Michigan Homestead Property Tax Credit Claim for Veterans and Blind People MI 1040CR 2 2024-2026

Understanding the Michigan Homestead Property Tax Credit Claim for Veterans and Blind People MI 1040CR 2

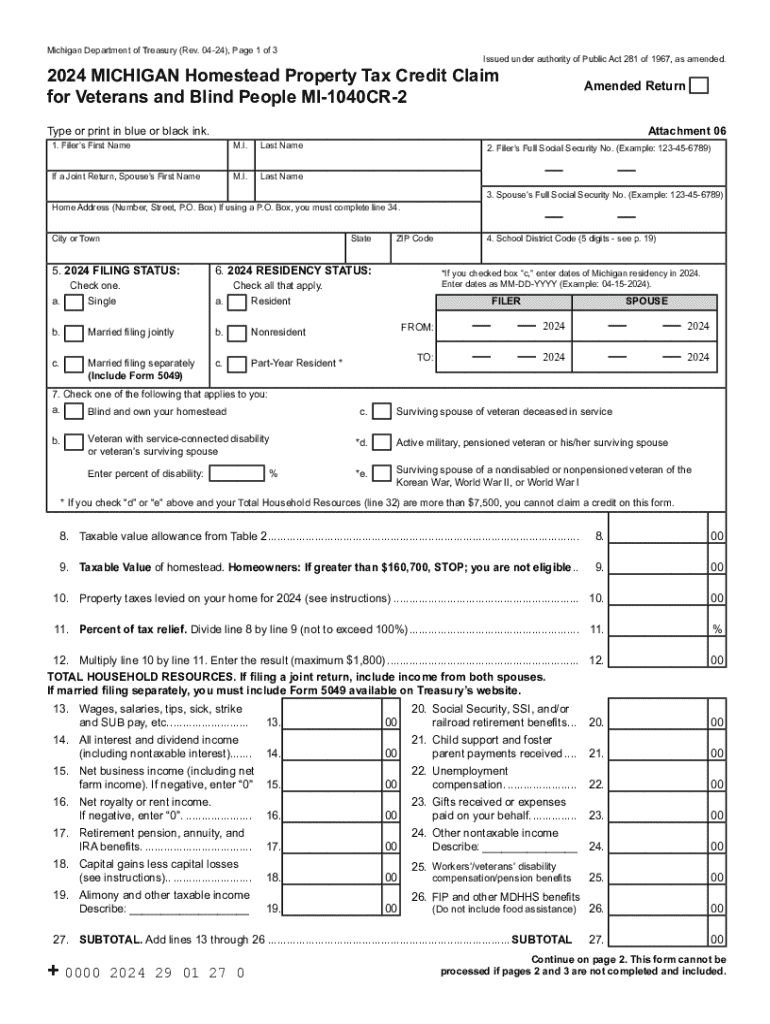

The Michigan Homestead Property Tax Credit Claim for Veterans and Blind People, known as MI 1040CR 2, is a tax benefit designed to assist eligible veterans and individuals who are legally blind. This credit aims to reduce the property tax burden for those who qualify, providing financial relief to support their housing needs. The program is specifically tailored to acknowledge the unique circumstances faced by veterans and blind residents in Michigan, ensuring they receive the necessary support.

Eligibility Criteria for MI 1040CR 2

To qualify for the MI 1040CR 2, applicants must meet specific eligibility requirements. These include:

- Being a veteran with a service-related disability or being legally blind.

- Owning and occupying the property as their principal residence.

- Meeting income limits set by the state, which may vary annually.

It is essential for applicants to review the current eligibility criteria to ensure they meet all requirements before submitting their claim.

Steps to Complete the MI 1040CR 2 Form

Filling out the MI 1040CR 2 form involves several key steps:

- Gather necessary documents, including proof of service for veterans or documentation confirming legal blindness.

- Complete the MI 1040CR 2 form, ensuring all sections are filled accurately.

- Calculate the credit amount based on property taxes paid and income levels.

- Submit the completed form to the appropriate local tax authority by the specified deadline.

Taking care to follow these steps can help ensure a smooth application process and maximize the potential tax credit received.

Required Documents for MI 1040CR 2 Submission

When applying for the MI 1040CR 2, applicants must provide specific documentation to support their claims. Required documents typically include:

- Proof of veteran status or legal blindness, such as a DD-214 form or medical documentation.

- Tax returns or income statements to demonstrate eligibility based on income limits.

- Property tax statements to verify the amount of taxes paid.

Ensuring that all required documents are included can facilitate a quicker review and approval process.

Form Submission Methods for MI 1040CR 2

Applicants can submit the MI 1040CR 2 form through various methods:

- Online submission via the Michigan Department of Treasury's official website.

- Mailing the completed form to the local tax authority.

- In-person submission at designated tax offices.

Each submission method has its advantages, and applicants should choose the one that best suits their needs and preferences.

Important Filing Deadlines for MI 1040CR 2

Timely submission of the MI 1040CR 2 form is crucial to ensure eligibility for the tax credit. The filing deadline typically aligns with the annual tax return deadlines, which is usually April fifteenth. However, it is advisable to confirm the exact dates each year, as they may vary. Meeting these deadlines helps avoid penalties and ensures that applicants receive their credits promptly.

Create this form in 5 minutes or less

Find and fill out the correct michigan homestead property tax credit claim for veterans and blind people mi 1040cr 2

Create this form in 5 minutes!

How to create an eSignature for the michigan homestead property tax credit claim for veterans and blind people mi 1040cr 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040CR 2 form?

The MI 1040CR 2 form is a Michigan state tax credit form that allows eligible residents to claim a credit for property taxes paid. It is essential for those looking to reduce their tax burden and maximize their refunds. Understanding how to fill out the MI 1040CR 2 correctly can signNowly impact your tax savings.

-

How can airSlate SignNow help with the MI 1040CR 2 form?

airSlate SignNow simplifies the process of completing and eSigning the MI 1040CR 2 form. With our user-friendly platform, you can easily fill out the form, add your electronic signature, and send it securely. This streamlines your tax filing process and ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the MI 1040CR 2?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring that you can manage your MI 1040CR 2 form and other documents without breaking the bank. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for the MI 1040CR 2 form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for your MI 1040CR 2 form. These tools enhance your efficiency and ensure that your documents are easily accessible and securely stored. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the MI 1040CR 2?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the MI 1040CR 2 form into your existing workflow. Whether you use accounting software or CRM systems, our platform can seamlessly connect to enhance your document management process.

-

What are the benefits of using airSlate SignNow for tax documents like the MI 1040CR 2?

Using airSlate SignNow for tax documents like the MI 1040CR 2 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents electronically, saving you time and ensuring that your sensitive information is protected. This modern approach to document management simplifies your tax filing experience.

-

Is airSlate SignNow secure for handling the MI 1040CR 2 form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your MI 1040CR 2 form and other documents are protected. We utilize advanced encryption and secure data storage practices to safeguard your information. You can trust that your sensitive tax documents are in safe hands with us.

Get more for Michigan Homestead Property Tax Credit Claim For Veterans And Blind People MI 1040CR 2

- Michigan warranty deed from individuals us legal forms

- Student tort liability insurance bagwell college of education form

- Hostcompanion service delivery log form 4122 fill online printable fillable blank fieldtripconsentformcom

- Forms and resources self help state oregon judicial department

- Minor child whose form

- Petition for confidential name change for minor child form

- With order for involuntary form

- Order on petition for involuntary administration of psychotropic form

Find out other Michigan Homestead Property Tax Credit Claim For Veterans And Blind People MI 1040CR 2

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online