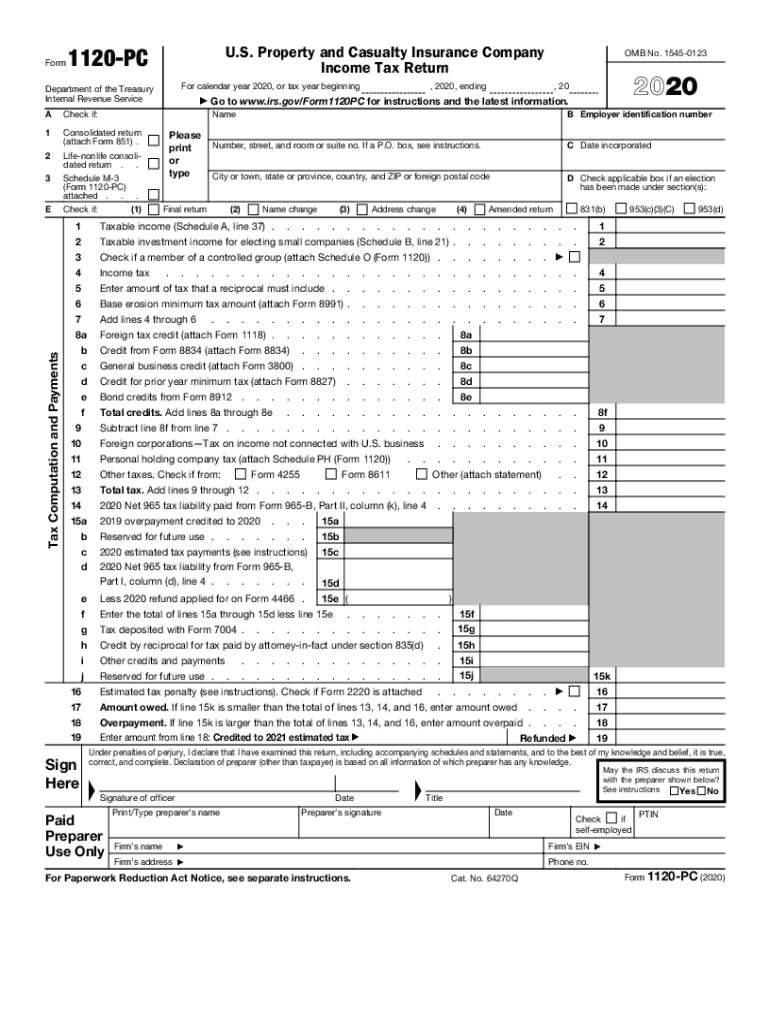

Form 1120 PC U S Property and Casualty Insurance Company Income Tax Return 2020

What is the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

The Form 1120 PC is specifically designed for U.S. property and casualty insurance companies to report their income, deductions, and tax liability. This form is essential for ensuring compliance with federal tax obligations and provides a structured way for these companies to disclose their financial activities to the Internal Revenue Service (IRS). The form includes sections for reporting gross premiums, losses incurred, and various deductions that are unique to the insurance industry.

Steps to complete the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

Completing the Form 1120 PC involves several key steps:

- Gather necessary financial records, including income statements, balance sheets, and prior tax returns.

- Fill out the form by entering gross premiums, losses, and deductions in the appropriate sections.

- Ensure all calculations are accurate, particularly for tax credits and liabilities.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify its accuracy.

Legal use of the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

The legal validity of the Form 1120 PC is established when it is completed accurately and submitted to the IRS by the designated deadline. Compliance with IRS regulations is crucial, as improper filing can lead to penalties. Additionally, the form must be signed by an authorized representative of the insurance company, affirming that the information provided is truthful and complete.

Filing Deadlines / Important Dates

Insurance companies must adhere to specific filing deadlines for the Form 1120 PC. Typically, the form is due on the fifteenth day of the third month following the end of the tax year. For calendar year filers, this means the deadline is March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Companies should also be aware of any extensions that may be available for filing.

Required Documents

To complete the Form 1120 PC, several documents are necessary:

- Financial statements, including income and balance sheets.

- Records of premiums collected and losses incurred.

- Documentation of deductions and credits claimed.

- Prior year tax returns for reference.

Examples of using the Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

Examples of situations where the Form 1120 PC is utilized include:

- A property insurance company reporting its annual income and expenses to the IRS.

- A casualty insurance firm claiming deductions for losses incurred during the tax year.

- Insurance companies that have undergone mergers or acquisitions using the form to report consolidated financials.

Quick guide on how to complete 2020 form 1120 pc us property and casualty insurance company income tax return

Complete Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to modify and eSign Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return with ease

- Obtain Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that reason.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet signature.

- Review the information and then click on the Done button to secure your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1120 pc us property and casualty insurance company income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1120 pc us property and casualty insurance company income tax return

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the IRS Form 1120 PC used for?

The IRS Form 1120 PC is used by certain corporations to report their income, gains, losses, deductions, and tax credits. This form is specifically designed for corporations that are subject to the Personal Holding Company (PHC) rules. Understanding this form is crucial for businesses to ensure compliance with IRS regulations.

-

How does airSlate SignNow help with IRS Form 1120 PC?

airSlate SignNow offers an efficient platform for businesses to prepare, sign, and send the IRS Form 1120 PC electronically. With our user-friendly interface, you can easily streamline the document workflow, saving time and reducing errors in your submissions. This ensures that your tax filings are processed smoothly.

-

What are the pricing options for airSlate SignNow's eSignature services?

airSlate SignNow provides flexible pricing plans to meet various business needs, starting from a basic plan suitable for small businesses to more advanced options for larger enterprises. Each plan includes features like unlimited eSignatures and document templates, making it easy to handle processes like IRS Form 1120 PC submissions without breaking the bank. A free trial is also available to explore our services.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, allowing you to easily manage documents like the IRS Form 1120 PC alongside your finance operations. These integrations help automate workflows and enhance productivity by connecting your eSignature processes to your existing software ecosystem.

-

What security measures does airSlate SignNow implement for document handling?

airSlate SignNow prioritizes the security of your documents, including IRS Form 1120 PC, by implementing robust encryption protocols and two-factor authentication. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure throughout the eSignature process.

-

Is airSlate SignNow mobile-friendly for completing IRS Form 1120 PC?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing users to complete and sign the IRS Form 1120 PC anytime, anywhere. This mobile accessibility ensures that you can manage your document workflows on the go, making it easier to meet filing deadlines.

-

How can airSlate SignNow improve my document turnaround time for IRS Form 1120 PC?

By using airSlate SignNow, you can signNowly accelerate the document turnaround time for the IRS Form 1120 PC. Our platform allows for instant eSigning and real-time collaboration, reducing the delays associated with traditional paper-based processes and ensuring that your forms are submitted promptly.

Get more for Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

- Fictitious business name statement form

- Sb2 cover sheet sample form

- Cw371 form

- Submersion incident report form sirf

- Redetermination for medi cal beneficiaries long term care in form

- Request for continuance ventura superior court ventura courts ca form

- Donde puedo sacar el acta de nacimiento en san bernardino california form

- Coss department of social services federal state form

Find out other Form 1120 PC U S Property And Casualty Insurance Company Income Tax Return

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter