Form W 2 Wage and Tax Statement 2023-2026

What is the Form W-2 Wage and Tax Statement

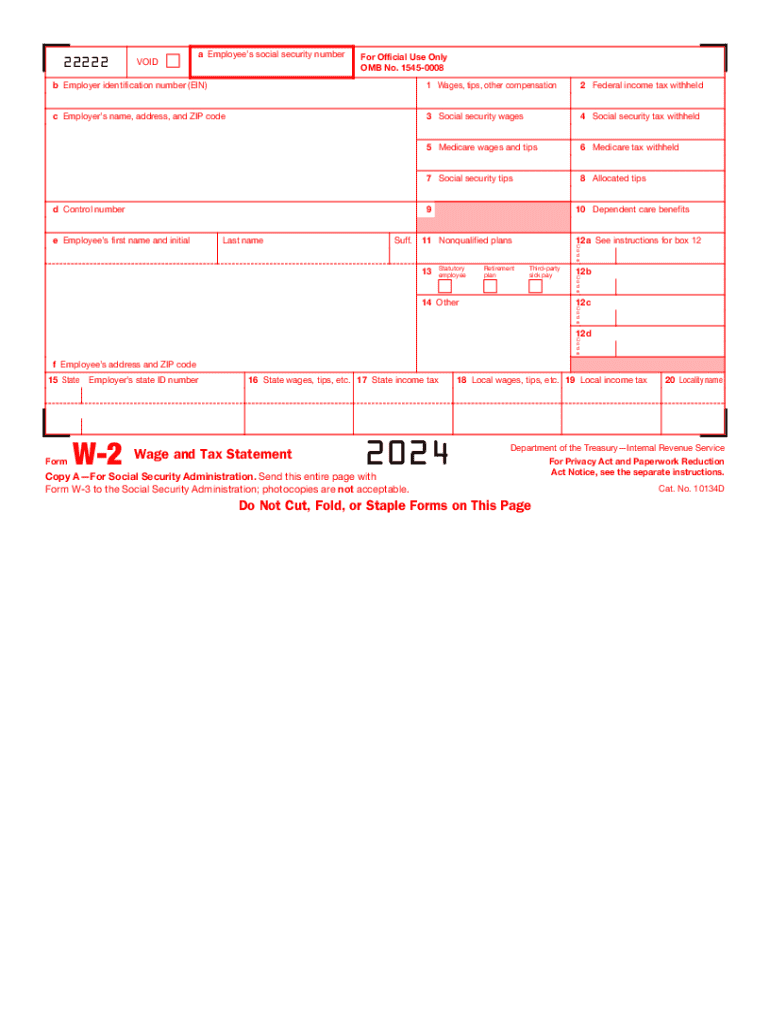

The W-2 form, officially known as the Wage and Tax Statement, is a crucial document used by employers in the United States to report an employee's annual wages and the amount of taxes withheld from their paycheck. Each year, employers must provide this form to their employees by January 31, detailing earnings and tax information for the previous calendar year. The W-2 form is essential for employees when filing their federal and state tax returns, as it summarizes their income and tax contributions.

How to Obtain the Form W-2 Wage and Tax Statement

Employees can obtain their W-2 form from their employer, who is responsible for issuing it. If an employee does not receive their W-2 by mid-February, they should contact their employer's payroll or human resources department. Additionally, employees can access a copy of their W-2 online through their employer's payroll portal if available. In cases where the employer is unreachable or unresponsive, individuals can request a copy directly from the IRS using Form 4506-T, which allows them to receive a transcript of their W-2 information.

Key Elements of the Form W-2 Wage and Tax Statement

The W-2 form contains several key elements that provide important information for tax filing. These include:

- Employee's Information: Name, address, and Social Security number.

- Employer's Information: Employer's name, address, and Employer Identification Number (EIN).

- Wages and Tips: Total earnings for the year, including tips and other compensation.

- Tax Withholdings: Amount of federal income tax withheld, Social Security tax, and Medicare tax.

- State Information: State income tax withheld and state identification number, if applicable.

Steps to Complete the Form W-2 Wage and Tax Statement

Completing the W-2 form involves several steps for employers:

- Gather Employee Information: Collect accurate details such as the employee's name, address, and Social Security number.

- Calculate Earnings: Sum up total wages, tips, and other compensation paid to the employee during the tax year.

- Determine Tax Withholdings: Calculate the total federal, state, Social Security, and Medicare taxes withheld from the employee's paychecks.

- Fill Out the Form: Complete the W-2 form accurately, ensuring all information is correct and legible.

- Distribute Copies: Provide copies of the completed W-2 to the employee, the IRS, and state tax agencies as required.

IRS Guidelines for the Form W-2 Wage and Tax Statement

The IRS provides specific guidelines for employers regarding the issuance and filing of the W-2 form. Employers must file W-2 forms electronically if they are submitting more than two forms. The deadline for filing W-2s with the IRS is January 31, and employers must ensure that all information is accurate to avoid penalties. Additionally, the IRS requires that employees receive their W-2 forms by the same deadline to ensure timely tax filing. Employers should also be aware of the penalties for non-compliance, which can include fines for late submissions or incorrect information.

Quick guide on how to complete form w 2 wage and tax statement 731664726

Complete Form W 2 Wage And Tax Statement effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form W 2 Wage And Tax Statement on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form W 2 Wage And Tax Statement effortlessly

- Find Form W 2 Wage And Tax Statement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Form W 2 Wage And Tax Statement and ensure optimal communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 2 wage and tax statement 731664726

Create this form in 5 minutes!

How to create an eSignature for the form w 2 wage and tax statement 731664726

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of w 2 tax forms for businesses?

W 2 tax forms are essential for businesses as they report employee wages and tax withholdings to the IRS. Proper handling of w 2 tax forms ensures compliance with tax regulations and helps avoid penalties. Using airSlate SignNow, businesses can easily manage and eSign these documents, streamlining the process.

-

How can airSlate SignNow help with w 2 tax document management?

airSlate SignNow simplifies w 2 tax document management by allowing users to create, send, and eSign forms electronically. This reduces paperwork and speeds up the filing process. With our platform, businesses can ensure that all w 2 tax forms are securely stored and easily accessible.

-

What features does airSlate SignNow offer for handling w 2 tax forms?

Our platform offers features such as customizable templates, automated workflows, and secure eSigning for w 2 tax forms. These tools help businesses save time and reduce errors in document handling. Additionally, airSlate SignNow provides tracking capabilities to monitor the status of w 2 tax forms.

-

Is airSlate SignNow cost-effective for managing w 2 tax forms?

Yes, airSlate SignNow is a cost-effective solution for managing w 2 tax forms. Our pricing plans are designed to fit various business sizes and budgets, ensuring that you get the best value for your investment. By reducing manual processes, you can save both time and money.

-

Can airSlate SignNow integrate with other accounting software for w 2 tax management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage w 2 tax forms alongside your financial data. This integration helps streamline your workflow and ensures that all information is synchronized, reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for w 2 tax eSigning?

Using airSlate SignNow for w 2 tax eSigning offers numerous benefits, including enhanced security, faster processing times, and improved compliance. Our platform ensures that all signatures are legally binding and securely stored. This not only speeds up the filing process but also provides peace of mind.

-

How does airSlate SignNow ensure the security of w 2 tax documents?

airSlate SignNow prioritizes the security of your w 2 tax documents through advanced encryption and secure cloud storage. We comply with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. You can trust our platform for secure document management.

Get more for Form W 2 Wage And Tax Statement

- Maine relative caretaker legal documents package maine form

- Maine standby temporary guardian legal documents package maine form

- Maine 7 form

- Bill of sale with warranty by individual seller maine form

- Bill of sale with warranty for corporate seller maine form

- Bill of sale without warranty by individual seller maine form

- Bill of sale without warranty by corporate seller maine form

- Verification of creditors matrix maine form

Find out other Form W 2 Wage And Tax Statement

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format