Tax Commission Expense Form 2018

What is the Tax Commission Expense Form

The Tax Commission Expense Form is a document used by individuals and businesses to report specific expenses related to their tax obligations. This form is essential for ensuring accurate reporting of deductible expenses, which can significantly impact tax liability. It is designed to capture detailed information about various expenses incurred in the course of business operations or personal financial activities. Understanding this form is crucial for taxpayers aiming to maximize their deductions while remaining compliant with IRS regulations.

How to use the Tax Commission Expense Form

Using the Tax Commission Expense Form involves several straightforward steps. First, gather all necessary documentation that supports the expenses you intend to report. This may include receipts, invoices, and any relevant financial statements. Next, fill out the form by entering accurate details in the designated fields, ensuring that all expenses are categorized correctly. Once completed, review the form for accuracy before submitting it. This process helps in maintaining compliance and ensuring that you receive the appropriate deductions.

Steps to complete the Tax Commission Expense Form

Completing the Tax Commission Expense Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including receipts and invoices.

- Download or access the Tax Commission Expense Form from the appropriate source.

- Fill in your personal or business information at the top of the form.

- Detail each expense in the provided sections, ensuring accurate categorization.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

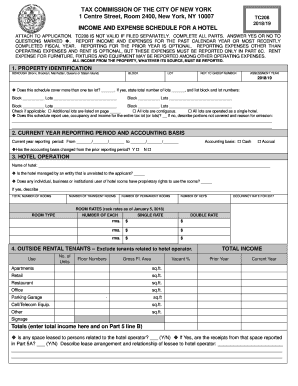

Key elements of the Tax Commission Expense Form

The Tax Commission Expense Form contains several key elements that are vital for accurate reporting. These include:

- Personal or Business Information: This section requires the taxpayer's name, address, and identification number.

- Expense Categories: The form typically includes predefined categories for different types of expenses, such as travel, supplies, and utilities.

- Total Expenses: A summary section where total expenses are calculated and reported.

- Signature Line: A section for the taxpayer to sign, affirming that the information provided is accurate and complete.

Legal use of the Tax Commission Expense Form

The legal use of the Tax Commission Expense Form is governed by IRS regulations and state tax laws. It is crucial for taxpayers to ensure that the form is filled out accurately and submitted by the appropriate deadlines. Misuse or inaccuracies can lead to penalties or audits. Therefore, understanding the legal implications of the information reported on this form is essential for compliance and avoiding potential legal issues.

Form Submission Methods

Submitting the Tax Commission Expense Form can be done through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many states offer online portals where taxpayers can submit their forms electronically.

- Mail: The form can be printed and mailed to the designated tax authority address.

- In-Person: Some taxpayers may choose to submit the form in person at local tax offices.

Quick guide on how to complete tax commission expense 2018 2019 form

Your assistance manual on how to prepare your Tax Commission Expense Form

If you're wondering how to finalize and submit your Tax Commission Expense Form, here are a few straightforward guidelines on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, create, and finalize your tax paperwork with convenience. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to revise answers as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Tax Commission Expense Form in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Tax Commission Expense Form in our editor.

- Populate the mandatory fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Make use of this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper may increase the likelihood of return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct tax commission expense 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the tax commission expense 2018 2019 form

How to create an eSignature for your Tax Commission Expense 2018 2019 Form online

How to make an eSignature for the Tax Commission Expense 2018 2019 Form in Chrome

How to generate an eSignature for signing the Tax Commission Expense 2018 2019 Form in Gmail

How to make an electronic signature for the Tax Commission Expense 2018 2019 Form right from your mobile device

How to generate an eSignature for the Tax Commission Expense 2018 2019 Form on iOS devices

How to create an eSignature for the Tax Commission Expense 2018 2019 Form on Android devices

People also ask

-

What is the Tax Commission Expense Form?

The Tax Commission Expense Form is a document designed to help businesses report and manage their tax-related expenses efficiently. It streamlines the process of tracking deductions and ensures compliance with tax regulations, making it essential for accurate financial reporting.

-

How does airSlate SignNow help with the Tax Commission Expense Form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and signing the Tax Commission Expense Form electronically. By simplifying document management, businesses can save time and reduce errors associated with manual processes.

-

Is there a cost associated with using the Tax Commission Expense Form on airSlate SignNow?

AirSlate SignNow offers various pricing plans that include access to features like the Tax Commission Expense Form. You can choose a plan that fits your business needs and budget, ensuring you get a cost-effective solution for document management.

-

What features are included with the Tax Commission Expense Form in airSlate SignNow?

When using the Tax Commission Expense Form on airSlate SignNow, you benefit from electronic signatures, customizable templates, and secure document storage. These features enhance productivity and ensure your tax-related documents are managed securely.

-

Can I integrate airSlate SignNow with other applications for the Tax Commission Expense Form?

Yes, airSlate SignNow offers integrations with various applications that can enhance the usability of the Tax Commission Expense Form. Whether you need to connect with accounting software or CRM systems, these integrations streamline your workflow.

-

How can airSlate SignNow improve the efficiency of managing the Tax Commission Expense Form?

By utilizing airSlate SignNow, businesses can automate the completion and signature process for the Tax Commission Expense Form, reducing the time spent on administrative tasks. This increased efficiency allows teams to focus on more strategic activities.

-

Are there templates available for the Tax Commission Expense Form?

AirSlate SignNow provides templates for the Tax Commission Expense Form that can be customized to fit your specific business needs. This feature saves time and ensures that your documentation is consistent and compliant with tax regulations.

Get more for Tax Commission Expense Form

- Connecticut small employer health reinsurance pool form

- Texas employer new hire reporting form fillable

- Affidavit of non receipt north dakota department of transportation motor vehicle division sfn 16782 rev dot nd form

- Ifb2 form

- Aprientices gov in com form

- Record requests transcript requests dallas independent school district form

- Customerrequesting party information

- Hisd transcript request form

Find out other Tax Commission Expense Form

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement