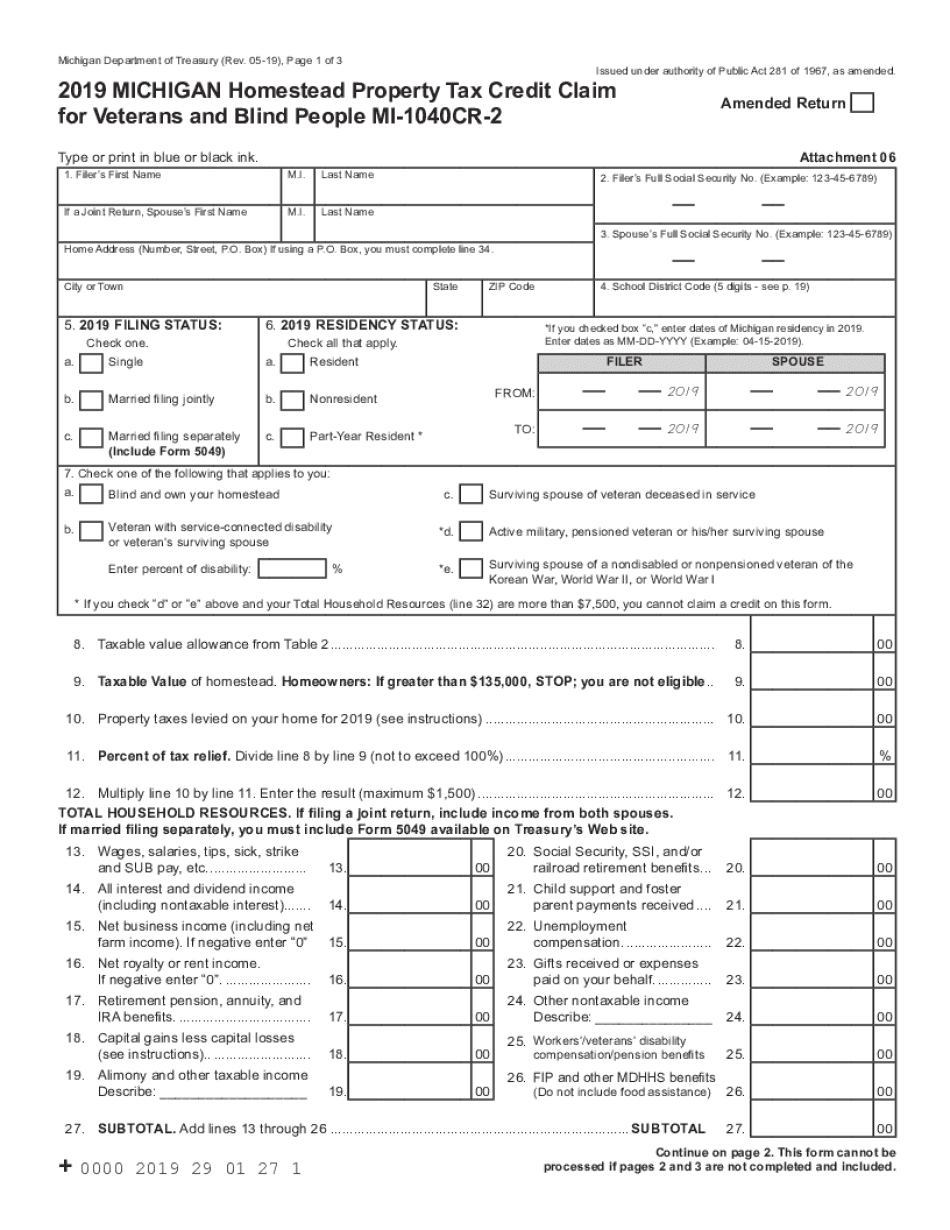

Michigan Homestead Property Tax Credit Claim for Veterans 2019

What is the Michigan Homestead Property Tax Credit Claim for Veterans

The Michigan Homestead Property Tax Credit Claim for Veterans is a specific provision designed to assist veterans who own a home in Michigan. This credit aims to reduce the property tax burden for eligible veterans, providing financial relief to those who have served in the military. The credit is applicable to the property taxes paid on the veteran's principal residence, allowing for a potential reduction in the overall tax liability.

Eligibility Criteria

To qualify for the Michigan Homestead Property Tax Credit Claim for Veterans, applicants must meet certain criteria. Key eligibility requirements include:

- The applicant must be a veteran who has been honorably discharged from military service.

- The property must be the veteran's principal residence.

- The applicant must meet specific income thresholds set by the state.

- Property taxes must be paid in full to qualify for the credit.

Steps to Complete the Michigan Homestead Property Tax Credit Claim for Veterans

Completing the Michigan Homestead Property Tax Credit Claim for Veterans involves several steps to ensure accurate submission. Follow these steps:

- Gather necessary documents, including proof of veteran status and income information.

- Obtain the 2019 MI 1040CR form, which includes the specific section for veterans.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate local tax authority by the specified deadline.

Required Documents

When applying for the Michigan Homestead Property Tax Credit Claim for Veterans, certain documents are necessary to support the application. These may include:

- Proof of military service, such as a DD-214 form.

- Documentation of income, including tax returns or W-2 forms.

- Property tax statements for the home in question.

Form Submission Methods

The Michigan Homestead Property Tax Credit Claim for Veterans can be submitted through various methods to accommodate applicants' preferences. These methods include:

- Online submission through the Michigan Department of Treasury's website.

- Mailing the completed form to the local tax authority.

- In-person submission at designated tax offices.

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of the filing deadlines associated with the Michigan Homestead Property Tax Credit Claim for Veterans. The typical deadline for submission is usually set for July 1 of the year following the tax year for which the credit is being claimed. Late submissions may result in the loss of eligibility for that tax year.

Quick guide on how to complete 2019 michigan homestead property tax credit claim for veterans

Accomplish Michigan Homestead Property Tax Credit Claim For Veterans effortlessly on any device

Digital document management has risen in popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Michigan Homestead Property Tax Credit Claim For Veterans on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Michigan Homestead Property Tax Credit Claim For Veterans without hassle

- Find Michigan Homestead Property Tax Credit Claim For Veterans and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Michigan Homestead Property Tax Credit Claim For Veterans and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 michigan homestead property tax credit claim for veterans

Create this form in 5 minutes!

How to create an eSignature for the 2019 michigan homestead property tax credit claim for veterans

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2019 mi 1040cr and how does it work?

The 2019 mi 1040cr is a tax credit form for Michigan residents designed to provide credit for property taxes. It works by allowing homeowners to claim a refund based on the property taxes paid in the previous year, facilitating better financial planning. Understanding how to accurately complete this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the 2019 mi 1040cr form?

airSlate SignNow offers a streamlined process for signing and submitting your 2019 mi 1040cr form electronically. With its user-friendly interface, you can easily fill out and eSign the necessary documentation, saving time and reducing the risk of errors. This efficient solution is ideal for those looking to simplify their tax preparation.

-

What features does airSlate SignNow provide for completing the 2019 mi 1040cr?

airSlate SignNow includes features like customizable templates, real-time collaborative editing, and secure storage for your 2019 mi 1040cr documents. These capabilities enhance the overall user experience, ensuring that you can manage your tax forms efficiently and effectively. Additionally, the platform supports seamless integrations with popular applications to streamline your workflow.

-

Is airSlate SignNow cost-effective for handling the 2019 mi 1040cr form?

Yes, airSlate SignNow is a cost-effective solution for managing your 2019 mi 1040cr form. By eliminating the need for paper documentation and allowing for electronic signatures, you can save both money and resources. The pricing options are competitive, making it accessible for individuals and businesses alike.

-

Can I access the 2019 mi 1040cr form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is fully compatible with both iOS and Android devices, allowing you to access your 2019 mi 1040cr form on the go. This mobile accessibility ensures you have the flexibility to complete and sign your documents wherever you are, making tax season less stressful.

-

What kind of support does airSlate SignNow offer for the 2019 mi 1040cr?

airSlate SignNow provides comprehensive customer support for users navigating the 2019 mi 1040cr form. You can access online resources, tutorials, and a dedicated support team ready to assist with any questions or technical issues. This ensures that you have the guidance needed to complete your forms accurately.

-

Are there any integrations available with airSlate SignNow for the 2019 mi 1040cr?

Yes, airSlate SignNow offers numerous integrations with various platforms to enhance your experience with the 2019 mi 1040cr form. You can easily connect your existing software solutions to streamline data entry and document management. This interoperability increases productivity and helps ensure all relevant information is captured.

Get more for Michigan Homestead Property Tax Credit Claim For Veterans

- Written revocation of will washington form

- Last will and testament for other persons washington form

- Notice to beneficiaries of being named in will washington form

- Estate planning questionnaire and worksheets washington form

- Document locator and personal information package including burial information form washington

- Demand to produce copy of will from heir to executor or person in possession of will washington form

- Wa dissolution form

- Response to petition for dissolution of marriage washington form

Find out other Michigan Homestead Property Tax Credit Claim For Veterans

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself