Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return 2021

Understanding the Virginia Resident Form 760

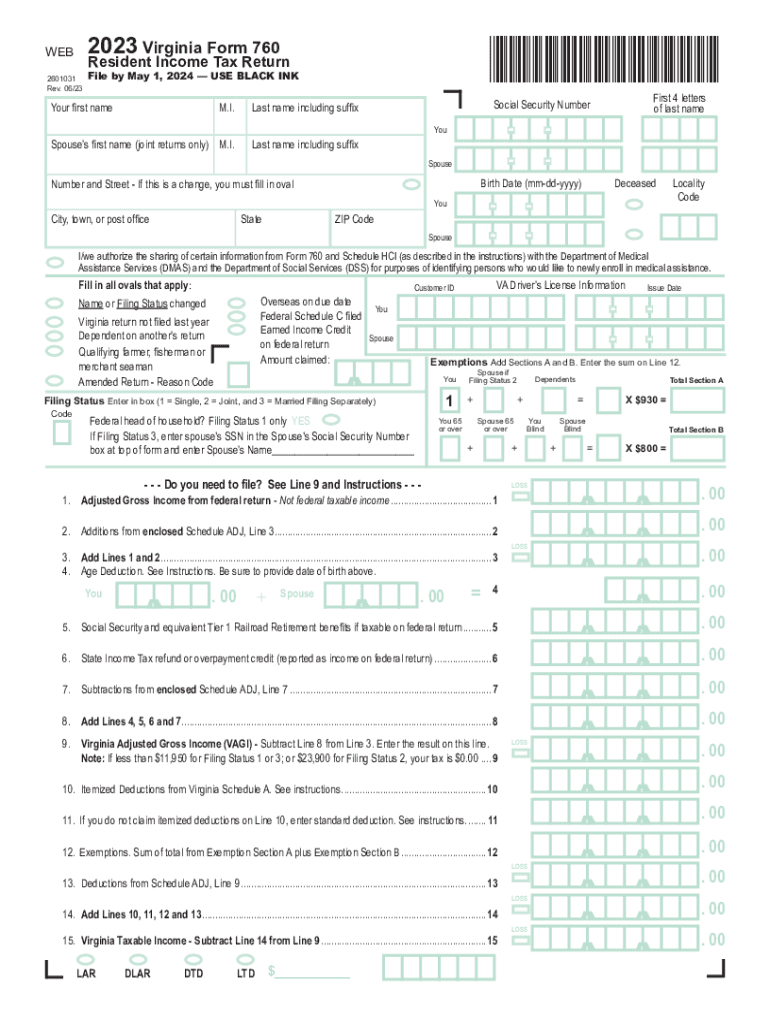

The Virginia Resident Form 760 is the primary document used by residents of Virginia to report their individual income tax. This form is essential for calculating the amount of tax owed to the state based on the taxpayer's income for the year. It is designed for individuals who are full-year residents of Virginia and must report all sources of income, including wages, salaries, and other earnings. The form also allows for various deductions and credits that can reduce the overall tax liability.

Steps to Complete the Virginia Resident Form 760

Completing the Virginia Resident Form 760 involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s and 1099s, as well as documentation for any deductions or credits.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Complete the sections detailing your income from various sources, ensuring accuracy to avoid potential issues.

- Calculate adjustments: Include any applicable adjustments to your income, such as contributions to retirement accounts.

- Claim deductions and credits: Utilize available deductions and credits to lower your taxable income and overall tax liability.

- Review and sign: Carefully review the completed form for accuracy before signing and dating it.

How to Obtain the Virginia Resident Form 760

The Virginia Resident Form 760 can be obtained through several convenient methods. It is available for download directly from the Virginia Department of Taxation website, where you can access the most current version of the form. Additionally, physical copies can often be found at local libraries, post offices, and tax preparation offices throughout Virginia. If you prefer, you may also request a paper form to be mailed to you by contacting the Virginia Department of Taxation directly.

Key Elements of the Virginia Resident Form 760

Understanding the key elements of the Virginia Resident Form 760 is essential for accurate completion. Important sections include:

- Filing Status: Indicate whether you are filing as single, married filing jointly, married filing separately, or head of household.

- Income Information: Report all sources of income, including wages, dividends, and rental income.

- Deductions: List any allowable deductions, such as medical expenses or mortgage interest.

- Tax Calculation: Follow the instructions to calculate your tax liability based on the income reported.

- Refund or Amount Due: Determine if you are owed a refund or if you need to make a payment.

Filing Deadlines for Virginia Tax Returns

Filing deadlines for the Virginia Resident Form 760 are crucial to avoid penalties. Typically, the due date for filing is May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who need additional time can apply for an extension, which allows for an extra six months to file, though any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods for Virginia Tax Returns

There are multiple methods available for submitting the Virginia Resident Form 760. Taxpayers can choose to file electronically through approved e-filing software, which often simplifies the process and speeds up refunds. Alternatively, the completed form can be mailed to the appropriate address listed in the form instructions. In-person submission is also an option at designated tax offices, providing a direct way to ensure that your return is filed correctly.

Quick guide on how to complete virginia resident form 760 individual income tax return individual income tax return

Effortlessly Prepare Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return on Any Device

Digital document management has become a widespread practice among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return from any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return with Ease

- Locate Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the document or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to misplaced or lost files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia resident form 760 individual income tax return individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the virginia resident form 760 individual income tax return individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Virginia tax?

airSlate SignNow is a digital signing solution that allows businesses to send and eSign documents efficiently. When it comes to Virginia tax, using our platform helps streamline tax-related documentation, ensuring compliance and reducing paperwork errors.

-

How can airSlate SignNow help with Virginia tax document management?

With airSlate SignNow, users can manage Virginia tax documents seamlessly by creating, sending, and signing forms electronically. This reduces the time spent on manual processes and facilitates better organization, making it easier to stay compliant with Virginia tax regulations.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a range of pricing plans that cater to different business needs. Each plan is designed to provide value, especially for businesses handling Virginia tax documents, with features that simplify document management and enhance efficiency.

-

Does airSlate SignNow integrate with other software for Virginia tax purposes?

Yes, airSlate SignNow integrates with various software applications, including those that manage financial and tax-related tasks. This integration capability is particularly beneficial for handling Virginia tax documentation, allowing for a smoother workflow between systems.

-

What features does airSlate SignNow offer for handling Virginia tax forms?

airSlate SignNow includes features like customizable templates, secure storage, and audit trails, which are essential for handling Virginia tax forms effectively. These features ensure that your documentation process is not only efficient but also compliant with state regulations.

-

Can airSlate SignNow help in reducing the time spent on Virginia tax filing?

Absolutely! By utilizing airSlate SignNow's digital signing capabilities, you can signNowly reduce the time spent on Virginia tax filing. Our solution automates many of the processes, enabling faster completion and submission of tax documents.

-

Is airSlate SignNow secure for handling sensitive Virginia tax information?

Yes, airSlate SignNow prioritizes security with features like encryption and secure access protocols to protect sensitive Virginia tax information. You can trust our platform to maintain the confidentiality and integrity of your important documents.

Get more for Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return

- Professional limited liability company form

- Form pllc 02

- Noi form

- Instructions to form scc544 articles of incorporation of a virginia professional stock corporation

- Formscc544

- Certificate of occupancy fairfax county form

- Application for certificate of registration to transact business in form

- Cattle assessment refund form draft

Find out other Virginia Resident Form 760 Individual Income Tax Return Individual Income Tax Return

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure