Insurance Premium Tax Surplus LinesPurchasing Groups 2022

Understanding Insurance Premium Tax for Surplus Lines Purchasing Groups

The Insurance Premium Tax for Surplus Lines Purchasing Groups is a specific tax applied to insurance premiums collected by surplus lines insurers. Surplus lines insurers provide coverage for risks that standard insurers may not cover. This tax is typically imposed at the state level, meaning that the rates and regulations can vary significantly across different states in the U.S.

Purchasing groups, which are associations of individuals or businesses that come together to obtain insurance, may benefit from this tax structure. By pooling their resources, these groups can often secure better rates and coverage options. It is essential for members of purchasing groups to understand how this tax affects their overall insurance costs and compliance obligations.

Steps to Complete the Insurance Premium Tax for Surplus Lines Purchasing Groups

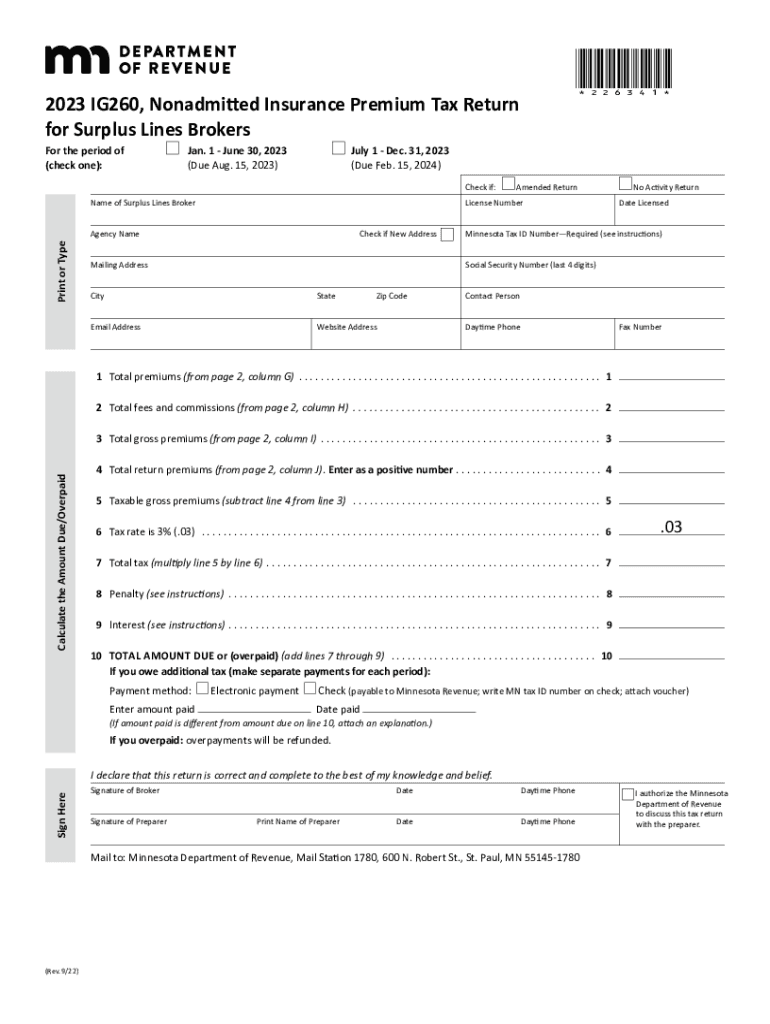

Completing the Insurance Premium Tax for Surplus Lines Purchasing Groups involves several key steps:

- Gather necessary documentation, including details of the insurance policies and premiums paid.

- Determine the applicable tax rate based on the state in which the purchasing group operates.

- Calculate the total tax owed based on the premiums collected.

- Complete the required tax forms, ensuring all information is accurate and complete.

- Submit the forms along with any payment by the specified deadline.

Each step is crucial for ensuring compliance and avoiding penalties. It is advisable to consult with a tax professional if there are any uncertainties during the process.

Required Documents for Filing Insurance Premium Tax

When filing the Insurance Premium Tax for Surplus Lines Purchasing Groups, certain documents are essential:

- Detailed records of insurance premiums collected.

- Copies of all insurance policies issued to members of the purchasing group.

- State-specific tax forms that need to be completed.

- Any additional documentation required by the state tax authority.

Ensuring that all required documents are accurate and complete will facilitate a smoother filing process and help prevent delays or issues with compliance.

State-Specific Rules for Insurance Premium Tax

Each state in the U.S. has its own regulations regarding the Insurance Premium Tax for Surplus Lines Purchasing Groups. These rules can include variations in tax rates, filing deadlines, and specific forms required for submission. It is crucial for purchasing groups to be aware of the regulations in their respective states to ensure compliance.

Some states may also have exemptions or special provisions for certain types of coverage or group structures. Researching state-specific rules will help purchasing groups navigate their tax obligations effectively.

Penalties for Non-Compliance with Insurance Premium Tax Regulations

Failing to comply with the Insurance Premium Tax regulations can result in significant penalties. Common consequences include:

- Fines based on the amount of tax owed.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action from state tax authorities.

To avoid these penalties, it is essential for purchasing groups to understand their obligations and ensure timely and accurate filings.

Eligibility Criteria for Surplus Lines Purchasing Groups

To qualify as a Surplus Lines Purchasing Group, certain eligibility criteria must be met. These may include:

- Membership in an association or group formed for a common purpose.

- Demonstrating that the group is formed to provide insurance coverage for its members.

- Compliance with state regulations governing surplus lines insurance.

Understanding these criteria is vital for groups looking to benefit from surplus lines coverage and the associated tax structure.

Quick guide on how to complete insurance premium tax surplus linespurchasing groups

Effortlessly Prepare Insurance Premium Tax Surplus LinesPurchasing Groups on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to easily locate the necessary document and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your files swiftly without any hold-ups. Manage Insurance Premium Tax Surplus LinesPurchasing Groups on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

The Easiest Method to Edit and eSign Insurance Premium Tax Surplus LinesPurchasing Groups with Ease

- Search for Insurance Premium Tax Surplus LinesPurchasing Groups and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information using the features that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and press the Done button to secure your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Insurance Premium Tax Surplus LinesPurchasing Groups and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct insurance premium tax surplus linespurchasing groups

Create this form in 5 minutes!

How to create an eSignature for the insurance premium tax surplus linespurchasing groups

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Insurance Premium Tax Surplus Lines Purchasing Groups?

Insurance Premium Tax Surplus Lines Purchasing Groups are organizations that allow businesses to group together to purchase surplus lines insurance. This type of insurance often covers risks that standard insurance policies do not. By pooling resources, these groups can obtain better rates and coverage options tailored to their specific needs.

-

How does airSlate SignNow facilitate the processing of Insurance Premium Tax Surplus Lines Purchasing Groups?

airSlate SignNow streamlines the eSigning process for documents related to Insurance Premium Tax Surplus Lines Purchasing Groups. With our easy-to-use platform, businesses can quickly send out contracts and agreements for electronic signatures, reducing processing time and increasing efficiency. This helps your group stay compliant with industry regulations and effectively manage your insurances.

-

What are the pricing options for airSlate SignNow in relation to Insurance Premium Tax Surplus Lines Purchasing Groups?

airSlate SignNow offers various pricing plans designed to meet the needs of different businesses, including those involved with Insurance Premium Tax Surplus Lines Purchasing Groups. Our competitive pricing structure ensures that you get a cost-effective solution without compromising on features. You can choose from monthly or annual subscriptions to best fit your budget.

-

What features does airSlate SignNow offer for managing Insurance Premium Tax Surplus Lines Purchasing Groups?

airSlate SignNow provides a variety of features that are essential for managing Insurance Premium Tax Surplus Lines Purchasing Groups. Key features include customizable templates, secure electronic signatures, and automated reminders for document signing. These tools enhance collaboration and ensure all members of the group can easily access and sign necessary documents online.

-

Can airSlate SignNow integrate with other tools for Insurance Premium Tax Surplus Lines Purchasing Groups?

Yes, airSlate SignNow offers seamless integrations with many popular applications, enhancing your workflow for Insurance Premium Tax Surplus Lines Purchasing Groups. You can connect with CRM systems, cloud storage services, and project management tools to centralize your operations. This integration capability helps ensure that your documentation processes remain efficient and organized.

-

What benefits do Insurance Premium Tax Surplus Lines Purchasing Groups gain from using airSlate SignNow?

By using airSlate SignNow, Insurance Premium Tax Surplus Lines Purchasing Groups can benefit from faster turnaround times and improved accuracy in documentation. Our platform minimizes human error and allows for secure storage of signed agreements. Additionally, you gain the ability to track document status in real-time, ensuring everyone stays in the loop.

-

Is airSlate SignNow compliant with regulations regarding Insurance Premium Tax Surplus Lines Purchasing Groups?

Absolutely, airSlate SignNow is designed to comply with legal standards and regulations applicable to Insurance Premium Tax Surplus Lines Purchasing Groups. We prioritize the security and privacy of your documents while providing an eSigning solution that meets industry requirements. This compliance gives users peace of mind while managing sensitive insurance documents.

Get more for Insurance Premium Tax Surplus LinesPurchasing Groups

- Optum rx prior auth form

- Progressive application for benefits michigan auto law form

- Health p e i medication list form government of pei home page gov pe

- Cfra designation notice template form

- New patient registration form able acupuncture amp herbal medicine

- 18 005 form

- Patient access to release medical records form

- Roland morris acute low back pain disability questionnaire form

Find out other Insurance Premium Tax Surplus LinesPurchasing Groups

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document