Form 1045 Application for Tentative Refund What it is 2021

Understanding Form 1045 Application For Tentative Refund

The Form 1045 Application For Tentative Refund is a tax form used by individuals and businesses to apply for a quick refund of overpaid taxes. This form allows taxpayers to expedite the refund process by requesting a refund based on a carryback of a net operating loss (NOL) or certain tax credits. By filing this application, taxpayers can receive their refunds sooner than waiting for the standard processing of their tax return.

Steps to Complete the Form 1045 Application For Tentative Refund

Completing the Form 1045 requires careful attention to detail. Here are the key steps involved:

- Gather necessary documents, including your tax returns and any relevant financial statements.

- Fill out the form accurately, providing all required information, such as your name, taxpayer identification number, and the amount of the refund requested.

- Indicate the specific tax year for which you are claiming the refund.

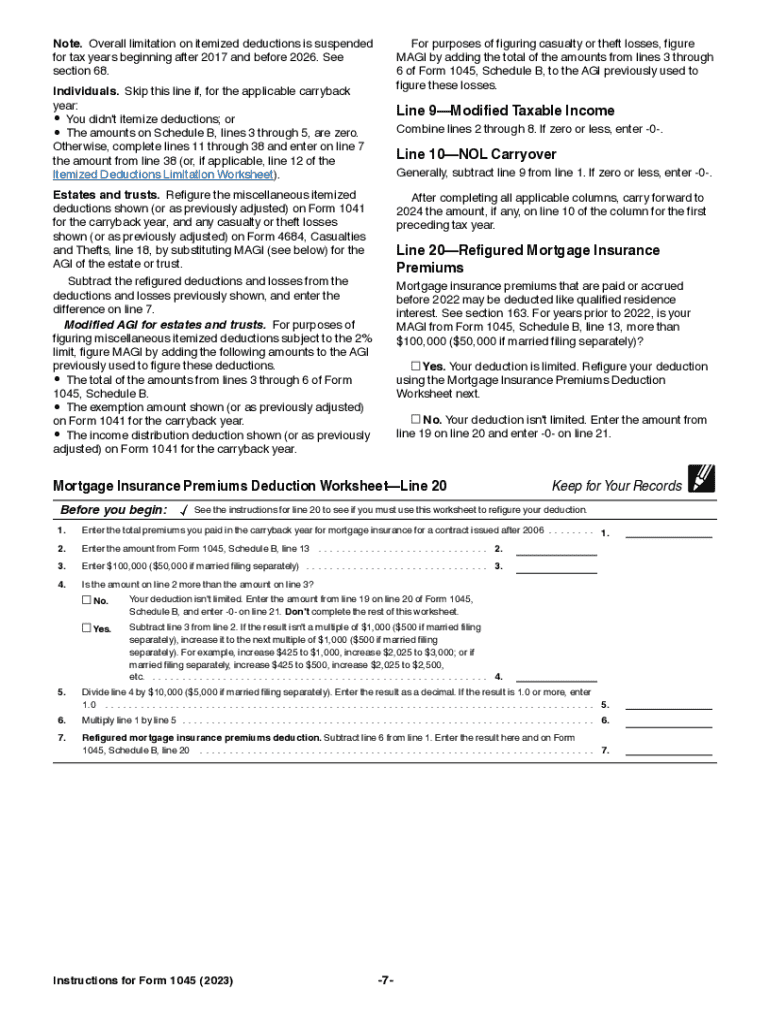

- Attach any supporting documentation that substantiates your claim, such as schedules or worksheets related to the NOL or credits.

- Review the completed form for accuracy before submission.

How to Obtain the Form 1045 Application For Tentative Refund

The Form 1045 can be obtained directly from the Internal Revenue Service (IRS) website or by contacting the IRS office. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, taxpayers may also find the form through tax preparation software, which often includes the necessary forms for electronic filing.

Filing Deadlines for Form 1045 Application For Tentative Refund

Timely filing of Form 1045 is crucial to ensure you receive your refund without delays. The application must be filed within twelve months of the end of the tax year in which the NOL or credit occurred. For example, if you experienced a loss in the 2022 tax year, you would need to file your application by December 31, 2023. Adhering to this timeline helps prevent complications in the refund process.

Eligibility Criteria for Form 1045 Application For Tentative Refund

To be eligible to file Form 1045, you must have incurred a net operating loss or be eligible for certain tax credits that can be carried back to prior tax years. The form is primarily intended for individual taxpayers, partnerships, and corporations. It is important to assess your specific tax situation to determine if you qualify for a tentative refund through this application.

IRS Guidelines for Form 1045 Application For Tentative Refund

The IRS provides clear guidelines for the use of Form 1045. Taxpayers should ensure they follow the instructions provided by the IRS, which detail how to fill out the form, what information is required, and how to submit it. The guidelines also outline the types of losses and credits that are eligible for a tentative refund, helping taxpayers understand their rights and obligations when applying for a refund.

Quick guide on how to complete form 1045 application for tentative refund what it is

Accomplish Form 1045 Application For Tentative Refund What It Is seamlessly on any device

Managing documents online has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Form 1045 Application For Tentative Refund What It Is from any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 1045 Application For Tentative Refund What It Is with ease

- Find Form 1045 Application For Tentative Refund What It Is and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1045 Application For Tentative Refund What It Is and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1045 application for tentative refund what it is

Create this form in 5 minutes!

How to create an eSignature for the form 1045 application for tentative refund what it is

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1045 Application For Tentative Refund?

The Form 1045 Application For Tentative Refund is a tax form that allows individuals to request a quick refund of overpaid taxes. It is specifically designed for those who have experienced a net operating loss or other qualifying event. Understanding what the Form 1045 Application For Tentative Refund is can simplify the process of reclaiming your funds from the IRS.

-

How can airSlate SignNow help with the Form 1045 Application For Tentative Refund?

airSlate SignNow provides a user-friendly platform that allows you to electronically sign and send your Form 1045 Application For Tentative Refund seamlessly. With our solution, you can streamline the signing process, ensuring that your application is completed quickly and accurately. Our efficient workflow reduces the hassle and time typically associated with filing.

-

What are the pricing options for airSlate SignNow when filing the Form 1045 Application For Tentative Refund?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it cost-effective for filing your Form 1045 Application For Tentative Refund. You can choose from monthly or annual subscriptions, each designed to provide value through enhanced features. Our pricing ensures that you have access to essential tools without breaking the bank.

-

Are there any integrations available with airSlate SignNow for tracking the Form 1045 Application For Tentative Refund?

Yes, airSlate SignNow integrates with various platforms to enhance your filing process for the Form 1045 Application For Tentative Refund. You can connect with apps like Google Drive, Dropbox, and various CRM systems, allowing for easy document management. These integrations ensure that your workflow remains efficient and organized.

-

What features does airSlate SignNow provide for efficiently handling the Form 1045 Application For Tentative Refund?

airSlate SignNow offers features such as eSignature capabilities, document templates, and automated reminders to help manage the Form 1045 Application For Tentative Refund. These tools make it easy to prepare, sign, and submit your application, reducing errors and speeding up the process. Our platform is designed to simplify your document workflow.

-

How secure is the airSlate SignNow platform when filing the Form 1045 Application For Tentative Refund?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Form 1045 Application For Tentative Refund. Our platform utilizes advanced encryption and complies with industry standards to protect your data. You can trust that your information is safe when using our services.

-

What are the benefits of using airSlate SignNow for the Form 1045 Application For Tentative Refund?

Using airSlate SignNow for your Form 1045 Application For Tentative Refund offers numerous benefits, including faster processing times and improved accuracy. The platform is designed to reduce manual errors and provide a clear audit trail for your submissions. Additionally, you’ll save time and money by streamlining your filing process.

Get more for Form 1045 Application For Tentative Refund What It Is

- Motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem form

- Tn tangible personal property form

- Organization phone no form

- Application for service or early retirement benefits form

- Tangible personal property tax form

- 1500010263 kentucky department of revenue form

- Payroll tax forms city of burkesville cityofburkesville

- Form 200 local intangibles tax return rev 7 21 form 200 local intangibles tax return county taxes

Find out other Form 1045 Application For Tentative Refund What It Is

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template