Form 1120 PC U S Property and Casualty Insurance Company Income Tax Return 2024

What is the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

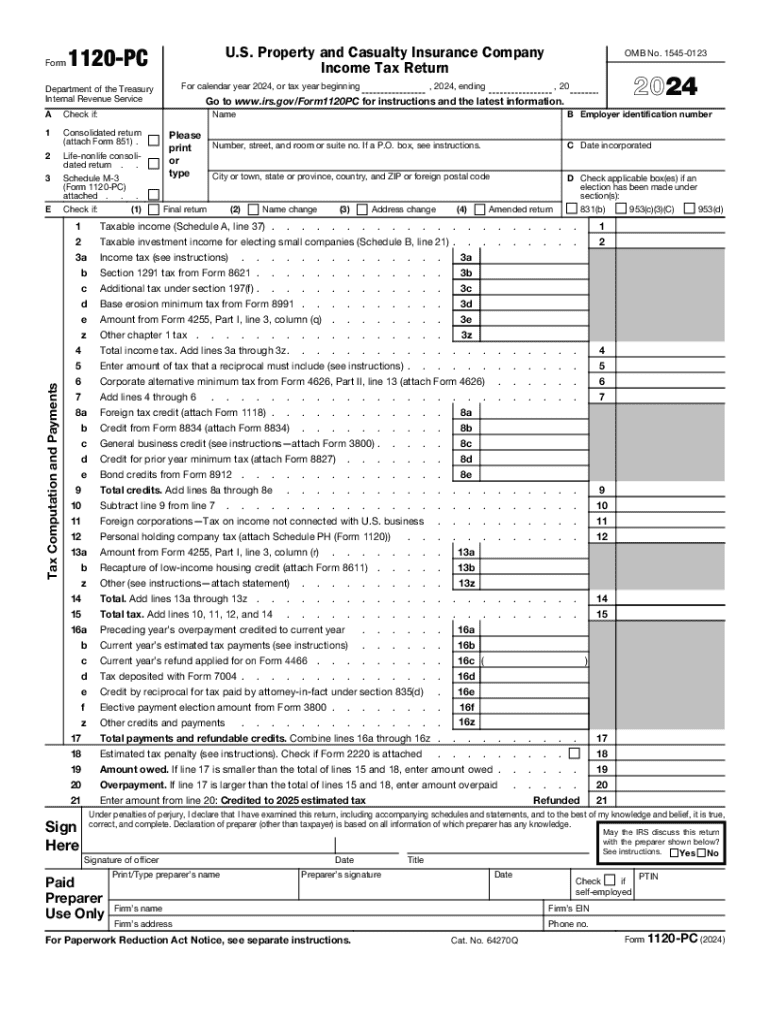

The Form 1120 PC is specifically designed for U.S. property and casualty insurance companies to report their income, gains, losses, deductions, and credits. This form is essential for ensuring compliance with federal tax regulations pertaining to insurance companies. It allows these entities to detail their financial activities and calculate their tax obligations accurately. The form is a critical component in the overall tax filing process for insurers operating within the United States.

How to use the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

Using the Form 1120 PC involves several steps. First, insurance companies must gather all relevant financial information, including income from premiums, investment income, and any losses incurred during the tax year. Next, the form requires the reporting of various deductions, such as claims paid and operating expenses. After filling out the form, companies must review it for accuracy before submission. This ensures that all data is correct and complies with IRS regulations.

Steps to complete the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

Completing the Form 1120 PC involves a systematic approach:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form section by section, starting with basic company information.

- Report total income, including premiums and investment gains.

- Detail deductions, such as losses and operating expenses.

- Calculate the tax liability based on the reported income and deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either electronically or by mail.

Key elements of the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

The Form 1120 PC includes several key elements that are crucial for accurate reporting:

- Company Information: Basic details about the insurance company, including name, address, and Employer Identification Number (EIN).

- Income Reporting: Sections for detailing various sources of income, including premiums and investment earnings.

- Deductions: Areas to report allowable deductions, such as claims paid and administrative expenses.

- Tax Calculation: A section to compute the total tax liability based on the reported income and deductions.

- Signature Section: A place for authorized representatives to sign and date the form, certifying its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 PC are crucial for compliance. Typically, the form must be filed by the fifteenth day of the third month after the end of the tax year. For calendar year filers, this means the deadline is March 15. Companies may apply for an extension, but it is important to file the extension request before the initial deadline to avoid penalties. Keeping track of these dates ensures that companies remain compliant with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 1120 PC on time can result in significant penalties. The IRS imposes a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, inaccuracies in the form can lead to further penalties or audits. It is essential for insurance companies to ensure timely and accurate filing to avoid these consequences, which can impact their financial standing and reputation.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 pc u s property and casualty insurance company income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pc u s property and casualty insurance company income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 1120 PC?

The IRS Form 1120 PC is a tax form used by corporations to report their income, gains, losses, deductions, and credits. It is specifically designed for personal service corporations. Understanding how to properly fill out the IRS Form 1120 PC is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with IRS Form 1120 PC?

airSlate SignNow simplifies the process of preparing and signing IRS Form 1120 PC by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their forms, ensuring that all necessary information is accurately captured and securely stored.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for small businesses and larger enterprises. Each plan includes features that support the completion of IRS Form 1120 PC, making it a cost-effective solution for tax preparation.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage services and accounting software. This allows users to easily access and manage their IRS Form 1120 PC alongside other important documents, streamlining the workflow.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features for document signing, including customizable templates, in-person signing options, and automated reminders. These features enhance the efficiency of completing IRS Form 1120 PC and ensure timely submissions.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive documents like the IRS Form 1120 PC. Users can trust that their information is safe while using the platform.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage and sign their IRS Form 1120 PC on the go. The mobile-friendly interface ensures that you can complete your tax documents anytime, anywhere.

Get more for Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

- Wageworks special handling form

- Finding the equation of circles problems matching worksheet answers form

- Form 68 lease rental agreement 240571114

- Schedule se form

- Va form 21 0820

- Enzyme cut out activity answer key pdf form

- Health new england prior authorization form

- Dot ld 0274 claim against california department of form

Find out other Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document