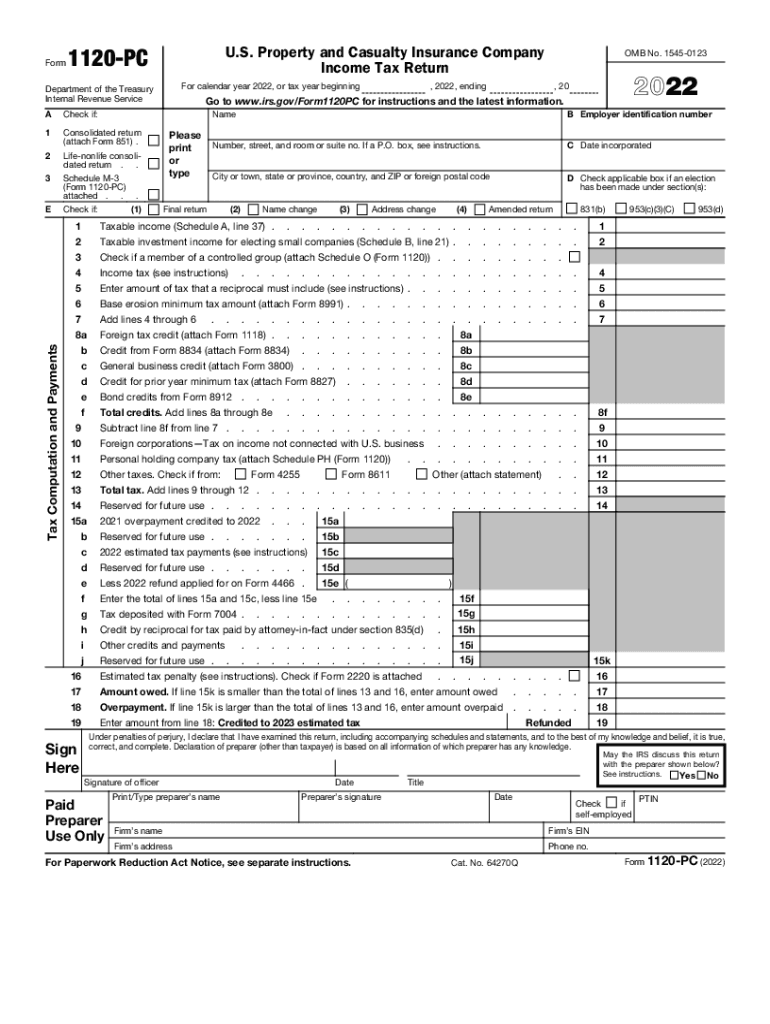

About Form 1120 PC, U S Property and Casualty Insurance Company Income 2022

IRS Guidelines

The IRS provides specific guidelines regarding the mn property tax refund 2020, which is essential for taxpayers seeking to claim their refunds accurately. Taxpayers must ensure they meet the eligibility criteria established by the IRS, which includes having a valid property tax statement and being a resident of Minnesota during the tax year in question. The guidelines detail the necessary forms and documentation required to support the refund claim. Understanding these guidelines is crucial for a successful filing process.

Filing Deadlines / Important Dates

For the mn property tax refund 2020, it is vital to be aware of the filing deadlines and important dates. Typically, the deadline for filing a property tax refund application is August 15 of the year following the tax year. For the 2020 tax year, this means applications must be submitted by August 15, 2021. Missing this deadline can result in the loss of the refund opportunity. Taxpayers should also note any changes in deadlines due to special circumstances or state regulations.

Required Documents

When applying for the mn property tax refund 2020, taxpayers must gather specific documents to support their claims. Essential documents include the property tax statement, proof of income, and any relevant identification. It is also advisable to keep copies of previous tax returns and any correspondence with the Minnesota Department of Revenue. Having these documents organized can streamline the application process and reduce the likelihood of delays.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their mn property tax refund 2020 application. The Minnesota Department of Revenue allows for online submissions through their official website, which is a convenient option for many. Alternatively, individuals can choose to mail their completed forms to the appropriate address provided by the department. In-person submissions may also be possible at designated locations, although this option may vary based on local regulations and public health guidelines.

Eligibility Criteria

To qualify for the mn property tax refund 2020, taxpayers must meet specific eligibility criteria set forth by the Minnesota Department of Revenue. Generally, applicants must have owned and occupied their property as their primary residence for at least six months during the tax year. Additionally, income limits apply, which vary based on family size and other factors. Understanding these criteria is essential for determining eligibility and ensuring a successful application.

Application Process & Approval Time

The application process for the mn property tax refund 2020 involves several steps. Taxpayers must complete the appropriate forms, provide necessary documentation, and submit their application by the deadline. Once submitted, the approval time can vary based on the volume of applications received by the Minnesota Department of Revenue. Typically, applicants can expect to receive their refunds within a few weeks to a few months after submission, depending on the processing time.

Quick guide on how to complete about form 1120 pc us property and casualty insurance company income

Complete About Form 1120 PC, U S Property And Casualty Insurance Company Income effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly and without interruptions. Handle About Form 1120 PC, U S Property And Casualty Insurance Company Income on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign About Form 1120 PC, U S Property And Casualty Insurance Company Income with ease

- Locate About Form 1120 PC, U S Property And Casualty Insurance Company Income and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 1120 PC, U S Property And Casualty Insurance Company Income and guarantee exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1120 pc us property and casualty insurance company income

Create this form in 5 minutes!

People also ask

-

What is the mn property tax refund 2020 and who is eligible for it?

The mn property tax refund 2020 is designed to help eligible homeowners recover a portion of their property taxes. To qualify, residents must meet specific income and residency requirements. Understanding if you're eligible is crucial to optimizing your financial situation, especially if you used airSlate SignNow to manage your claims.

-

How can airSlate SignNow assist with the mn property tax refund 2020 process?

airSlate SignNow streamlines the mn property tax refund 2020 application process by enabling users to easily send and eSign necessary documents. This minimizes paperwork hassles and ensures timely submissions, leading to a smoother refund experience. With our user-friendly platform, managing your tax matters has never been easier.

-

Are there any costs associated with using airSlate SignNow for mn property tax refund 2020 applications?

Using airSlate SignNow offers cost-effective solutions for managing your mn property tax refund 2020 applications without hidden fees. We provide various pricing plans that cater to individual and business needs, ensuring that you get the best value for simplifying your document workflows. You’ll save time and money in the long run.

-

Can I integrate airSlate SignNow with other software for my mn property tax refund 2020 needs?

Yes, airSlate SignNow easily integrates with various accounting and tax preparation software, helping you manage your mn property tax refund 2020 applications seamlessly. Integration capabilities enhance our platform, allowing for a smoother workflow when dealing with your tax documents. Benefit from enhanced efficiency while keeping your processes organized.

-

How does airSlate SignNow ensure the security of my mn property tax refund 2020 documents?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption protocols to protect your mn property tax refund 2020 documents throughout the entire signing process. Rest assured that your personal information and financial data are handled with the utmost confidentiality and security.

-

What features does airSlate SignNow offer for tracking my mn property tax refund 2020 applications?

airSlate SignNow provides a comprehensive tracking system for your mn property tax refund 2020 applications, allowing you to monitor the status of your submitted documents in real-time. Notifications and reminders can help you stay on top of application deadlines and ensure you're informed every step of the way. Keep your tax processes organized with our powerful tools.

-

Is there customer support available if I have questions about the mn property tax refund 2020 process?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any queries related to the mn property tax refund 2020 process. Our team is available to provide guidance and help troubleshoot any issues that may arise, ensuring that your experience with our platform is smooth and successful.

Get more for About Form 1120 PC, U S Property And Casualty Insurance Company Income

- New york legal 497322033 form

- New york legal ny 497322034 form

- New york married form

- Ny amendments form

- Legal last will and testament form for married person with adult and minor children from prior marriage new york

- Legal last will and testament form for married person with adult and minor children new york

- Mutual wills package with last wills and testaments for married couple with adult and minor children new york form

- New york widow form

Find out other About Form 1120 PC, U S Property And Casualty Insurance Company Income

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document