1040cr Michigan 2017

What is the MI 1040CR 2?

The MI 1040CR 2 is a Michigan tax form used to claim the homestead property tax credit. This form is specifically designed for residents who own or rent their primary residence and meet certain eligibility criteria. The credit is intended to reduce the property taxes owed by qualifying individuals, making housing more affordable. Understanding the MI 1040CR 2 is essential for those looking to benefit from this tax relief program.

Steps to Complete the MI 1040CR 2

Completing the MI 1040CR 2 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of income and property ownership or rental agreements. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Be sure to report your total household resources, which include all income sources. After completing the form, review it carefully for any errors before submitting it to the appropriate state agency.

Eligibility Criteria for the MI 1040CR 2

To qualify for the homestead property tax credit using the MI 1040CR 2, applicants must meet specific eligibility criteria. These include being a Michigan resident, owning or renting a home, and having a total household income below a certain threshold. Additionally, the property must be used as the applicant's primary residence. Understanding these criteria is crucial for ensuring that you can successfully claim the credit.

Required Documents for the MI 1040CR 2

When filing the MI 1040CR 2, certain documents are required to support your claim. These typically include proof of income, such as W-2 forms or tax returns, and documentation of property ownership or rental agreements. It is important to have these documents ready to facilitate the completion of the form and to substantiate your eligibility for the homestead property tax credit.

Form Submission Methods for the MI 1040CR 2

The MI 1040CR 2 can be submitted through various methods. Taxpayers have the option to file the form online, which is often the most convenient and efficient method. Alternatively, individuals may choose to print the completed form and submit it by mail to the appropriate state office. In-person submissions may also be possible at designated locations. Understanding these submission methods can help streamline the filing process.

Legal Use of the MI 1040CR 2

The MI 1040CR 2 is a legally recognized form that must be completed accurately to ensure compliance with Michigan tax laws. Submitting this form allows taxpayers to claim their rightful homestead property tax credit, which is a benefit established by state legislation. It is important to follow all legal guidelines when completing and submitting the form to avoid penalties or issues with the state tax authority.

Quick guide on how to complete mi 1040cr 2 2017 2019 form

Prepare 1040cr Michigan effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 1040cr Michigan on any device with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest way to modify and eSign 1040cr Michigan with ease

- Obtain 1040cr Michigan and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign 1040cr Michigan and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040cr 2 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the mi 1040cr 2 2017 2019 form

How to create an eSignature for the Mi 1040cr 2 2017 2019 Form online

How to generate an electronic signature for the Mi 1040cr 2 2017 2019 Form in Google Chrome

How to create an eSignature for signing the Mi 1040cr 2 2017 2019 Form in Gmail

How to make an eSignature for the Mi 1040cr 2 2017 2019 Form from your mobile device

How to make an electronic signature for the Mi 1040cr 2 2017 2019 Form on iOS devices

How to generate an eSignature for the Mi 1040cr 2 2017 2019 Form on Android

People also ask

-

What is the MI 1040CR 2, and who should use it?

The MI 1040CR 2 is a Michigan state tax form designed for filing claims for the homestead property tax credit. Homeowners and renters who meet specific income requirements can use this form to potentially reduce their property tax burden. If you live in Michigan and want to take advantage of this credit, using the MI 1040CR 2 is essential.

-

How do I fill out the MI 1040CR 2 form?

Filling out the MI 1040CR 2 form involves providing information about your income, property taxes, and any eligible credits. It's important to gather all necessary documents, such as your income statements and property tax bills, before completing the form. A clear and organized approach will ensure accurate submissions and minimize errors.

-

Where can I file my MI 1040CR 2 form?

You can file your MI 1040CR 2 form by mailing it to the appropriate Michigan Department of Treasury address. Additionally, e-filing options may be available depending on your tax preparation software. Always check the latest guidelines provided by the state for the most efficient filing options.

-

Are there any eligibility criteria for the MI 1040CR 2?

Yes, the eligibility criteria for the MI 1040CR 2 include specific income limits, property ownership, and residency status. Both homeowners and qualified renters may be eligible if they meet these requirements. Before applying, ensure you review the latest guidelines to confirm your eligibility.

-

What are the benefits of using the MI 1040CR 2?

Using the MI 1040CR 2 can lead to signNow savings on property taxes, making it a valuable form for Michigan residents. It helps ease the financial burden for low-income households while promoting home ownership. By effectively utilizing this form, you can maximize potential savings and credits.

-

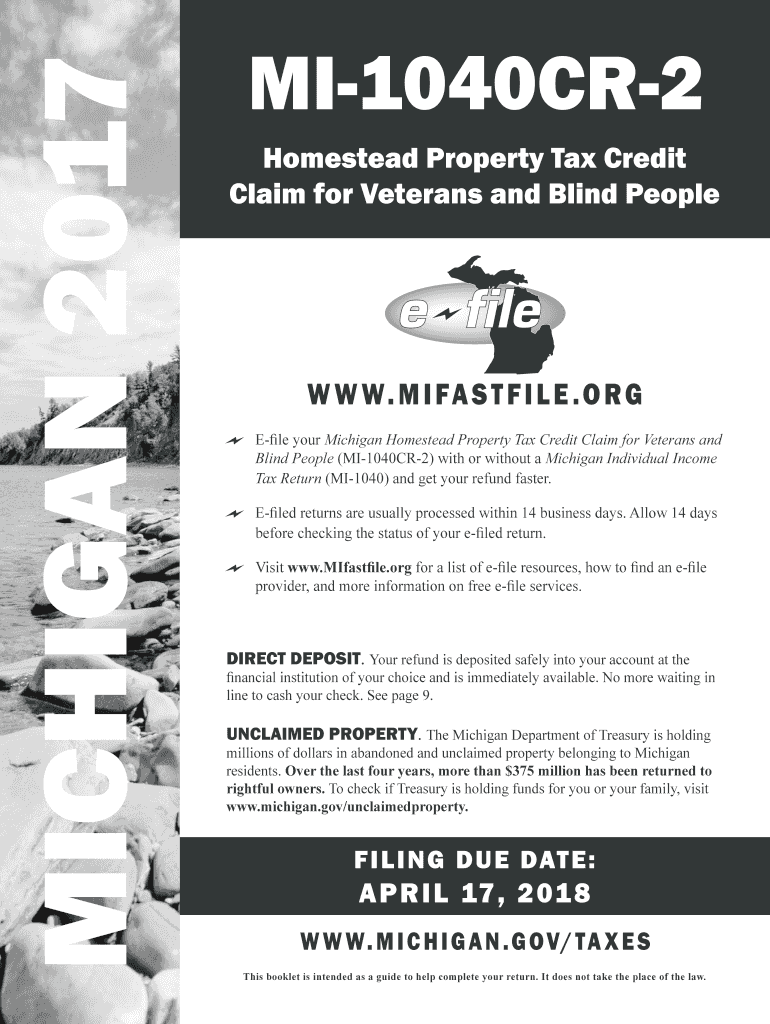

Is there a deadline for submitting the MI 1040CR 2?

Yes, the deadline for submitting the MI 1040CR 2 typically aligns with the annual income tax filing deadline. Make sure to keep track of these dates to ensure your form is submitted on time. Failing to meet deadlines may result in the inability to claim your homestead property tax credit.

-

Can I amend my MI 1040CR 2 after submission?

If you need to make changes after submitting your MI 1040CR 2, you can amend your form by submitting the appropriate documentation as instructed by the Michigan Department of Treasury. It's crucial to address any necessary corrections promptly to secure the credits you are entitled to. Keep detailed records of all amendments for your future reference.

Get more for 1040cr Michigan

Find out other 1040cr Michigan

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast