Forms W2 2021

What is the W-2 Form?

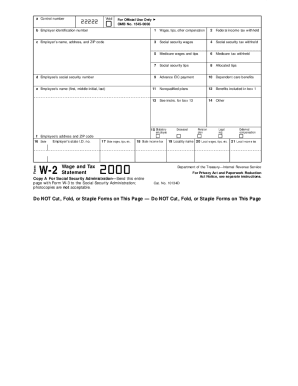

The W-2 form, officially known as the Wage and Tax Statement, is a crucial document used in the United States for tax reporting. Employers are required to complete this form for each employee they pay, detailing the wages earned and the taxes withheld throughout the year. The W-2 form serves as a summary of an employee's earnings and tax contributions, making it essential for accurate income tax filing.

How to Obtain the W-2 Form

Employees can obtain their W-2 form from their employer, who is responsible for providing it by January 31 of each year. If an employee does not receive their W-2 form, they should first contact their employer's payroll department. Additionally, employees can access their W-2 forms through online payroll systems if their employer offers this service. In cases where the form is lost, employees can request a duplicate from their employer or use the IRS's Form 4852 as a substitute.

Steps to Complete the W-2 Form

Completing the W-2 form involves several key steps:

- Gather necessary information, including your Social Security number, employer's identification number, and total earnings for the year.

- Fill in the employee's information, including name, address, and Social Security number.

- Input the employer's details, such as name, address, and Employer Identification Number (EIN).

- Report wages, tips, and other compensation in the appropriate boxes, along with federal income tax withheld.

- Include state and local tax information if applicable.

After completing the form, ensure all information is accurate to avoid issues with the IRS.

Legal Use of the W-2 Form

The W-2 form is legally required for employers to report wages and taxes withheld to the IRS. It is also essential for employees to accurately report their income when filing their annual tax returns. The form must be filed by the employer with the IRS, and a copy must be provided to the employee. Failure to comply with these requirements can result in penalties for both the employer and the employee.

Key Elements of the W-2 Form

The W-2 form contains several key elements that are important for both employers and employees:

- Employee Information: Includes the employee's name, address, and Social Security number.

- Employer Information: Contains the employer's name, address, and Employer Identification Number (EIN).

- Wages and Tips: Reports total wages, tips, and other compensation earned by the employee.

- Tax Withholding: Details federal income tax withheld, Social Security tax withheld, and Medicare tax withheld.

- State and Local Information: Includes state wages and taxes withheld, if applicable.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the W-2 form:

- January 31: Employers must provide W-2 forms to employees by this date.

- February 28: Employers must file W-2 forms with the IRS by this date if filing by mail.

- March 31: Employers must file W-2 forms electronically with the IRS by this date.

Meeting these deadlines is crucial to ensure compliance and avoid penalties.

Quick guide on how to complete forms w2

Effortlessly Prepare Forms W2 on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Forms W2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Simplest Method to Modify and eSign Forms W2 with Ease

- Locate Forms W2 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and press the Done button to save your edits.

- Select how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Forms W2 and ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms w2

Create this form in 5 minutes!

How to create an eSignature for the forms w2

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is a W2 form2002 and why is it important?

The W2 form2002 is a tax document that reports annual wages and the amount of taxes withheld for an employee. Understanding this form is crucial for accurate tax filing and ensuring compliance with IRS regulations. It plays a signNow role in preparing your tax return and can impact your tax refund or liability.

-

How can airSlate SignNow help with managing W2 form2002?

airSlate SignNow provides a streamlined platform for sending, receiving, and securely electronically signing W2 form2002. With its easy-to-use interface, businesses can efficiently manage their documentation process, ensuring that all tax forms are completed and submitted in a timely manner. This saves time and reduces errors in document management.

-

Is airSlate SignNow cost-effective for small businesses needing W2 form2002?

Yes, airSlate SignNow offers various pricing plans that are designed to be budget-friendly for small businesses needing W2 form2002. By choosing a plan that fits your needs, you can access features like cloud storage, document sharing, and eSignature capabilities at an affordable rate. This cost-effectiveness helps small businesses manage their tax documents without breaking the bank.

-

What features does airSlate SignNow offer for W2 form2002 processing?

airSlate SignNow offers several features for W2 form2002 processing, including bulk sending, customizable templates, and document tracking. These functionalities enable businesses to ensure that W2 forms are delivered efficiently and can be easily signed by recipients. The platform also allows for real-time monitoring of document status, providing more control over the process.

-

Can airSlate SignNow integrate with other software for W2 form2002 management?

Yes, airSlate SignNow integrates with a variety of popular software applications, enhancing its use for W2 form2002 management. Integrations with tools like Salesforce, Google Drive, and Microsoft Office simplify workflows by allowing users to manage documents directly within their existing platforms. This interoperability helps streamline the document management process.

-

What are the benefits of using airSlate SignNow for W2 form2002 management?

Using airSlate SignNow for W2 form2002 management provides numerous benefits, including enhanced security, improved efficiency, and reduced paper waste. The platform's encryption ensures that sensitive information remains protected, while electronic signatures speed up the signing process. Ultimately, this allows businesses to stay organized and compliant with tax regulations.

-

Is there customer support available for W2 form2002 issues on airSlate SignNow?

Absolutely, airSlate SignNow offers comprehensive customer support for any issues related to W2 form2002. Users can easily access support through various channels, including live chat, email, and a thorough help center. This ensures that any questions or concerns regarding W2 forms are addressed promptly and efficiently.

Get more for Forms W2

- Printable 2020 delaware form 209 claim for refund of deceased taxpayer

- Penalty who must pay the underpayment part i required instructions for form 2210 2019internal revenue serviceinstructions for

- Iowa ia 126 form

- Ia minimum form

- Fillable online instructions for forms n 11 and n 12 rev

- Printable 2020 illinois form il 505 b automatic extension payment

- Illinois form il 1040 x v payment voucher for amended

- How to control your mouse using a keyboard on windows 10 how to move the mouse cursor with the keyboard in windowsuse mouse form

Find out other Forms W2

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile