County Local Option Transient Rental Tax Rates Tourist 2022

What is the County Local Option Transient Rental Tax Rates Tourist

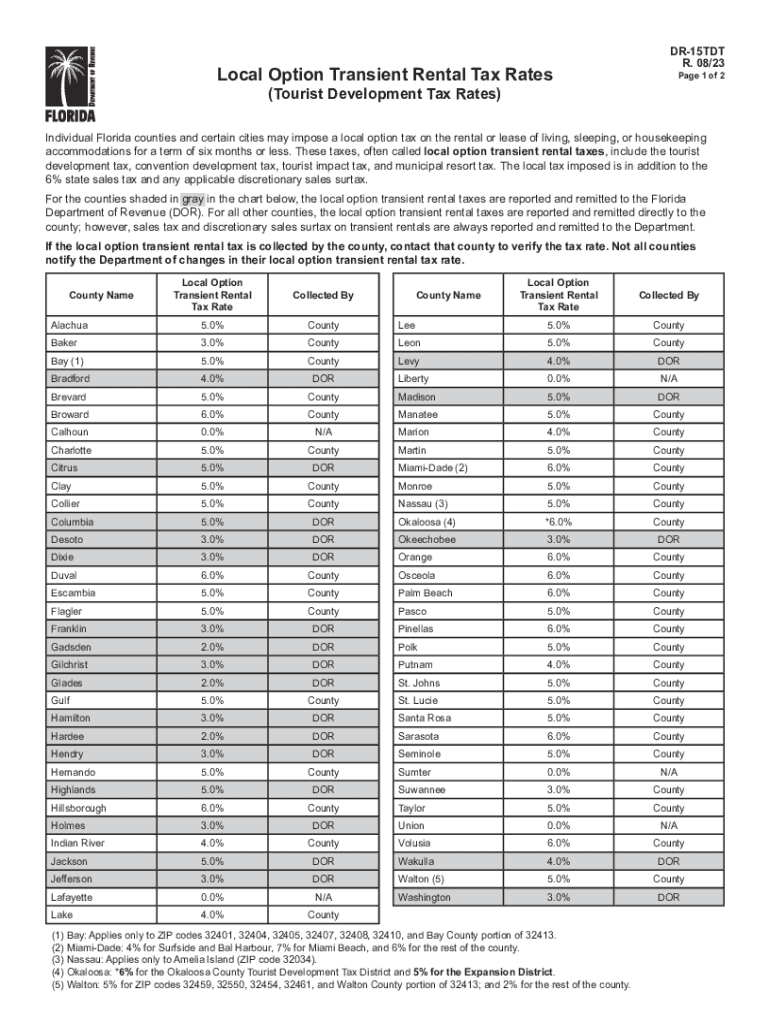

The County Local Option Transient Rental Tax Rates Tourist refers to a tax levied by local governments on short-term rentals, such as vacation homes and rental properties. This tax is typically applied to the rental fee charged to guests and is designed to generate revenue for local services and tourism-related initiatives. The rates can vary significantly by county, reflecting local policies and economic conditions. Understanding these rates is essential for property owners who wish to comply with local tax regulations while maximizing their rental income.

How to obtain the County Local Option Transient Rental Tax Rates Tourist

To obtain the County Local Option Transient Rental Tax Rates Tourist, property owners should contact their local tax authority or visit the official county website. Most counties provide detailed information regarding their transient rental tax rates, including current rates, applicable exemptions, and payment procedures. It is advisable to review any local ordinances or guidelines that may affect the rental business. Additionally, some counties may offer informational sessions or resources to assist property owners in understanding their tax obligations.

Key elements of the County Local Option Transient Rental Tax Rates Tourist

Key elements of the County Local Option Transient Rental Tax Rates Tourist include the tax rate percentage, the duration of the rental, and any applicable exemptions or deductions. Property owners must be aware of the specific rate set by their county, which can range from one to ten percent or more. Other important factors may include the definition of a transient rental, the method of tax collection, and deadlines for remitting payments. Understanding these elements helps ensure compliance and avoids potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the County Local Option Transient Rental Tax Rates Tourist can vary by county and are typically established by local tax authorities. Property owners should be aware of the specific due dates for tax payments, which may be monthly, quarterly, or annually. Missing these deadlines can result in penalties or interest charges. It is essential to maintain accurate records of rental activity and tax payments to ensure timely filing and compliance with local regulations.

Penalties for Non-Compliance

Penalties for non-compliance with the County Local Option Transient Rental Tax Rates Tourist can be significant. Property owners who fail to file their tax returns or remit payments on time may face fines, interest on unpaid taxes, and even legal action. Additionally, local authorities may impose stricter regulations on properties that do not comply with tax requirements. Understanding the potential consequences of non-compliance emphasizes the importance of adhering to local tax laws and maintaining accurate records.

Eligibility Criteria

Eligibility criteria for the County Local Option Transient Rental Tax Rates Tourist generally include the classification of the property as a transient rental, which typically involves renting out a dwelling for less than thirty consecutive days. Property owners must also ensure they are registered with the appropriate local authorities and comply with any zoning or licensing requirements. Meeting these criteria is essential for determining tax obligations and avoiding penalties.

Quick guide on how to complete county local option transient rental tax rates tourist

Complete County Local Option Transient Rental Tax Rates Tourist effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle County Local Option Transient Rental Tax Rates Tourist on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign County Local Option Transient Rental Tax Rates Tourist with ease

- Locate County Local Option Transient Rental Tax Rates Tourist and click on Get Form to initiate.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, SMS, or via an invitation link, or download it to your computer.

No more concerns about missing or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign County Local Option Transient Rental Tax Rates Tourist and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct county local option transient rental tax rates tourist

Create this form in 5 minutes!

How to create an eSignature for the county local option transient rental tax rates tourist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are County Local Option Transient Rental Tax Rates Tourist?

County Local Option Transient Rental Tax Rates Tourist are specific tax rates imposed by local counties on short-term rentals, such as vacation homes and Airbnb listings. These rates can vary signNowly depending on the county, and understanding them is essential for compliance and effective pricing strategies for rental property owners.

-

How can airSlate SignNow help me manage County Local Option Transient Rental Tax Rates Tourist?

airSlate SignNow provides a streamlined approach to managing documentation related to County Local Option Transient Rental Tax Rates Tourist. You can easily create, send, and eSign rental agreements and tax forms, making it simpler to stay compliant with county regulations and track necessary payments.

-

Are there any features in airSlate SignNow that cater specifically to rental property owners?

Yes! airSlate SignNow offers features like customizable templates and automated workflows that signNowly ease the management of County Local Option Transient Rental Tax Rates Tourist documentation. This functionality ensures you can handle your rental agreements and tax forms efficiently without unnecessary delays.

-

What integrations does airSlate SignNow offer to assist with rental tax management?

airSlate SignNow integrates seamlessly with various accounting and management tools that can help you track County Local Option Transient Rental Tax Rates Tourist. These integrations enable you to sync data across platforms, ensuring accurate records and simplifying the tax filing process.

-

Is airSlate SignNow a cost-effective solution for short-term rental businesses?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses, including those managing short-term rentals. With its user-friendly interface and affordable pricing plans, you can efficiently handle your documentation needs related to County Local Option Transient Rental Tax Rates Tourist without breaking the bank.

-

How does airSlate SignNow ensure security for my rental documents?

Security is paramount at airSlate SignNow. The platform employs robust encryption methods and strict access controls to safeguard your documents related to County Local Option Transient Rental Tax Rates Tourist, ensuring that sensitive information remains protected throughout the signing process.

-

Can I use airSlate SignNow for international rentals as well?

While airSlate SignNow is primarily focused on U.S. markets and County Local Option Transient Rental Tax Rates Tourist, its versatile platform can be adapted for use in international rentals. You can create custom agreements that meet both local and international regulations, though consideration for varying tax laws will be essential.

Get more for County Local Option Transient Rental Tax Rates Tourist

- Marching band order form auxiliary copy lhbands

- Form u 1a manufacturers data report for pressure vessels

- American legion riders application illegion form

- Snapchat law enforcement guide last updated octob form

- Himrcm screening within health program participat form

- Exchange student applicationstudy abroad form

- Heavy comsports entertainment breaking news ampamp shopping form

- Application for certified accounting technician cat status form

Find out other County Local Option Transient Rental Tax Rates Tourist

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors