About Form 1120 PC, U S Property and Casualty 2023

Understanding the Casualty Loss Form

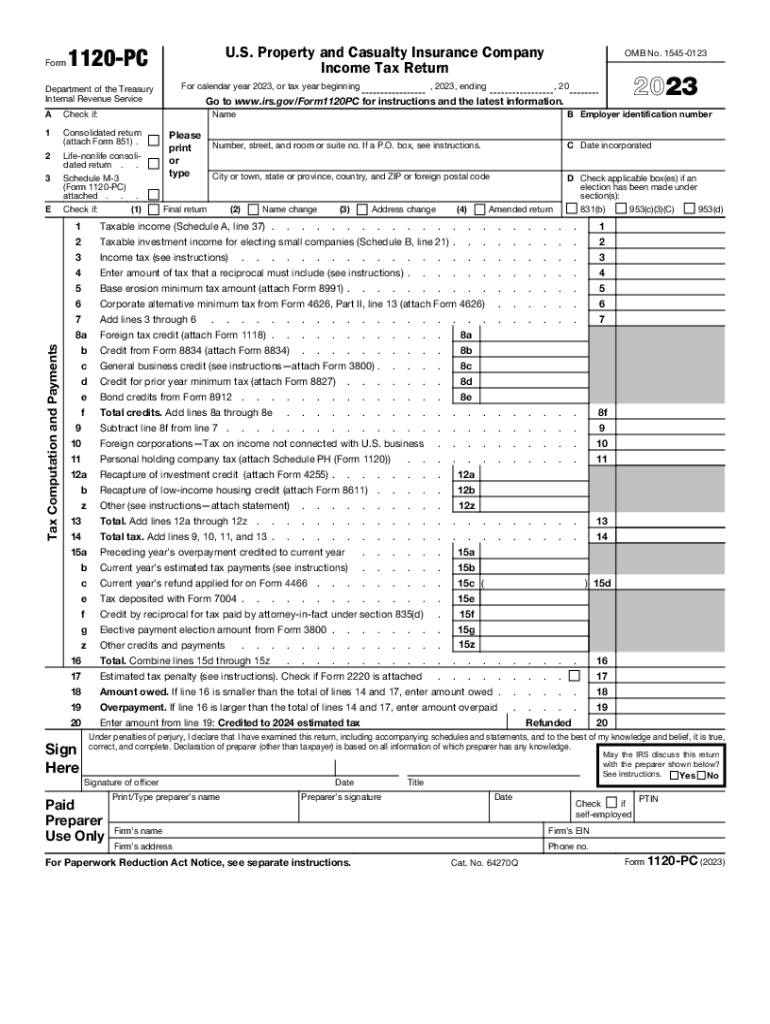

The casualty loss form, specifically Form 1120 PC, is utilized by U.S. property and casualty insurance companies to report their income, deductions, and other tax-related information. This form is essential for businesses in the insurance sector, as it helps determine the taxable income and ensures compliance with IRS regulations. The form includes sections for reporting gross premiums, losses incurred, and other financial details pertinent to the insurance business.

Steps to Complete the Casualty Loss Form

Completing the casualty loss form involves several key steps. First, gather all necessary financial documents, including income statements, loss reports, and any relevant tax records. Next, accurately fill out each section of Form 1120 PC, ensuring that all figures are correct and correspond with your financial statements. Pay special attention to the loss calculation section, as this is critical for determining your tax liability. Once completed, review the form for any errors before submission.

Filing Deadlines for the Casualty Loss Form

It is important to be aware of the filing deadlines for the casualty loss form to avoid penalties. Generally, Form 1120 PC must be filed by the 15th day of the third month following the end of the tax year. For example, if your tax year ends on December 31, the form is due by March 15 of the following year. If additional time is needed, you may file for an extension, but this must be done before the original deadline.

Required Documents for Filing

To successfully file the casualty loss form, several documents are required. These include:

- Financial statements, including income and balance sheets

- Detailed records of losses incurred during the tax year

- Any previous tax returns that may provide context for current filings

- Documentation supporting deductions claimed on the form

Having these documents organized and ready will facilitate a smoother filing process.

IRS Guidelines for the Casualty Loss Form

The IRS provides specific guidelines regarding the completion and submission of the casualty loss form. These guidelines include instructions on how to calculate losses, what constitutes a deductible loss, and how to report any gains from casualty events. It is crucial to adhere to these guidelines to ensure compliance and avoid potential audits or penalties.

Penalties for Non-Compliance

Failure to file the casualty loss form accurately and on time can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to provide required information. Additionally, non-compliance can lead to increased scrutiny of future filings, which may result in further penalties or audits. Understanding these risks emphasizes the importance of careful preparation and adherence to filing requirements.

Quick guide on how to complete about form 1120 pc u s property and casualty

Effortlessly prepare About Form 1120 PC, U S Property And Casualty on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily find the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage About Form 1120 PC, U S Property And Casualty on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign About Form 1120 PC, U S Property And Casualty seamlessly

- Find About Form 1120 PC, U S Property And Casualty and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring printing new document copies. airSlate SignNow handles all your document management needs in just a few clicks from your chosen device. Modify and eSign About Form 1120 PC, U S Property And Casualty and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1120 pc u s property and casualty

Create this form in 5 minutes!

How to create an eSignature for the about form 1120 pc u s property and casualty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a casualty loss form and why do I need it?

A casualty loss form is a document used to report damages or losses due to unexpected events like accidents, natural disasters, or theft. It's essential for claiming tax deductions or insurance reimbursements. Using a casualty loss form ensures you're accurately documenting your financial losses, which can signNowly impact your financial recovery.

-

How can airSlate SignNow streamline my casualty loss form process?

airSlate SignNow simplifies the process of completing and signing your casualty loss form with its user-friendly interface. You can easily fill out required fields, collect signatures, and send the form directly to your insurance provider or tax professional. This streamlines the documentation process, saving you time and avoiding errors.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the ability to create and send casualty loss forms. This trial gives you access to all essential tools, enabling you to experience how our solution can enhance your document management prior to any financial commitment.

-

What features does airSlate SignNow provide for managing casualty loss forms?

airSlate SignNow provides features such as templates for casualty loss forms, electronic signatures, and cloud storage for easy access. Additionally, it offers tracking capabilities, allowing you to monitor the status of your documents. These features ensure that your casualty loss form is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow supports integration with various productivity tools and software, making it easy to sync your casualty loss form processes with your existing workflow. You can connect with platforms like Google Drive, Microsoft Office, and many others, enhancing your document management experience.

-

How secure is the information I submit using airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit your casualty loss form, all data is encrypted both in transit and at rest, ensuring that your information is safe. Additionally, we comply with industry standards for data protection and privacy, giving you peace of mind while handling sensitive documents.

-

What benefits do I gain from using airSlate SignNow for a casualty loss form?

Using airSlate SignNow for your casualty loss form offers numerous benefits, including increased efficiency, reduced paperwork, and quicker turnaround times. You'll also enhance collaboration with stakeholders, allowing for seamless communication and document sharing. Ultimately, this results in a more organized approach to managing your claims.

Get more for About Form 1120 PC, U S Property And Casualty

- Agreed written termination of lease by landlord and tenant maine form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497310845 form

- Notice breach written form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497310847 form

- Me provisions form

- Business credit application maine form

- Individual credit application maine form

- Interrogatories to plaintiff for motor vehicle occurrence maine form

Find out other About Form 1120 PC, U S Property And Casualty

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract