13545 CT CT 1065 and CT 1120SI E File Mandate 2021

What is the 13545 CT CT 1065 And CT 1120SI E File Mandate

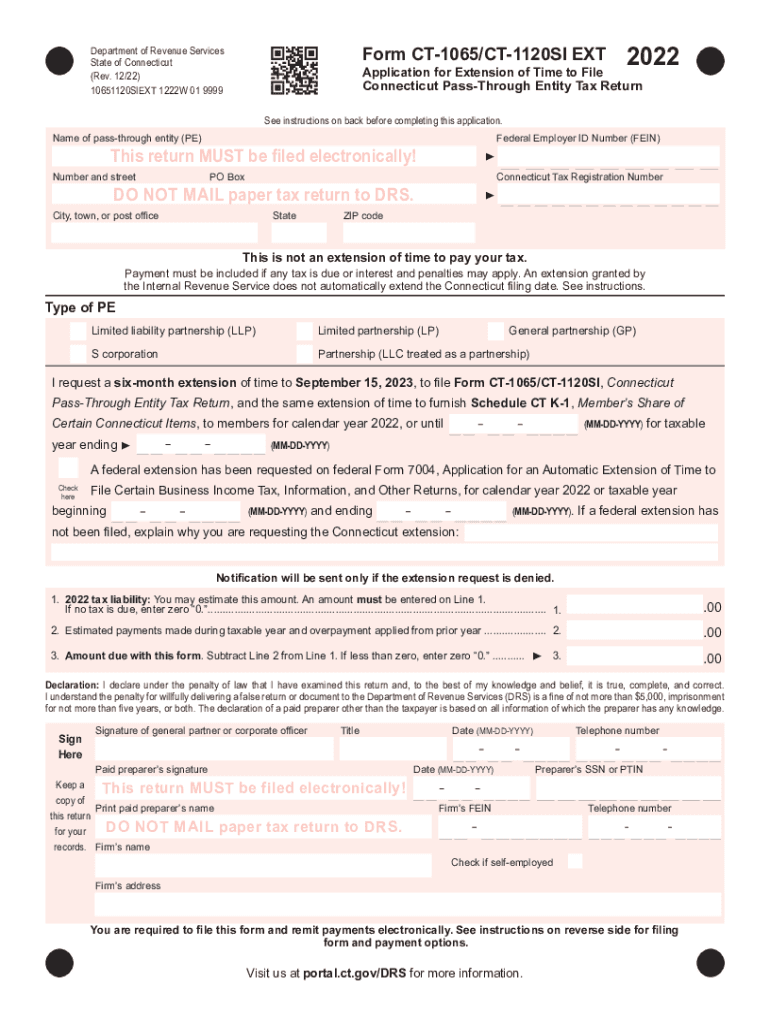

The 13545 CT CT 1065 and CT 1120SI E File Mandate is a regulatory requirement for certain business entities in Connecticut to electronically file their tax returns. This mandate specifically applies to partnerships and S corporations, ensuring they submit their tax documents in a digital format. The initiative aims to streamline the filing process, reduce paper usage, and enhance the efficiency of tax administration within the state.

How to use the 13545 CT CT 1065 And CT 1120SI E File Mandate

Utilizing the 13545 CT CT 1065 and CT 1120SI E File Mandate involves several steps. First, businesses must ensure they are eligible to file electronically. This typically includes partnerships and S corporations operating within Connecticut. Next, they should gather all necessary financial documents and information required for the CT 1065 or CT 1120SI forms. Finally, businesses can use approved e-filing software to complete and submit their forms electronically, following the guidelines set forth by the Connecticut Department of Revenue Services.

Steps to complete the 13545 CT CT 1065 And CT 1120SI E File Mandate

Completing the 13545 CT CT 1065 and CT 1120SI E File Mandate involves a systematic approach:

- Gather Documentation: Collect all financial records, including income statements and expense reports.

- Choose E-Filing Software: Select an IRS-approved e-filing software that supports the CT 1065 and CT 1120SI forms.

- Complete the Forms: Fill out the necessary information accurately, ensuring compliance with Connecticut tax laws.

- Review and Submit: Double-check all entries for accuracy before submitting the forms electronically.

- Retain Confirmation: Save the confirmation of submission for your records, as it serves as proof of filing.

Legal use of the 13545 CT CT 1065 And CT 1120SI E File Mandate

The legal use of the 13545 CT CT 1065 and CT 1120SI E File Mandate is crucial for compliance with Connecticut tax laws. Businesses that fall under the mandate must adhere to the e-filing requirement to avoid penalties. Non-compliance can lead to fines and other legal repercussions. It is essential for entities to understand their obligations under this mandate and ensure they are using the forms correctly to maintain good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the 13545 CT CT 1065 and CT 1120SI E File Mandate are typically aligned with federal tax deadlines. Generally, partnerships and S corporations must file their returns by the fifteenth day of the third month following the end of their tax year. For most entities operating on a calendar year, this means a deadline of March fifteenth. It is important to stay informed about any changes to these dates that may arise due to state regulations or federal updates.

Required Documents

To successfully complete the 13545 CT CT 1065 and CT 1120SI E File Mandate, businesses need to prepare several key documents:

- Financial Statements: Income statements and balance sheets for the tax year.

- Partnership Agreements: Documentation outlining the terms of the partnership.

- Tax Identification Numbers: Employer Identification Numbers (EINs) for all partners and the business entity.

- Prior Year Returns: Copies of previous tax returns for reference and consistency.

Quick guide on how to complete 13545 ct ct 1065 and ct 1120si e file mandate

Effortlessly Prepare 13545 CT CT 1065 And CT 1120SI E File Mandate on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without hassle. Handle 13545 CT CT 1065 And CT 1120SI E File Mandate on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign 13545 CT CT 1065 And CT 1120SI E File Mandate Effortlessly

- Obtain 13545 CT CT 1065 And CT 1120SI E File Mandate and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important parts of your papers or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 13545 CT CT 1065 And CT 1120SI E File Mandate and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 13545 ct ct 1065 and ct 1120si e file mandate

Create this form in 5 minutes!

How to create an eSignature for the 13545 ct ct 1065 and ct 1120si e file mandate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 13545 CT CT 1065 And CT 1120SI E File Mandate?

The 13545 CT CT 1065 And CT 1120SI E File Mandate outlines regulations for electronically filing specific tax forms in Connecticut. This mandate aims to streamline the tax filing process for businesses, making it more efficient and user-friendly. By adhering to this mandate, businesses can ensure compliance with state regulations while enjoying the benefits of electronic filing.

-

How does airSlate SignNow support the 13545 CT CT 1065 And CT 1120SI E File Mandate?

airSlate SignNow facilitates compliance with the 13545 CT CT 1065 And CT 1120SI E File Mandate by providing an intuitive platform for eSigning and sending necessary documents. Our solution simplifies the process of preparing and transmitting tax forms, ensuring they meet state requirements. With airSlate SignNow, you can confidently manage your e-filing needs.

-

What features does airSlate SignNow offer for the 13545 CT CT 1065 And CT 1120SI E File Mandate?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and easy document management to help users comply with the 13545 CT CT 1065 And CT 1120SI E File Mandate. These tools simplify your workflow, allowing you to prepare and submit tax forms efficiently. Additionally, our platform offers real-time tracking for document statuses.

-

Is airSlate SignNow a cost-effective solution for businesses managing the 13545 CT CT 1065 And CT 1120SI E File Mandate?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses dealing with the 13545 CT CT 1065 And CT 1120SI E File Mandate. We offer flexible pricing plans to cater to various business needs, ensuring accessibility without compromising on quality. By using our platform, you can save time and reduce costs associated with traditional document processing.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing under the 13545 CT CT 1065 And CT 1120SI E File Mandate offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. The user-friendly interface makes it easier to prepare and file documents, while the secure eSignature feature ensures the integrity of your submissions. This allows businesses to focus more on growth and less on administrative tasks.

-

Can airSlate SignNow integrate with other software for the 13545 CT CT 1065 And CT 1120SI E File Mandate?

airSlate SignNow provides integrations with various applications, helping businesses streamline their processes related to the 13545 CT CT 1065 And CT 1120SI E File Mandate. Whether you're using accounting software or document management systems, our platform can seamlessly connect to enhance your workflow. This ensures that all relevant data is easily accessible when preparing your tax forms.

-

How do I get started with airSlate SignNow for e-filing under the 13545 CT CT 1065 And CT 1120SI E File Mandate?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account on our website, explore our features tailored for the 13545 CT CT 1065 And CT 1120SI E File Mandate, and begin uploading your documents. Our user-friendly interface guides you through the eSigning and submission process, ensuring compliance and efficiency.

Get more for 13545 CT CT 1065 And CT 1120SI E File Mandate

- Cook county assessors officevacancyoccupancy af form

- Community garage sale registration form saturday may 7 romeoville

- Return to school form sfhscollegeprep

- Homeless questionnaire form auburn school district 10

- R poh permit application and form

- Www osfhealthcarefoundation orgwp contentlittle company of mary hospital nursing alumni monetary form

- Premise alert information program woodstockilgov

- Membership ampamp village of carol stream dog license form

Find out other 13545 CT CT 1065 And CT 1120SI E File Mandate

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF