Michigan Homestead Property Tax Credit Claim for Veterans 2022

What is the Michigan Homestead Property Tax Credit Claim for Veterans

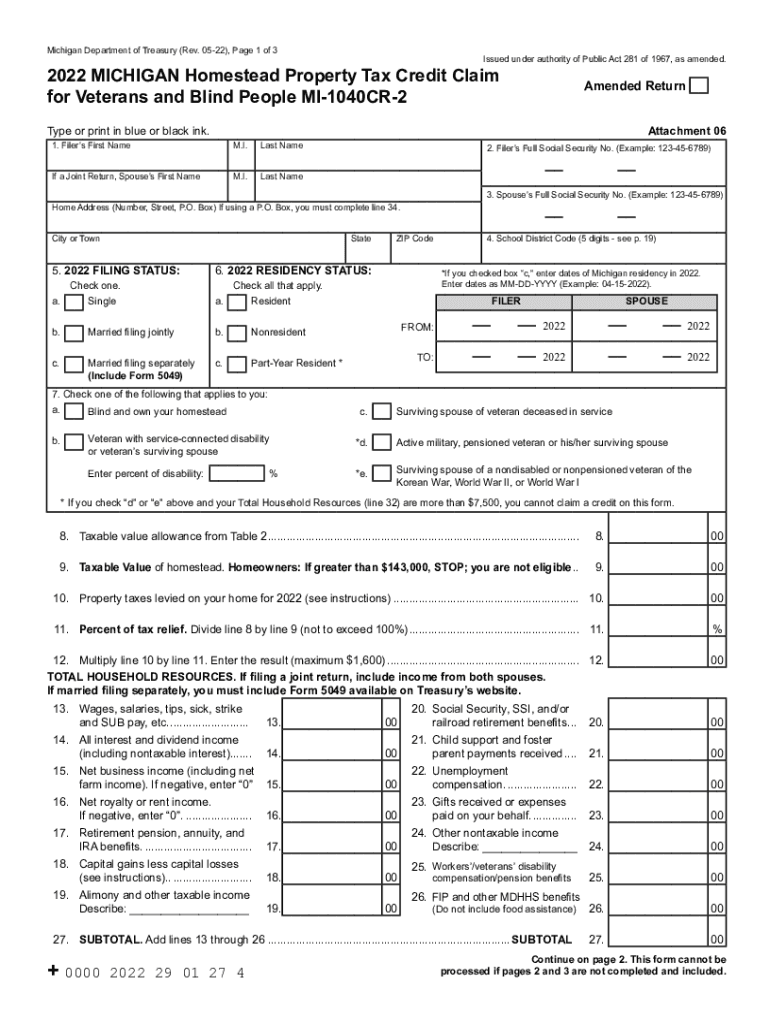

The Michigan Homestead Property Tax Credit Claim for Veterans is a specific provision designed to provide financial relief to eligible veterans who own and occupy their homes in Michigan. This tax credit aims to reduce the property tax burden for those who have served in the military, acknowledging their service and sacrifice. The credit can be applied to the property taxes of a primary residence, helping veterans manage their financial obligations more effectively.

Eligibility Criteria

To qualify for the Michigan Homestead Property Tax Credit Claim for Veterans, applicants must meet certain eligibility criteria:

- Must be a veteran with an honorable discharge from the military.

- Must occupy the property as their primary residence.

- Must meet income limits set by the state, which may vary from year to year.

- Must not be receiving a similar property tax credit from another state or local government.

Steps to Complete the Michigan Homestead Property Tax Credit Claim for Veterans

Completing the Michigan Homestead Property Tax Credit Claim for Veterans involves several key steps:

- Gather necessary documentation, including proof of military service and income statements.

- Obtain the form MI-1040CR, specifically the version for veterans.

- Fill out the form accurately, providing all required information regarding your property and financial situation.

- Submit the completed form along with any supporting documents to your local tax assessor’s office by the specified deadline.

Required Documents

When applying for the Michigan Homestead Property Tax Credit Claim for Veterans, certain documents are essential for a successful application:

- Proof of military service, such as a DD-214 form.

- Income verification documents, including W-2 forms or tax returns.

- Property tax statements for the home being claimed.

- Any additional documentation that supports the claim, as required by the local tax authority.

Form Submission Methods

Applicants can submit the Michigan Homestead Property Tax Credit Claim for Veterans through various methods:

- Online submission via the Michigan Department of Treasury website, if available.

- Mailing the completed form to the appropriate local tax assessor’s office.

- In-person submission at the local tax office during business hours.

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of the filing deadlines for the Michigan Homestead Property Tax Credit Claim for Veterans. Typically, the deadline for submission aligns with the property tax filing dates, which may vary by county. Keeping track of these dates ensures that veterans do not miss out on potential tax relief.

Quick guide on how to complete 2022 michigan homestead property tax credit claim for veterans

Complete Michigan Homestead Property Tax Credit Claim For Veterans effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without holdup. Handle Michigan Homestead Property Tax Credit Claim For Veterans on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Michigan Homestead Property Tax Credit Claim For Veterans effortlessly

- Locate Michigan Homestead Property Tax Credit Claim For Veterans and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you prefer. Modify and eSign Michigan Homestead Property Tax Credit Claim For Veterans and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 michigan homestead property tax credit claim for veterans

Create this form in 5 minutes!

How to create an eSignature for the 2022 michigan homestead property tax credit claim for veterans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2022 homestead property and who qualifies for it?

A 2022 homestead property refers to a primary residence that qualifies for specific tax benefits under homestead laws. Homeowners must occupy the property as their main residence to qualify, and eligibility may vary by state. Understanding the criteria for a 2022 homestead property can help you save on property taxes.

-

How can I apply for a 2022 homestead property exemption?

To apply for a 2022 homestead property exemption, homeowners typically need to submit an application to their local tax assessor's office. The application may require proof of residency and ownership. Deadlines for submission vary by state, so it’s crucial to check local regulations.

-

Are there any costs associated with obtaining a 2022 homestead property exemption?

Generally, applying for a 2022 homestead property exemption does not incur a fee; however, any associated costs can vary by state and county. Some may require a small processing fee or additional documentation submissions. Always verify with your local tax assessor's office for any potential costs.

-

What are the benefits of declaring a 2022 homestead property?

Declaring a 2022 homestead property can protect homeowners from creditors and reduce property taxes signNowly. It may also qualify you for additional benefits, such as exemptions for seniors or disabled individuals. Overall, it can provide financial relief and enhance stability for homeowners.

-

Can I still claim my 2022 homestead property if I rent it out?

If you rent out your property and claim it as a 2022 homestead property, you may lose eligibility for exemptions. Most states require that it be your primary residence to qualify. Always consult your state’s homestead laws to determine your specific situation.

-

What happens if my 2022 homestead property status changes?

If your 2022 homestead property status changes, such as selling or renting the property, you must notify your local tax assessor's office. Failure to update your status may lead to penalties or back taxes owed. It's important to stay compliant with local regulations.

-

Are there specific features that come with a 2022 homestead property exemption?

A 2022 homestead property exemption typically includes features such as lower property tax rates and protections against certain claims. Some states may offer additional benefits, including exemptions for veterans or low-income households. These features can provide substantial financial advantages.

Get more for Michigan Homestead Property Tax Credit Claim For Veterans

- Bill of sale of automobile and odometer statement for as is sale tennessee form

- Construction contract cost plus or fixed fee tennessee form

- Painting contract for contractor tennessee form

- Trim carpenter contract for contractor tennessee form

- Fencing contract for contractor tennessee form

- Hvac contract for contractor tennessee form

- Landscape contract for contractor tennessee form

- Commercial contract for contractor tennessee form

Find out other Michigan Homestead Property Tax Credit Claim For Veterans

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment