Get the Reset Form Michigan Department of Treasury 2021

Understanding the 2014 Form Tax Credit Claim

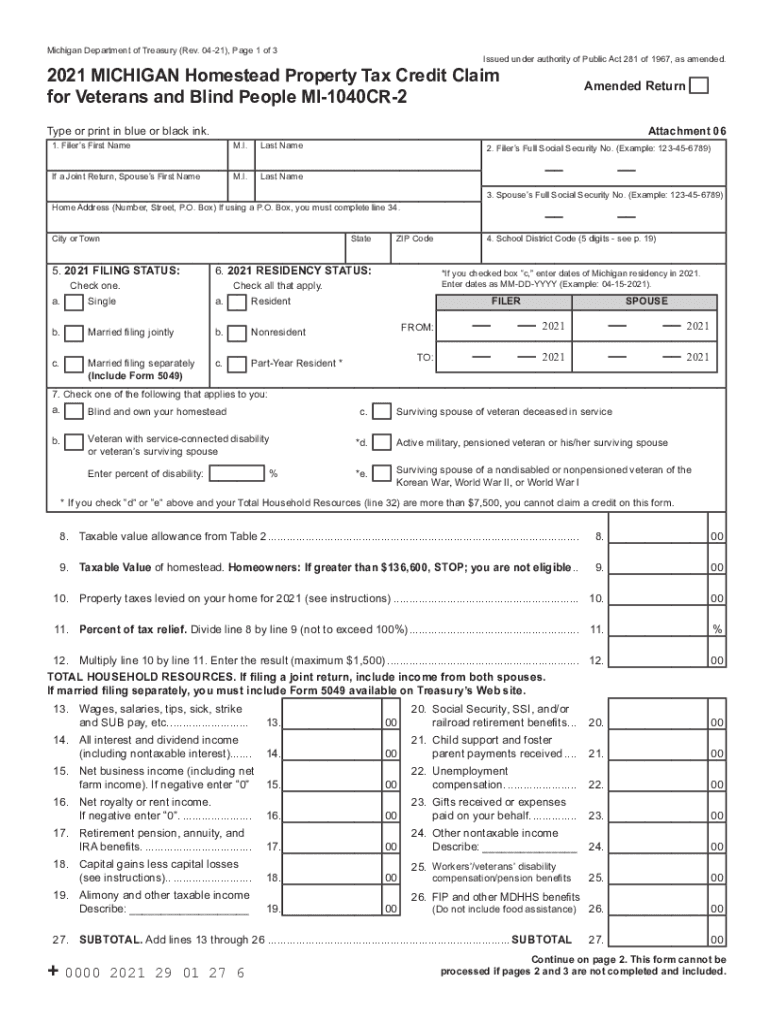

The 2014 form tax credit claim is a crucial document for taxpayers seeking to benefit from various tax credits available in the United States. This form allows individuals to claim credits related to their property taxes, which can significantly reduce their overall tax liability. Understanding the specifics of this form is essential for ensuring that you maximize your potential benefits while remaining compliant with tax regulations.

Steps to Complete the 2014 Form Tax Credit Claim

Completing the 2014 form tax credit claim requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including proof of property ownership and any previous tax filings.

- Fill out the personal information section accurately, ensuring that your name, address, and Social Security number are correct.

- Provide details about the property for which you are claiming the credit, including its assessed value and property tax amount.

- Calculate the total amount of credit you are eligible for based on the guidelines provided in the form instructions.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the 2014 Form Tax Credit Claim

To qualify for the 2014 form tax credit claim, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Ownership of the property for which the credit is claimed.

- Meeting income limits as outlined by state regulations.

- Filing a tax return for the year in which the credit is claimed.

It is important to review the eligibility requirements thoroughly to ensure compliance and avoid any potential issues during the filing process.

Required Documents for the 2014 Form Tax Credit Claim

When submitting the 2014 form tax credit claim, certain documents are required to support your application. These typically include:

- Proof of property ownership, such as a deed or mortgage statement.

- Documentation of property taxes paid, including receipts or tax bills.

- Any previous tax returns that may be relevant to your claim.

Having these documents ready can streamline the filing process and help ensure that your claim is processed without delays.

Form Submission Methods for the 2014 Form Tax Credit Claim

The 2014 form tax credit claim can be submitted through various methods, providing flexibility for taxpayers. Common submission options include:

- Online submission through the appropriate state tax authority’s website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, where assistance may be available.

Choosing the right submission method can depend on personal preference and the urgency of your claim.

Penalties for Non-Compliance with the 2014 Form Tax Credit Claim

Failure to comply with the requirements of the 2014 form tax credit claim can result in penalties. Potential consequences include:

- Denial of the tax credit, which means you will not receive the financial benefits you applied for.

- Fines or interest charges on any unpaid taxes resulting from incorrect claims.

- Increased scrutiny on future tax filings, which may lead to audits.

Understanding these penalties emphasizes the importance of accurate and timely submissions.

Quick guide on how to complete get the free reset form michigan department of treasury

Effortlessly complete Get The Reset Form Michigan Department Of Treasury on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Get The Reset Form Michigan Department Of Treasury on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Get The Reset Form Michigan Department Of Treasury effortlessly

- Find Get The Reset Form Michigan Department Of Treasury and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or disordered documents, tedious form sifting, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Get The Reset Form Michigan Department Of Treasury and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free reset form michigan department of treasury

Create this form in 5 minutes!

How to create an eSignature for the get the free reset form michigan department of treasury

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2014 form tax credit claim?

The 2014 form tax credit claim is a specific tax document that allows individuals or businesses to claim eligible tax credits for that fiscal year. Understanding this form is crucial for maximizing potential benefits and ensuring compliance. With airSlate SignNow, you can easily manage the eSigning process for this important document.

-

How can airSlate SignNow help with my 2014 form tax credit claim?

airSlate SignNow simplifies the process of creating, sending, and signing your 2014 form tax credit claim. Our user-friendly platform allows for quick document management and ensures that all necessary signatures are collected efficiently. This reduces delays and enhances the overall experience of filing your tax credit claim.

-

Is airSlate SignNow cost-effective for managing tax credit claims?

Yes, airSlate SignNow offers a cost-effective solution for managing your 2014 form tax credit claim and other documents. Our competitive pricing allows businesses of all sizes to access essential eSigning features. By streamlining the document workflow, users can save valuable time and resources while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow supports various integrations with popular tax management software. This ensures that you can seamlessly include the 2014 form tax credit claim into your existing workflows, making it easier for users to track their claims and maintain accurate records.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features designed to enhance your document signing experience. These include customizable templates, secure storage, and real-time tracking for your 2014 form tax credit claim. These tools help simplify the signing process and keep all stakeholders informed and engaged.

-

How secure is my 2014 form tax credit claim when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to protect your documents, including the 2014 form tax credit claim, during transmission and storage. You can be confident that your sensitive information is safe while utilizing our eSigning services.

-

What are the benefits of using airSlate SignNow for my tax processes?

Using airSlate SignNow for your tax processes, including the 2014 form tax credit claim, offers numerous benefits such as increased efficiency and reduced errors. Our platform allows you to manage documents quickly and securely, ensuring that your claims are submitted on time. Additionally, businesses can enhance collaboration among team members with streamlined workflows.

Get more for Get The Reset Form Michigan Department Of Treasury

- Warranty deed two individual grantors to three individual grantees mississippi form

- Record of unanimous action of the shareholders and directors mississippi form

- Mississippi promissory form

- Warranty deed to child reserving a life estate in the parents mississippi form

- Mississippi warranty 497313698 form

- Discovery interrogatories from plaintiff to defendant with production requests mississippi form

- Discovery interrogatories from defendant to plaintiff with production requests mississippi form

- Discovery interrogatories divorce 497313701 form

Find out other Get The Reset Form Michigan Department Of Treasury

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure