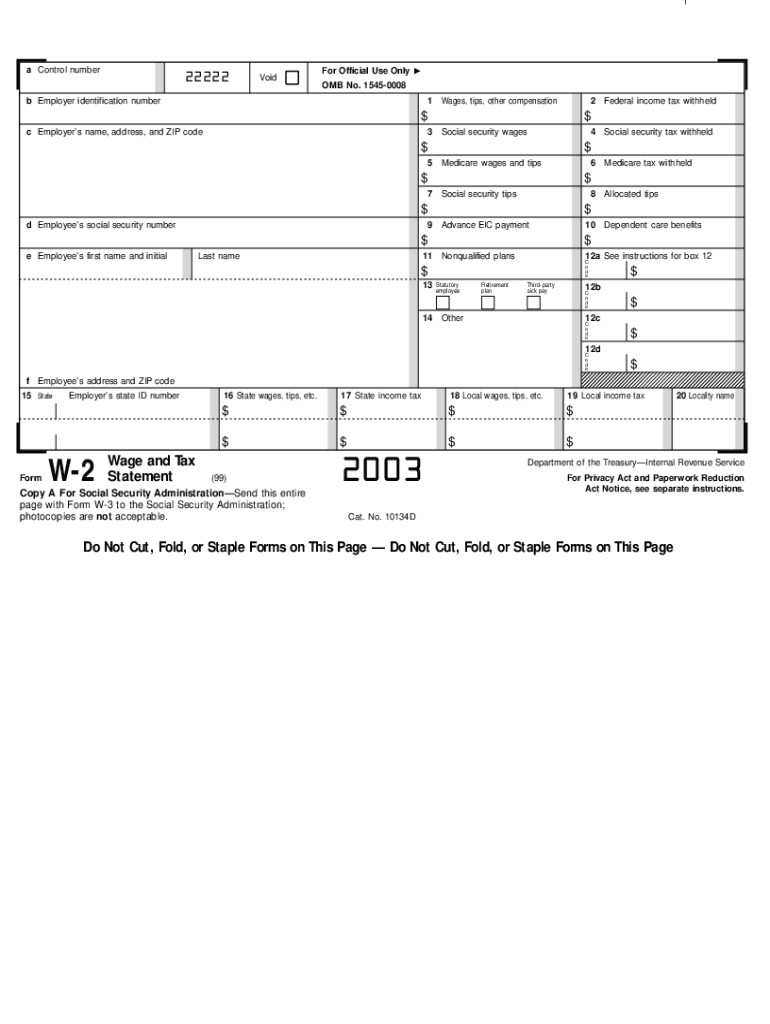

W 2 Form 2003

What makes the 2003 w 2 form legally valid?

Finding samples is not the difficult portion in terms of online document management; making them valid is.

The first step is to analyze the actual relevance of the sample you plan using. Officials can't accept outdated forms, so it's crucial that you only use forms that are current and up-to-date.

Secondly, make sure you input all the necessary information. Check required areas, the list of attachments, and extra samples carefully. File all the papers in one bundle in order to avoid misunderstandings and accelerate the procedure of processing your data.

Additionally, observe the filing ways needed. Find out if you're capable to submit documents via internet, and if you are, consider using specialized services to complete the 2003 w 2 form, eSign, and send.

How you can protect your 2003 w 2 form when preparing it online

If the institution the 2003 w 2 form will be delivered to allows you to do it online, implement secure document administration by following the instructions below:

- Look for a secure platform. Consider trying airSlate SignNow. We store info encrypted on reputable servers.

- Look into the platform's compliance. Discover more regarding a service's acceptance in other countries. For instance, airSlate SignNow electronic signatures are accepted in many countries.

- Pay attention to the hardware and software. Encrypted connections and safe servers mean nothing when you have viruses on your device or use public Wi-Fi.

- Add more protection levels. Switch on two-step authentications and create password-protected folders to guard delicate information.

- Count on potential hacking from anywhere. Remember that fraudsters can mask behind your loved ones and co-workers, or formal institutions. Examine documents and links you get via electronic mail or in messengers.

Quick guide on how to complete 2003 w 2 form

Uncover the most efficient method to complete and endorse your W 2 Form

Are you still spending time preparing your official paperwork on physical copies instead of managing it online? airSlate SignNow offers a superior way to accomplish and endorse your W 2 Form and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle documentation swiftly and in compliance with formal standards - robust PDF editing, organizing, securing, signing, and sharing tools available within a user-friendly layout.

Only a few steps are needed to fill out and endorse your W 2 Form:

- Upload the editable template to the editor by clicking the Get Form button.

- Verify the information you need to input in your W 2 Form.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is crucial or Delete fields that are no longer relevant.

- Click on Sign to create a legally binding eSignature using your preferred method.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your finalized W 2 Form in the Documents section of your profile, download it, or send it to your preferred cloud storage. Our service also provides versatile file sharing options. There’s no need to print your forms when you need to submit them to the relevant public office - simply send them via email, fax, or by arranging a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 2003 w 2 form

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

Create this form in 5 minutes!

How to create an eSignature for the 2003 w 2 form

How to generate an eSignature for your 2003 W 2 Form online

How to create an eSignature for the 2003 W 2 Form in Chrome

How to generate an eSignature for signing the 2003 W 2 Form in Gmail

How to make an electronic signature for the 2003 W 2 Form right from your mobile device

How to create an eSignature for the 2003 W 2 Form on iOS devices

How to create an electronic signature for the 2003 W 2 Form on Android OS

People also ask

-

What is a W 2 Form and why is it important?

A W 2 Form is a tax document that employers in the United States must send to their employees and the IRS each year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. Understanding the W 2 Form is crucial for accurate tax filing and ensuring compliance with federal regulations.

-

How can airSlate SignNow help me with my W 2 Form?

airSlate SignNow simplifies the process of signing and sending W 2 Forms electronically. With our platform, you can easily create, send, and eSign W 2 Forms securely, ensuring that your documents are handled efficiently and in compliance with IRS regulations.

-

What are the pricing options for using airSlate SignNow for W 2 Forms?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need a basic plan for occasional W 2 Form processing or a comprehensive solution for high-volume needs, we have a pricing option that fits your requirements.

-

Is airSlate SignNow secure for handling sensitive W 2 Form information?

Yes, airSlate SignNow prioritizes the security of your documents, including W 2 Forms. Our platform employs advanced encryption and security protocols to protect sensitive information, ensuring that your data remains confidential and secure during the signing process.

-

Can I integrate airSlate SignNow with my existing payroll software for W 2 Forms?

Absolutely! airSlate SignNow offers seamless integrations with various payroll and HR software solutions. This makes it easy to streamline your workflow for generating and managing W 2 Forms, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning W 2 Forms?

Using airSlate SignNow for eSigning W 2 Forms provides numerous benefits, including faster processing times and reduced paper usage. Our user-friendly interface and mobile accessibility also allow you to manage W 2 Forms on-the-go, making it a convenient solution for busy professionals.

-

How do I get started with airSlate SignNow for my W 2 Forms?

Getting started with airSlate SignNow for your W 2 Forms is simple. Sign up for an account, explore our features tailored for document management, and start creating or eSigning your W 2 Forms in just a few clicks. Our support team is also available to assist you every step of the way.

Get more for W 2 Form

Find out other W 2 Form

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later