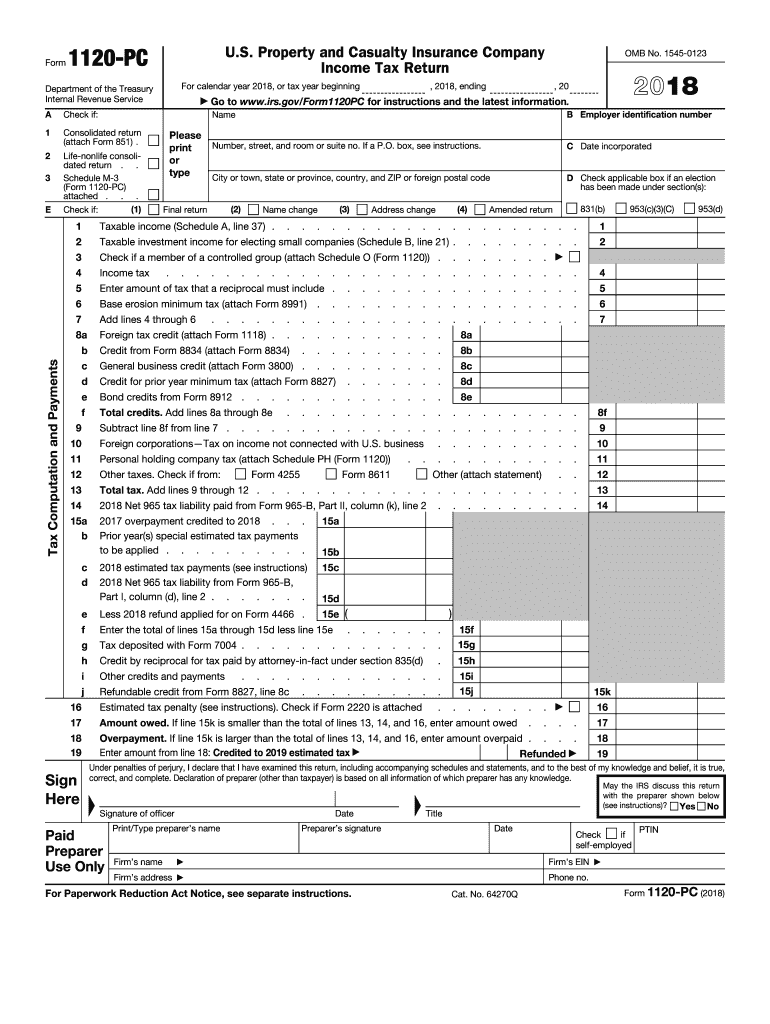

1120 Pc 2018

What is Form 4?

Form 4684, titled "Casualties and Thefts," is a tax form used by individuals and businesses in the United States to report losses due to casualties, thefts, and certain other events. The 2016 version of this form is specifically designed to help taxpayers calculate their deductible losses for the tax year 2016. This form is essential for those who have experienced significant financial losses from events such as natural disasters, accidents, or thefts, allowing them to claim appropriate deductions on their federal income tax returns.

Steps to Complete Form 4

Completing Form 4684 involves several key steps:

- Gather necessary information: Collect documentation related to the loss, including police reports for thefts, insurance claims, and any repair estimates.

- Identify the type of loss: Determine whether the loss is from a casualty or theft, as this will influence how you fill out the form.

- Calculate the loss: Use the guidelines provided in the form to calculate the amount of your loss. This includes determining the fair market value of the property before and after the event.

- Fill out the form: Complete all required sections of Form 4684, ensuring that all calculations are accurate and all necessary information is included.

- Attach to your tax return: Once completed, attach Form 4684 to your federal income tax return, ensuring it is submitted by the appropriate deadline.

Legal Use of Form 4

Form 4684 is legally recognized by the IRS for reporting losses due to casualties and thefts. To ensure compliance, taxpayers must accurately report their losses and provide supporting documentation. Misrepresenting information or failing to file the form correctly can lead to penalties or audits. It is crucial to follow IRS guidelines and retain copies of all submitted documents for future reference.

Filing Deadlines / Important Dates

The filing deadline for Form 4684 coincides with the due date of your federal income tax return. For most taxpayers, this is April 15 of the following year. If you require additional time, you may file for an extension, but it is important to ensure that Form 4684 is submitted by the extended deadline to avoid penalties. Always check for any changes in tax law that may affect deadlines.

Required Documents

When completing Form 4684, it is essential to have the following documents ready:

- Proof of ownership of the property lost or damaged.

- Documentation of the loss, such as police reports or insurance claims.

- Estimates for repairs or appraisals of the property’s value before and after the loss.

- Any other relevant financial records that support your claim.

Form Submission Methods

Form 4684 can be submitted in several ways:

- Online: If you are filing your tax return electronically, you can include Form 4684 as part of your e-filing process.

- Mail: You may also print the completed form and mail it along with your tax return to the appropriate IRS address.

- In-Person: In rare cases, you may choose to deliver your tax return and Form 4684 in person at an IRS office.

Quick guide on how to complete irs casualty loss form 2018 2019

Discover the simplest method to complete and endorse your 1120 Pc

Are you still spending time preparing your official documents on physical copies instead of doing it digitally? airSlate SignNow offers a superior approach to finalize and endorse your 1120 Pc and associated forms for public services. Our advanced eSignature solution equips you with all the tools necessary to handle documents swiftly and in line with formal regulations - robust PDF editing, managing, securing, signing, and sharing features are all available within an intuitive interface.

Only a few steps are needed to complete and endorse your 1120 Pc:

- Insert the fillable template into the editor by clicking the Get Form button.

- Review the information you need to supply in your 1120 Pc.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is truly important or Conceal fields that are no longer relevant.

- Press Sign to create a legally binding eSignature using any method you prefer.

- Insert the Date alongside your signature and finish your task by clicking the Done button.

Store your finished 1120 Pc in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when they need to be sent to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a go now!

Create this form in 5 minutes or less

Find and fill out the correct irs casualty loss form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs casualty loss form 2018 2019

How to make an eSignature for the Irs Casualty Loss Form 2018 2019 in the online mode

How to generate an eSignature for your Irs Casualty Loss Form 2018 2019 in Chrome

How to generate an electronic signature for signing the Irs Casualty Loss Form 2018 2019 in Gmail

How to create an eSignature for the Irs Casualty Loss Form 2018 2019 right from your smartphone

How to generate an eSignature for the Irs Casualty Loss Form 2018 2019 on iOS

How to generate an electronic signature for the Irs Casualty Loss Form 2018 2019 on Android devices

People also ask

-

What is Form 4684 2016 used for?

Form 4684 2016 is used to report casualties and thefts for tax purposes. This form helps taxpayers calculate their losses, allowing for potential deductions on their tax returns. If you're filing taxes, you need to fill out this form accurately to ensure compliance and maximize your deductions.

-

How can airSlate SignNow assist with Form 4684 2016?

airSlate SignNow simplifies the process of filling out Form 4684 2016 by allowing users to eSign the document securely. With its intuitive interface, you can easily fill in the required fields and send the form electronically. This not only saves time but also ensures that you can submit your tax forms quickly and securely.

-

Is there a fee to use airSlate SignNow for Form 4684 2016?

airSlate SignNow offers competitive pricing plans that cater to different needs, including those who need to fill out Form 4684 2016. You can choose from various subscription options that provide access to features designed to make document preparation and signing more efficient. The investment is cost-effective, especially for businesses that regularly handle official documents.

-

Can I integrate airSlate SignNow with other applications for Form 4684 2016?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage your Form 4684 2016 alongside your other financial documents. Whether you use accounting software or cloud storage services, you can connect airSlate SignNow to streamline your document management. This integration helps to maintain an organized workflow and facilitates easier access to your forms.

-

What are the benefits of using airSlate SignNow for tax forms like Form 4684 2016?

Using airSlate SignNow for tax forms such as Form 4684 2016 offers several benefits, including enhanced security and document tracking. The platform ensures that your sensitive information remains protected through encryption and secure storage. Additionally, the ability to track document status keeps you informed and in control during the submission process.

-

How does airSlate SignNow ensure the security of Form 4684 2016?

AirSlate SignNow prioritizes your document security, especially for sensitive forms like Form 4684 2016. It employs advanced security measures, including data encryption and secure access protocols, to protect your information. You can confidently send and store your forms, knowing that your data is safe.

-

Can I access Form 4684 2016 from mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow has a mobile-friendly platform that allows you to access and manage Form 4684 2016 on-the-go. Whether you're using a smartphone or tablet, you can fill out, sign, and send your forms conveniently from anywhere. This flexibility is perfect for busy professionals who need to manage their documents remotely.

Get more for 1120 Pc

Find out other 1120 Pc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors