey State Tax Filing, including customizable templates, secure eSigning, and tracking capabilities. These features promote efficient document management and ensure all your filing requirements are met. Plus, the platform’s user-friendly interface makes it accessible for everyone.

-

Are electronic signatures valid for New Jersey State Tax Filing?

Yes, electronic signatures are valid for New Jersey State Tax Filing, provided they meet certain legal standards. airSlate SignNow complies with these regulations, ensuring that your signed documents hold up in any legal context. Using eSignatures can expedite your filing and enhance record-keeping.

-

What benefits does airSlate SignNow provide for businesses filing New Jersey State taxes?

By using airSlate SignNow for New Jersey State Tax Filing, businesses can expect benefits such as reduced paperwork, improved accuracy, and enhanced collaboration. The platform helps eliminate traditional bottlenecks in the filing process, allowing for quicker turnaround times. This results in a more efficient tax filing season overall.

Get more for New Jersey State Tax Filing

- F3712 cfd pdf medical certificate for motor vehicle form

- Vehiclequeensland regulated ship cancellation of registration application form

- Apply for school transport assistance queensland government form

- Application for a new drivers licence number e126 form

- Power of attorney da form 5841 jul

- Guide 0174application guide for inland refugee claims form

- Employment application please print name form

- Ised isde 3591e changes regarding directors form 6 changes regarding directors

Find out other New Jersey State Tax Filing

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free